Ethereum Staking Share Reaches Record 50%

Ethereum staking contract holds over half of total supply, Santiment reports.

For the first time, Ethereum’s staking contract has accumulated more than half of the asset’s total supply, according to analysts at Santiment.

🤑 BREAKING: Ethereum’s proof-of-stake contract address now holds over half of Ethereum’s supply for the first time in the coin’s 11-year history.

🔐 There is often confusion about how this proof-of-stake address works. Think of it as a one-way vault that temporarily locks $ETH… pic.twitter.com/agj2YG37nu

— Santiment (@santimentfeed) February 17, 2026

The calculation of a 50.18% share (80.95 million ETH) is based on the historical issuance volume of Ethereum before the introduction of the burning mechanism. Currently, around 120 million ETH are in circulation.

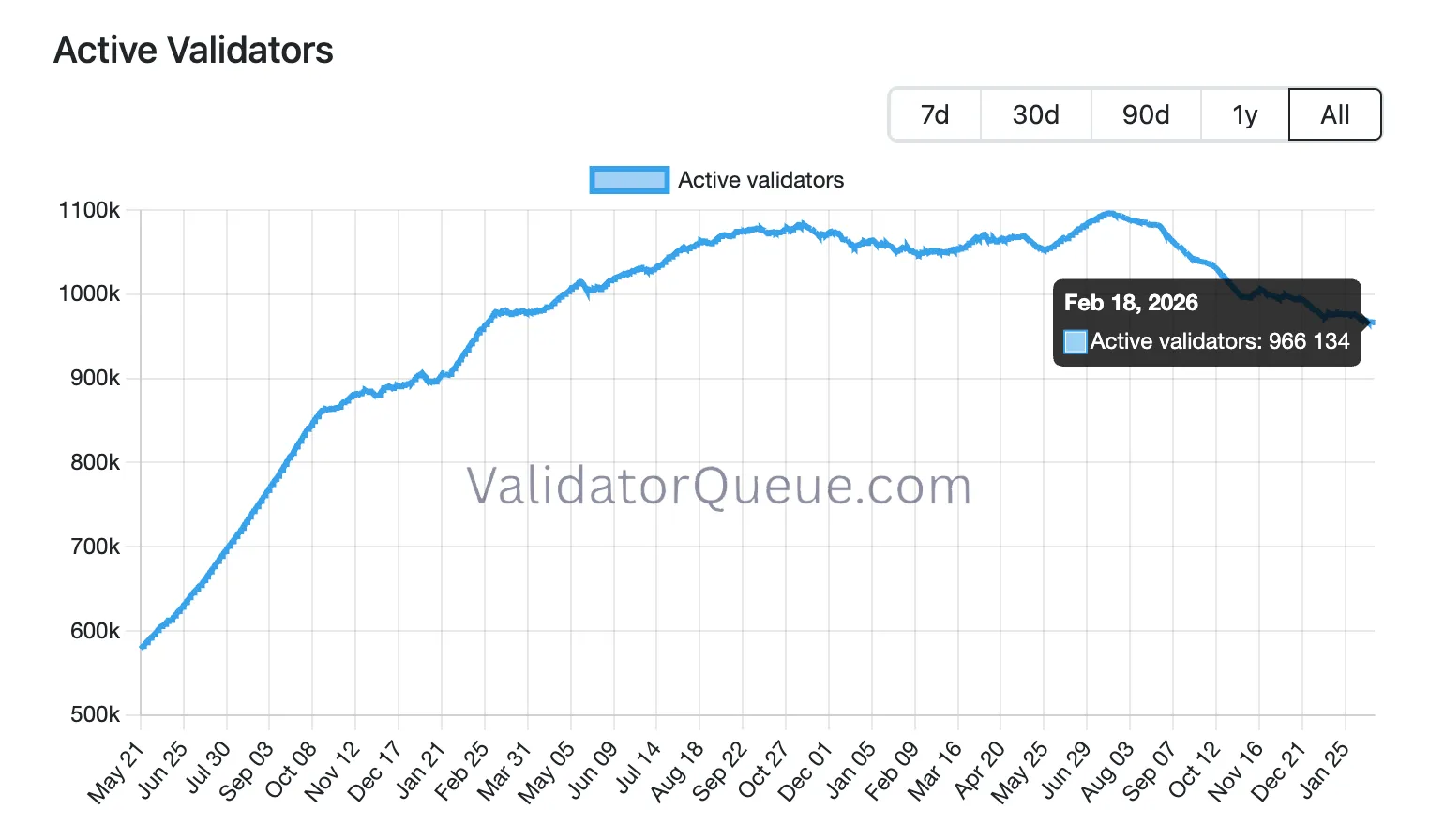

As of the time of writing, 36.9 million ETH are locked in the mainnet, representing 30.41% of the leading altcoin’s supply. The number of active validators is 966,134.

