Ethereum Price Unmoved by Fed Rate Cut

Market participants allowed a pullback to as low as $3300.

The price of the second-largest cryptocurrency by market capitalization failed to hold above $4000. The asset has been trading sideways for about two weeks after falling below $3700.

At the time of writing, Ethereum is trading at $3816, having decreased by 5% over the past day.

Trader sentiment remains cautious even after the Fed confirmed a 0.25% interest rate cut and the end of quantitative tightening.

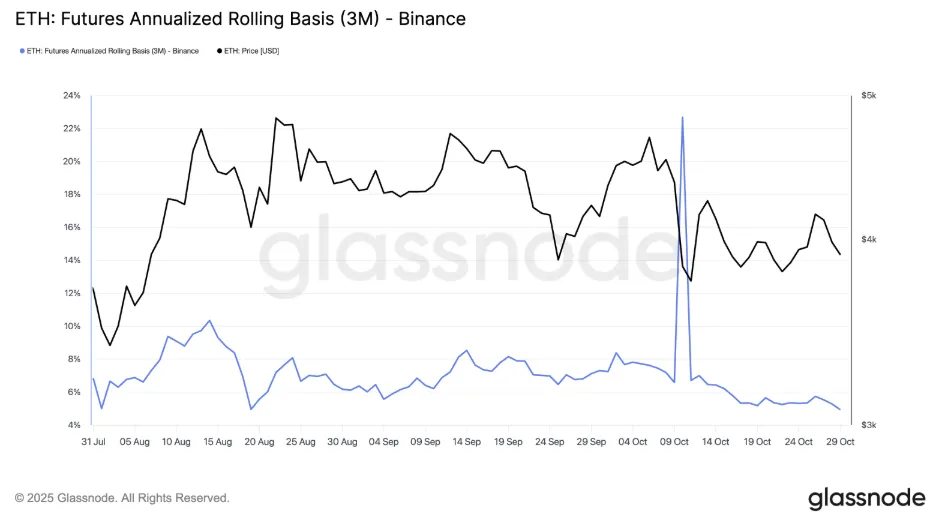

Ethereum futures are trading at a 5% premium to the spot price. This is the lower boundary of the neutral range of 5-10%, indicating low demand from traders using leverage.

A brief rise to $4000 did not restore a sustained bullish sentiment in the market.

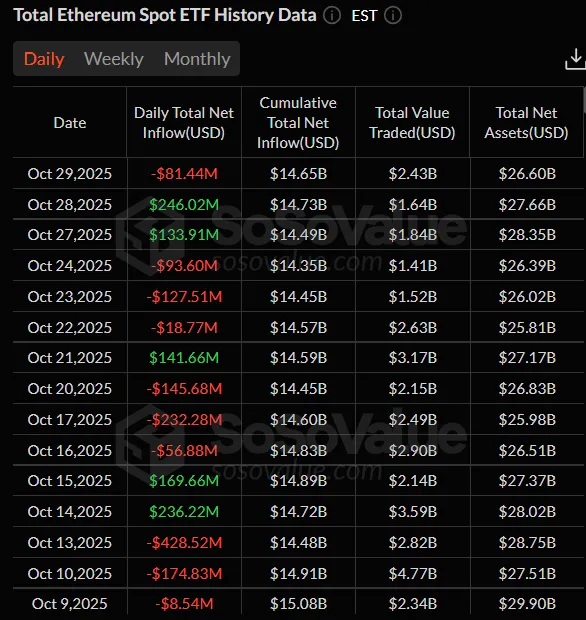

The bearish trend in futures coincided with an outflow of funds from US spot ETFs based on Ethereum, which has been dominant since mid-October. An inflow of approximately $380 million earlier this week also failed to give the price momentum.

What Do Experts Say?

Analyst Ted Pillows noted that the second-largest cryptocurrency by market cap failed to rise even amid positive developments.

$ETH has lost its $4,000 support level again.

25 bps rate cut, QT ending in a month and US-China trade talks happened within 24 hours, and yet Ethereum is down.

Either this is a classic bear trap, or the crypto market is going way lower. pic.twitter.com/tHUAs6QJ4R

— Ted (@TedPillows) October 30, 2025

According to him, the next support level is $3800. Its breach could trigger a sell-off to the $3500-3700 zone. For a resumption of growth, bulls need to hold above $4000.

“Either this is a classic bear trap, or the crypto market is going way lower,” added Pillows.

Other analysts are more optimistic. An expert under the pseudonym FibonacciTrading considers a drop to $3300 a “healthy pullback” within an upward trend.

$ETH (weekly) — Still the leader of the pack for $SBET and $BMNR, but right now it’s playing defense.

Price is testing whether that prior resistance has truly flipped into support — and the pressure from above is building.

A dip toward $3,300 would still count as a healthy… pic.twitter.com/bQG9cq4I2f

— FibonacciTrading (@Fibonacci_TA) October 30, 2025

An analyst known as Cactus believes that growth potential remains if bulls hold the support range of $3800-4200.

all on track $ETH

strong Q4 is still on the cards in my opinion

that said, important we do hold this support region HTF pic.twitter.com/wTgdqaOOIi

— Cactus (@thecryptocactus) October 30, 2025

Back on October 26, the cost of transactions in Ethereum dropped to 0.16 Gwei (about $0.01).

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!