Ethereum Fund Outflows Extend Downward Trend in Crypto Investments

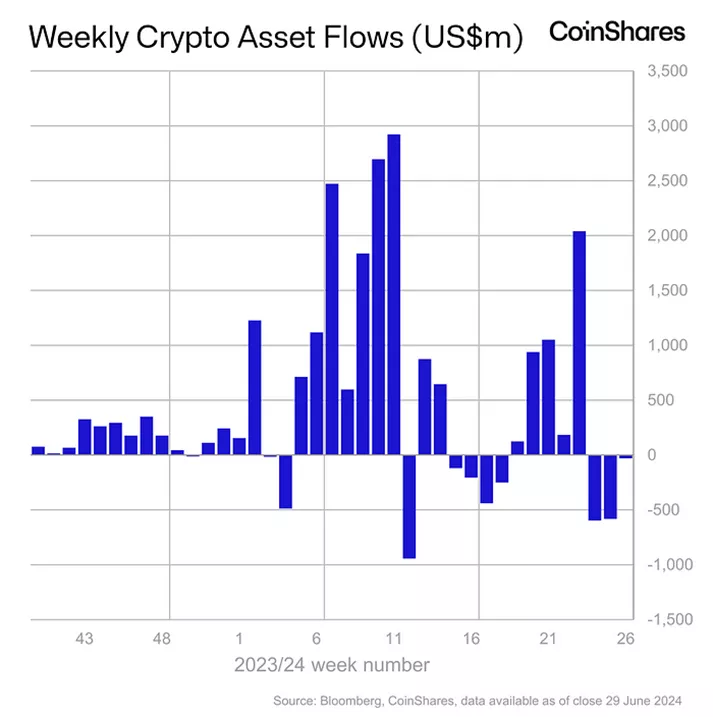

Cryptocurrency investment products experienced an outflow of $30 million from June 22 to June 28, following a $584 million outflow the previous week, according to calculations by CoinShares.

This negative trend continued for the third consecutive week, driven by the largest withdrawal from Ethereum funds since August 2023, amounting to $61 million.

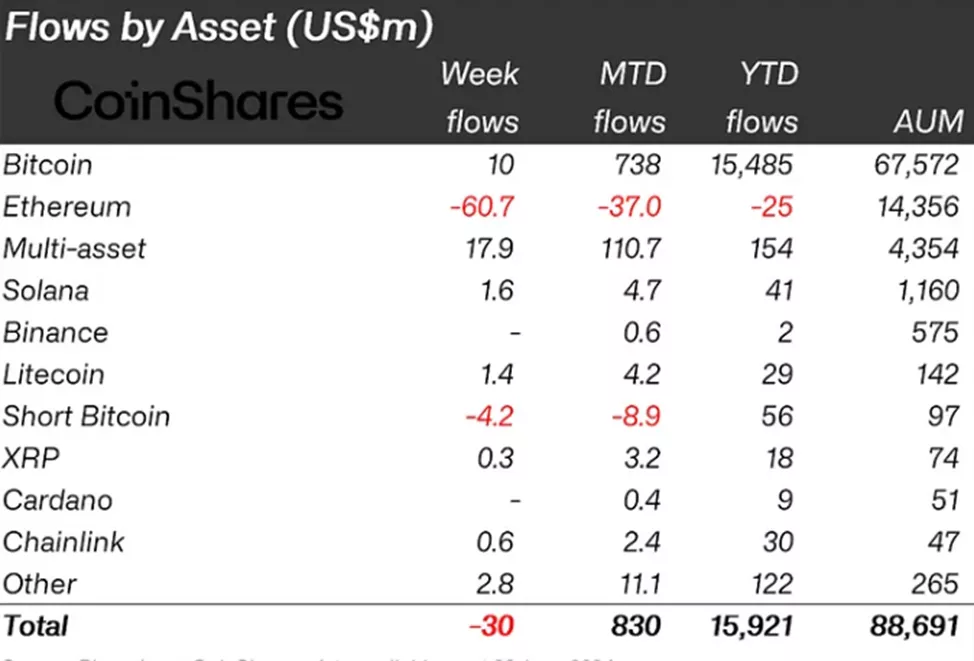

The total volume of assets under management fell to $88.7 billion.

Trading volume for ETP increased by 43% to $6.2 billion, although it remained below the average year-to-date level of $14.2 billion.

Clients added $10 million to bitcoin-related instruments, after withdrawing $630 million in the previous reporting period.

Investors withdrew $4.2 million from structures allowing short positions on digital gold, having previously added $1.2 million.

Outflows from Ethereum funds accelerated from $58 million to $61 million. The second-largest cryptocurrency by market capitalization has been the worst performer in terms of net inflows since the start of the year, with a negative $25 million.

Inflows into products based on a basket of altcoins amounted to $18 million, compared to $98 million the previous week.

There were also inflows into instruments based on Solana and Litecoin, amounting to $1.6 million and $1.4 million, respectively.

Back on June 27, investment firm VanEck filed an S-1 form with the SEC to register a Solana-based ETF.

The following day, Swiss crypto fund manager 21Shares made a similar move.

According to analysts at market maker GSR, if the Solana ETF is approved, the cryptocurrency could appreciate by 1.4 to 8.9 times.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!