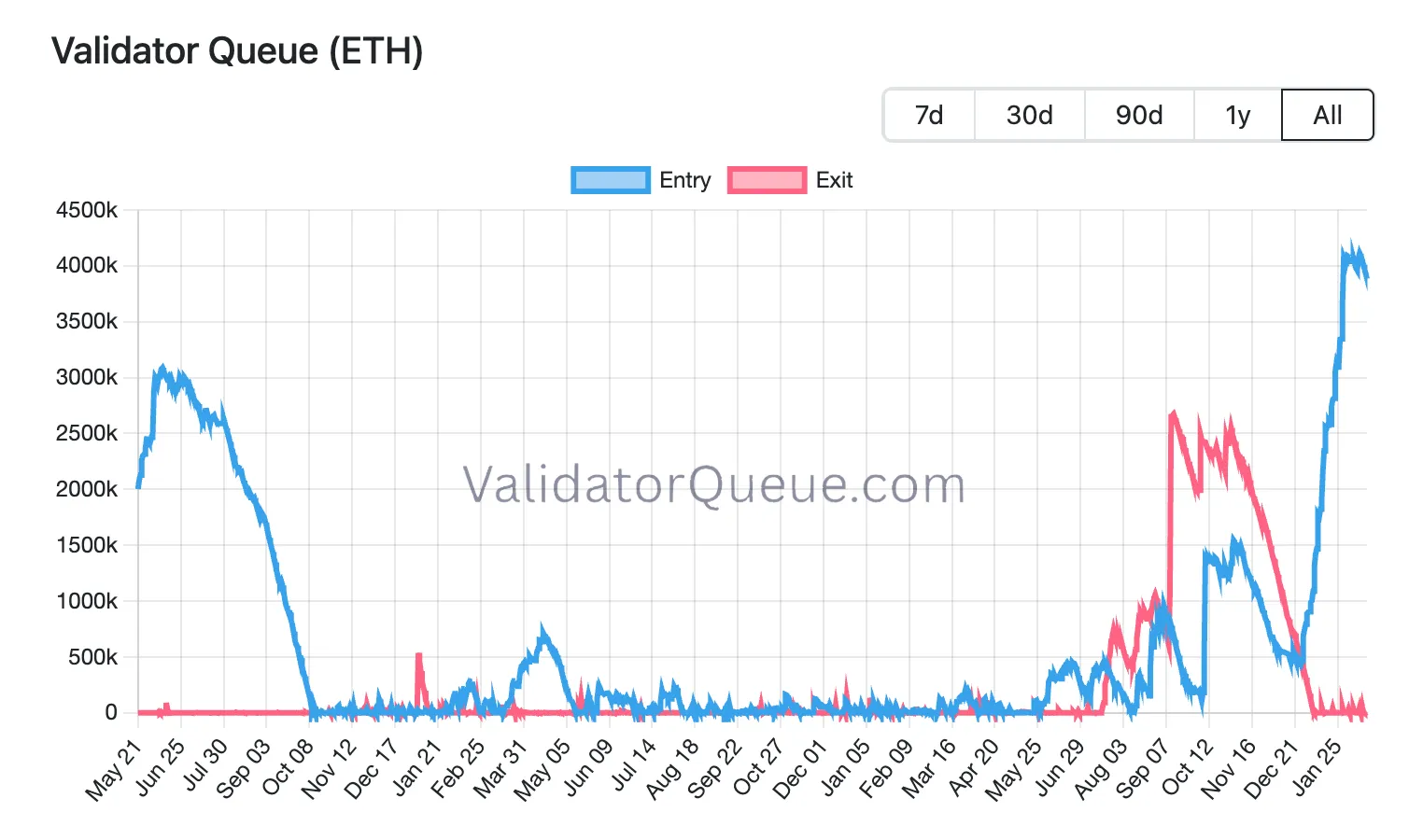

The Ethereum staking queue is near historical highs at 3.8 million ETH (waiting time — 67 days). A record of 4.1 million ETH was recorded on February 12.

Currently, 6,112 ETH are awaiting unlocking. The waiting time is estimated at two minutes.

A trend shift occurred on December 27, when the figures equaled around 460,000 coins.

BitMine

Earlier, Smart Economy podcast host Dylan Grabowski linked changes in queues to aggressive coin purchases by large treasury companies followed by locking. A similar trend is observed now.

On February 17, BitMine announced the purchase of 45,759 ETH, increasing the firm’s reserves to 4.3 million ETH ($9.6 billion). Of these, 3 million tokens ($6.1 billion) are locked in staking. Potentially, this could provide an annual passive income of $176 million, based on the current asset prices and a composite rate of 2.84%.

After deploying the MAVAN validator network, the company expects profits to rise to $252 million.

Earlier this month, analysts noted that the unrealized loss from the firm’s crypto strategy approached $7 billion. Over the past month, Ethereum’s price has plummeted by more than 40%.

Nevertheless, the company’s chairman, Tom Lee, stated that BitMine will continue accumulating regardless of short-term price fluctuations.

BlackRock

The world’s largest asset manager, BlackRock, has taken its first step towards launching a profitable Ethereum fund in the US. According to an updated S-1 registration form, an affiliated company structure acquired 4,000 seed shares at $25 each, providing the trust’s initial capital of $100,000.

The new exchange-traded structure, iShares Staked Ethereum Trust ETF (expected ticker ETHB), plans to stake between 70% and 95% of assets depending on market conditions.

According to BlackRock’s calculations, the average annual yield of such a strategy at the beginning of 2026 is about 3%.

The product will fundamentally differ from the existing BlackRock spot Ethereum ETF (ETHA), which only offers price tracking without additional income. ETHB will be the first tool allowing institutional investors to earn staking income through a traditional exchange-traded product.

The terms are as follows:

- sponsor fee: 0.25% per annum (reduced to 0.12% on the first $2.5 billion of assets for 12 months after launch);

- sponsor and execution agent fee (Coinbase Prime): 18% of gross staking income;

- liquidity reserve: 5-30% ETH will remain unstaked to meet operational needs, creation, and redemption of shares.

Earlier in February, billionaire Peter Thiel and his associated structure, Founders Fund, completely sold their stakes in the “treasury” company ETHZilla.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!