Ethereum Poised for Potential Surge Beyond $5000

Analyst predicted a cycle top at $8500.

On October 7th, the price of the second-largest cryptocurrency by market capitalization neared its all-time high, breaking through the $4800 level. MN Fund founder Michaël van de Poppe anticipates a new ATH in the near future.

The reason that I think that we’re about to see a new all-time high on $ETH is two-fold.

1 — The BTC pair looks bottomed out and ready for a new leg upwards, after a relatively normal correction.

2 — Gold is insanely parabolic, which means that, I don’t know at what level, it… pic.twitter.com/hjpNsmEPAM

— Michaël van de Poppe (@CryptoMichNL) October 7, 2025

He first pointed to the ETH/BTC ratio. According to the expert, the pair has “bottomed out” at the support level of 0.0256 and is “ready for a new phase of growth.”

Secondly, the upward momentum will be supported by gold. Previously, the precious metal set a record above $4000 per ounce. It is now due for a correction, which “will increase demand for risky assets” like cryptocurrencies.

Other market participants also maintain a positive outlook on the leading altcoin. Analyst Matt Hughes believes the asset is “ready to enter the all-time high zone.”

$ETH looks primed to break into all-time high territory, as it’s finally finding stability above the $4,350s. As long as that zone continues to hold as support, ATHs aren’t too far away.

5200 is my next target above 🚀#ETH pic.twitter.com/W75iSp4Upj

— The Great Mattsby (@matthughes13) October 7, 2025

“Ethereum has finally stabilized above $4350. As long as this zone remains as support, new records are within reach. The next target is $5200,” he wrote.

A trader under the pseudonym Poseidon predicted a cycle top at $8500.

Targeting $8,500 for the $ETH cycle top. pic.twitter.com/VFMkifEsWZ

— Poseidon (@CryptoPoseidonn) October 7, 2025

At the time of writing, the second-largest cryptocurrency by market capitalization is trading around $4500. Over the past day, its price has decreased by 4%.

Another Driver

Ethereum also shows a high correlation with the Russell 2000 index, which tracks small-cap company stocks. Analysts at Milk Road have forecasted a synchronized rise in assets amid the expected reduction in the key rate by the Fed.

This correlation is almost spooky.

The Russell 2000 (small cap equities) and $ETH are basically moving in sync.

Both are highly sensitive to interest rates.

With 4+ consecutive cuts on the horizon…

Expect both of them to move up in tandem. pic.twitter.com/V6HLlZpPht

— Milk Road Macro (@MilkRoadMacro) October 7, 2025

“The correlation looks almost mystical. The Russell 2000 and Ethereum are essentially moving in sync. Both assets are extremely sensitive to monetary policy. With four consecutive rate cuts on the horizon, growth is expected,” they wrote.

A “Cup and Handle” pattern is forming on the charts—a bullish continuation pattern indicating a period of consolidation before a breakout.

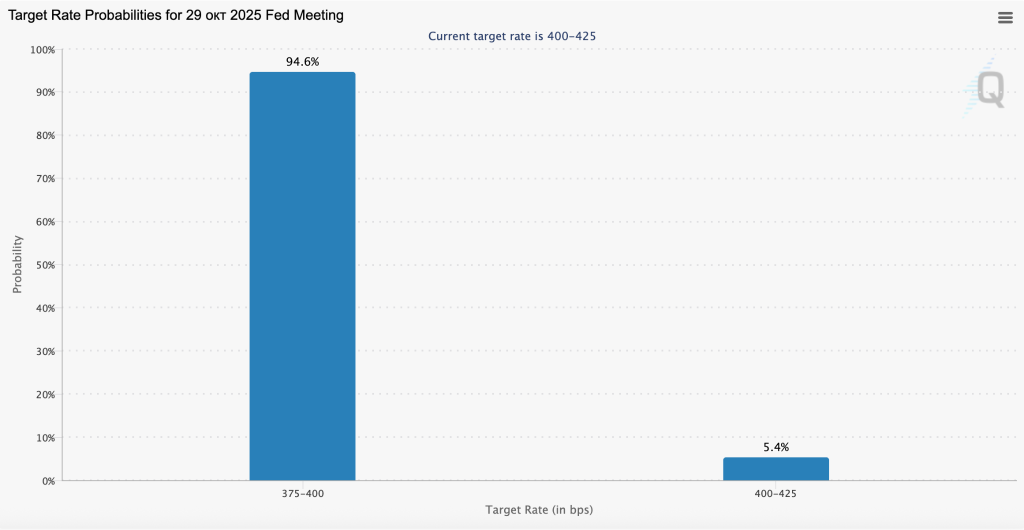

According to market participants, the probability of a Fed rate cut in October is 94.6%.

As reported during the recovery of the M2 money supply, analysts at XWIN Research suggested that Ethereum could rise to $10,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!