Ethereum Funds Experience Fifth Consecutive Week of Outflows

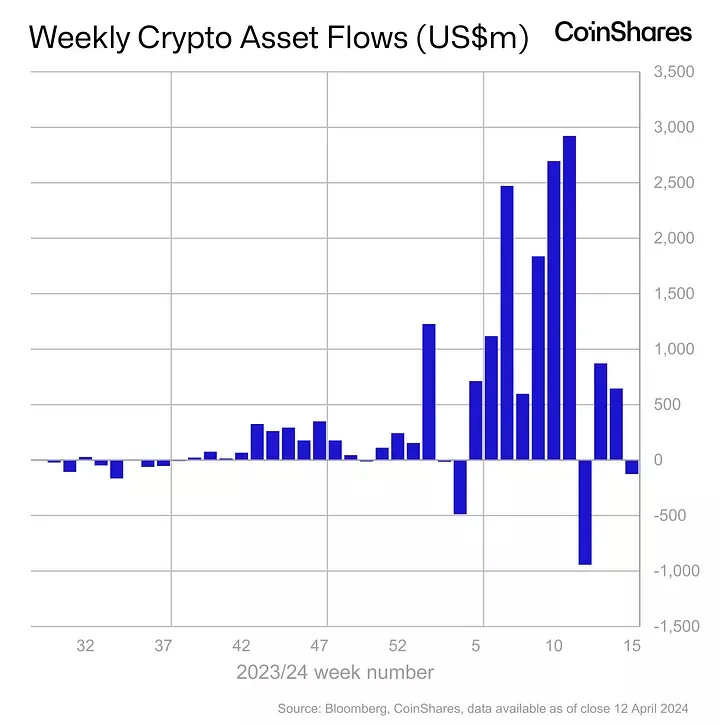

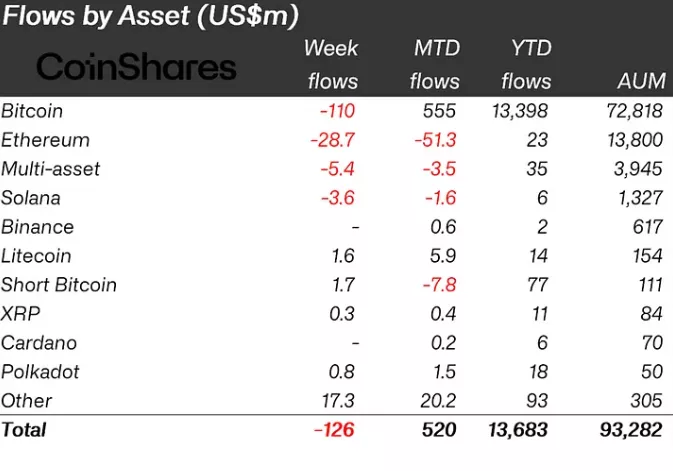

Cryptocurrency investment products saw an outflow of $126 million from April 6 to April 12, including $28.7 million from Ethereum funds, according to analysts at CoinShares.

In the previous two weeks, there was a combined inflow of $646 million and $862 million. Experts attributed the trend reversal to “market participants’ uncertainty” amid a pause in the rally.

Outflows from Ethereum funds increased from $22.5 million to $28.7 million, marking the fifth consecutive week of negative dynamics.

Clients withdrew $110 million from bitcoin-related instruments, whereas they had invested $663 million in the previous reporting period.

Investors put $1.7 million into structures allowing short positions on the leading cryptocurrency, following a prior outflow of $9.5 million.

Among altcoins, there was interest in “esoteric names” like MANA, BAT, and LIDO. Funds based on these attracted $4.9 million, $2.9 million, and $1.8 million, respectively.

Solana-based products saw an outflow of $3.6 million after a $4 million inflow the previous week.

Earlier, Solana developers updated the software as part of efforts to combat blockchain congestion, which leads to transaction delays.

Since the beginning of the year, this blockchain has accounted for 49.3% of global investor interest in blockchain ecosystems, as calculated by CoinGecko.

According to Bernstein’s forecast, the network “leads the battle” for on-chain payment adoption. Matty Taylor, co-founder of Colosseum and former head of growth at Solana Foundation, believes the blockchain will surpass Ethereum in the number of consumer Web3 applications.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!