Ethereum Staking Reaches Record 30% of Supply

Ethereum staking reaches record 30% of supply.

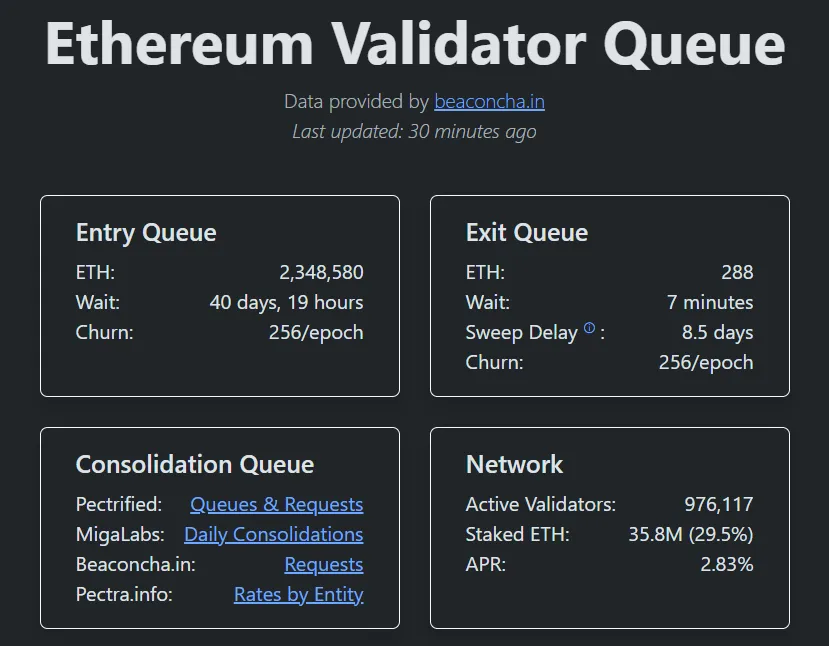

The amount of Ethereum coins locked in staking has reached a new all-time high. The Beacon Chain network holds 35.8 million ETH, accounting for 29.57% of the market supply of the second-largest cryptocurrency by market capitalization.

In dollar terms, this figure has exceeded $118 billion. The previous record of 29.54% was set in July 2025.

The number of active validators stands at 976,117. An additional 2.3 million coins are queued for entry. Meanwhile, the exit queue remains at historic lows, indicating a lack of selling pressure.

The market leader remains the liquid staking protocol Lido Finance, which accounts for about 24% of all locked assets.

Institutional Influence

Major players and issuers of exchange-traded products have been key drivers of growth:

- BitMine. Under the leadership of Tom Lee, the firm holds 4.07 million ETH (3.36% of total issuance). Over the past week, the company doubled its locked assets to 1.53 million ETH.

- ETF. Grayscale began distributing staking rewards among its fund investors. Morgan Stanley filed for the launch of a spot Ethereum ETF with a locking option, confirming asset managers’ interest in passive blockchain income.

Amid institutional activity, the price of the second-largest cryptocurrency by market capitalization rose by 5.5% in a day, reaching $3,320.

On January 14, Ethereum tested $3,350 following a record influx of new blockchain users.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!