Ethereum Options Market Sees Increased Bets on Price Surpassing $3600

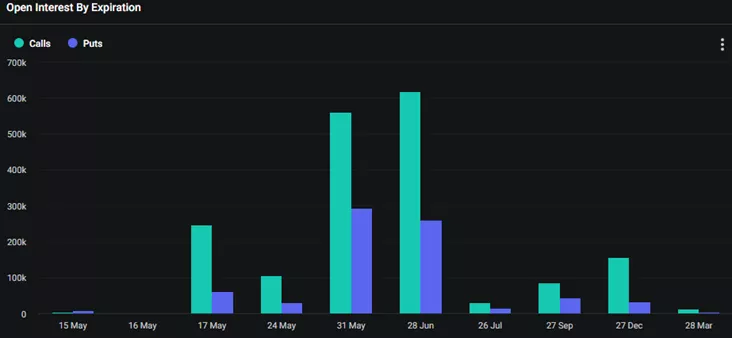

The distribution of Ethereum options expiring in June indicates a rise in bets on the asset moving above $3600, according to data from Deribit.

The volume of open call options at the specified strike price has increased to $161.4 million, second only to the $6500 strike ($193.9 million).

Overall, open interest for June calls stands at $1.89 billion, 2.37 times greater than for puts ($795.6 million).

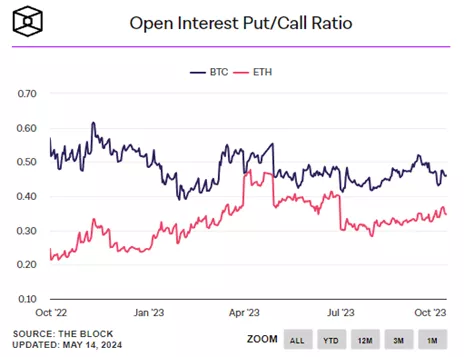

According to The Block, such a high concentration of call options not only reflects market participants’ optimism but may also indicate potential support for the underlying asset.

The put-to-call ratio is 0.35. Values below one suggest a predominance of bullish sentiment.

Glassnode has linked Ethereum’s lag behind Bitcoin post-halving to capital rotation.

Earlier, ForkLog reported that traders’ expectations for the second-largest cryptocurrency by market capitalization have become less optimistic, while bets on digital gold contracts are increasing towards a rise to $100,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!