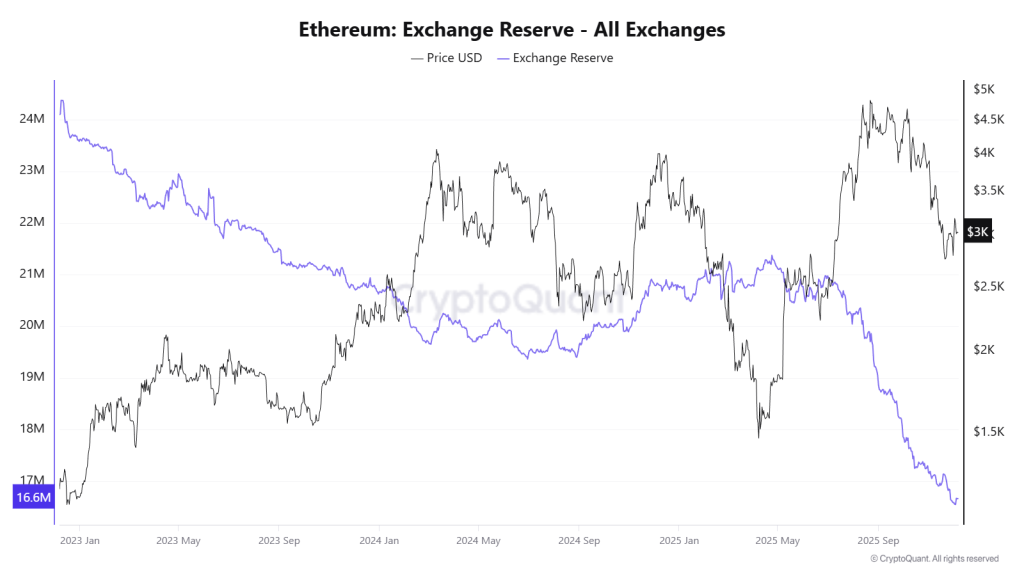

Ethereum Reserves on Exchanges Hit Historic Lows

Analysts predict an imminent supply crisis.

The volume of Ethereum held on centralized exchanges has dropped to 8.7% of the total supply, approximately 16.6 million ETH. Such levels have not been seen since the network’s inception in 2015.

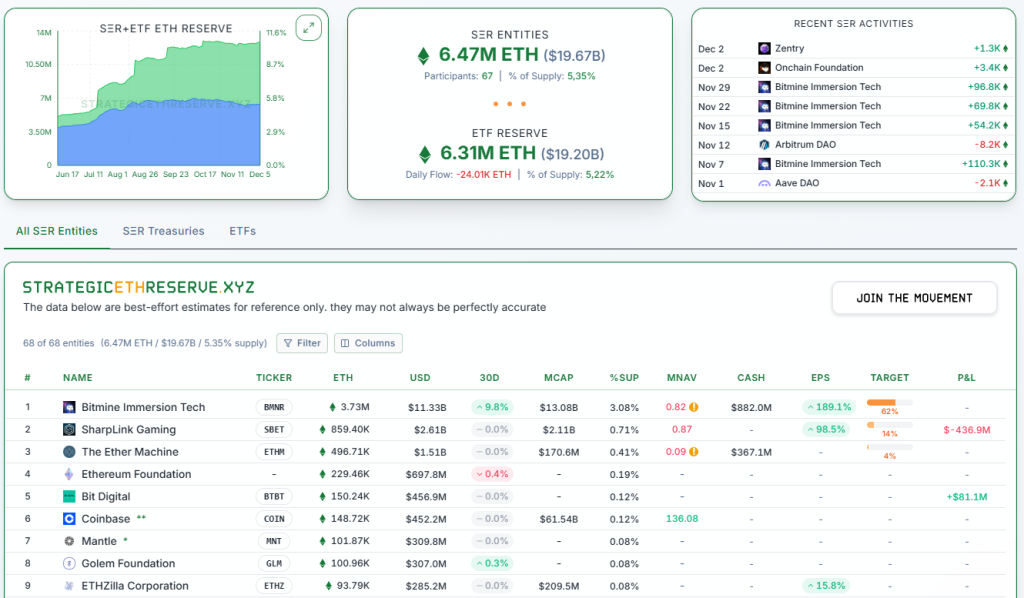

Since July 2025, this figure has fallen by approximately 20%. The sharp withdrawal of assets coincided with the rise of DAT companies, which began acquiring the second-largest cryptocurrency by market capitalization.

At the time of writing, the volume of assets managed by such firms and exchange-traded funds reached 12.79 million ETH, accounting for 11.6% of the coin’s supply.

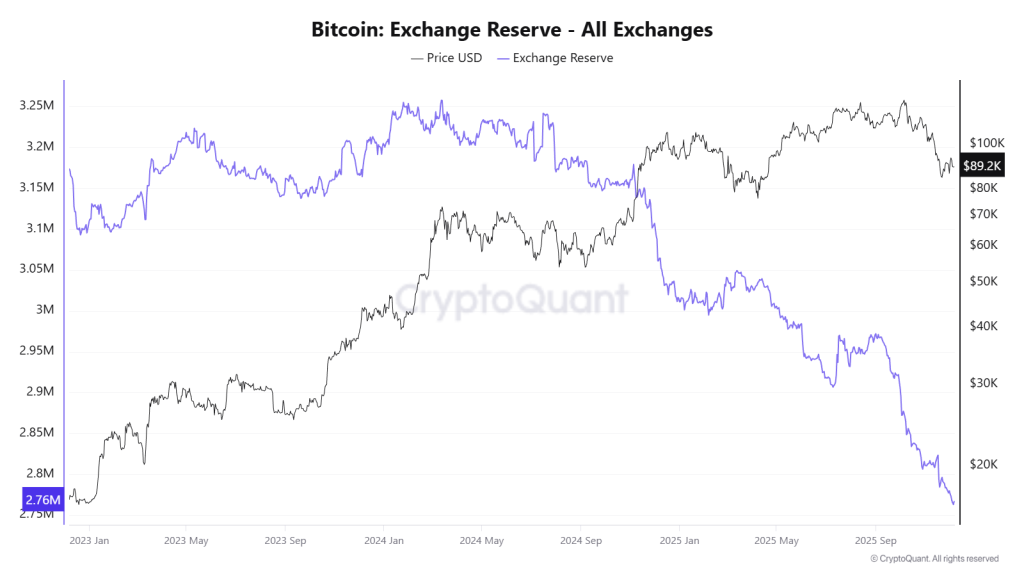

Meanwhile, Bitcoin’s share on centralized exchanges stands at about 13.1% (2.76 million BTC), also at a record low.

An analyst known as Milk Road noted that Ethereum is quietly entering its tightest supply environment ever.

$ETH is quietly entering its tightest supply environment ever.

Exchange balances just fell to 8.84% of total supply, a level we’ve never seen before.

For context, $BTC is still sitting near 14.8%.

ETH keeps getting pulled into places that don’t sell, staking, restaking, L2… pic.twitter.com/T7MW3D2bG1

— Milk Road (@MilkRoad) December 5, 2025

“ETH continues to flow into places where it is not sold: staking, restaking, L2 activity, data availability layers, collateral cycles, long-term storage. […] The coin’s supply is shrinking in the background while the market decides what to do next,” the expert emphasized.

He believes Ethereum will enter a rally phase once more buyers return to the market, facing a supply shortage.

Currently, ETH is trading around $3000, with little change in price over the past day.

On December 3, developers successfully deployed the Fusaka update on the Ethereum mainnet.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!