Ethereum Market Depth Declines 20% Following Spot ETF Launch

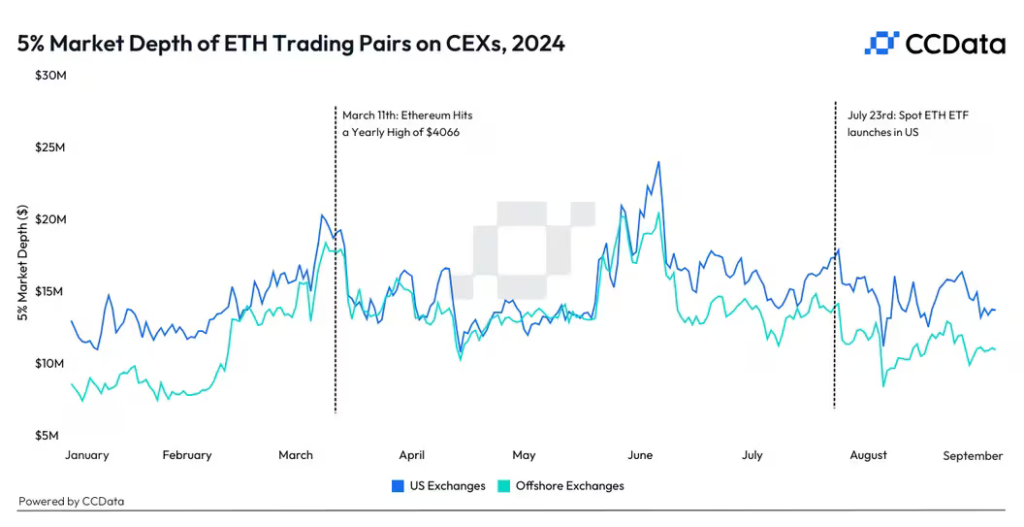

Since the launch of spot Ethereum ETFs in the US, the average 5% market depth for ETH pairs on domestic centralized exchanges has decreased by 20%, to approximately $14 million, according to CoinDesk, citing CCData.

In other words, it has become easier to move the spot price by 5% in either direction, indicating reduced liquidity and increased sensitivity to large orders.

On foreign CEX, the figure fell by 19% to around $10 million.

Theoretically, the launch of exchange-traded funds should positively impact the liquidity of the underlying asset, experts noted. This was the case with Bitcoin, but the trend did not hold for ETH.

CCData analyst Jacob Joseph noted that liquidity in ether pairs remains above early-year levels. However, since its peak in June, the indicator has fallen by 45%.

“This is likely due to unfavorable market conditions and the seasonal effect of summer, which is often accompanied by reduced trading activity,” he added.

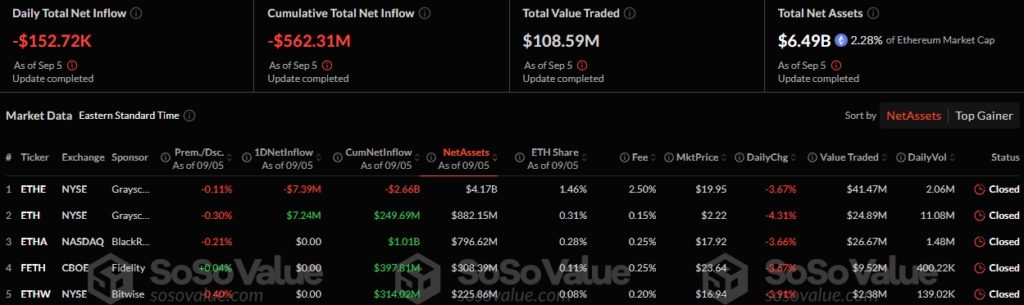

According to SoSoValue, from the start of trading in late July to September 5, spot Ethereum ETFs recorded a cumulative outflow of $562.3 million. The trend is driven by fund withdrawals from Grayscale’s product, with the total volume already reaching $2.66 billion.

The combined value of assets under management in exchange-traded ETH funds amounts to $6.49 billion, or 2.28% of Ethereum’s market capitalization.

By the end of August, the cryptocurrency’s price had dropped by 22%, outpacing Bitcoin’s decline of 8.6%, analysts at QCP Capital noted. They predict the correction may continue into September.

Earlier, 1confirmation founder Nick Tomaino suggested that within the next five years, Ethereum could surpass digital gold in market capitalization.

Meanwhile, ether’s price relative to Bitcoin has fallen by 44% since the transition to the Proof-of-Stake consensus algorithm in September 2022, according to CryptoQuant.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!