Ethereum Surpasses Bitcoin in Growth Following Fed Rate Cut

The second-largest cryptocurrency by market capitalization has outpaced Bitcoin in price growth following the recent 50 basis point rate cut by the Fed.

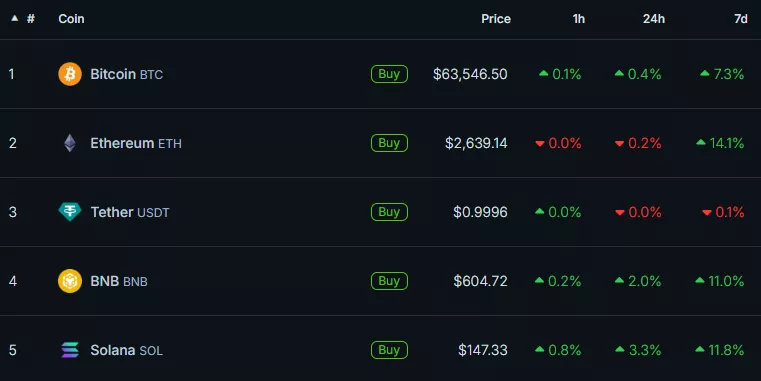

Over the past week, digital gold has risen by 7.3%, while Ethereum has surged by 14.1%.

Following the easing of monetary policy in the US, funding rates for perpetual futures based on Ether turned positive—0.0069% at the time of writing, according to CoinGlass.

In a conversation with The Block, YouHodler exchange executive Ruslan Lienha emphasized that the current situation indicates a predominance of bullish sentiment. He noted the risks of a potential correction in the event of excessive optimism or changes in external factors.

“The positive funding rate for Ethereum reflects increased demand for leveraged long positions,” explained the expert.

He reminded that funding rates are also quite volatile.

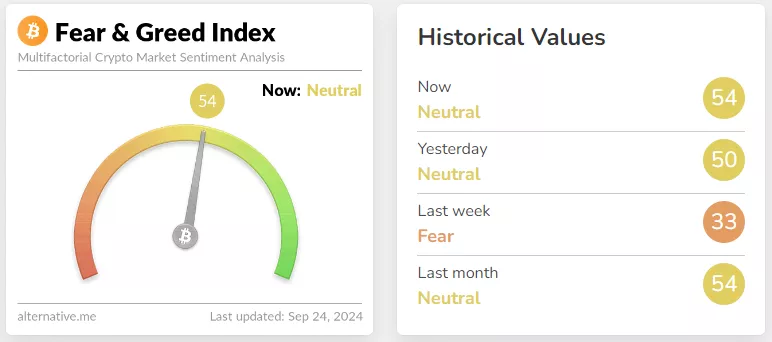

The cryptocurrency fear and greed index remains at neutral levels:

“Funding rates on major exchanges are improving, and the underlying yield is becoming more attractive, especially considering the recent rate cut,” noted QCP Capital.

Experts at Bitfinex highlighted positive trends in many altcoins but expressed concerns about increasing volatility.

“OI reached $11.48 billion, surpassing the August peak of $10.74 billion, which is a worrying sign of potential volatility in the altcoin market,” the report states.

At the time of writing, Bitcoin is trading around $63,530, and Ethereum is at $2,640. The total market capitalization is $2.33 trillion, according to CoinGecko.

Earlier, ForkLog reported that a record $79.2 million was withdrawn from ETH-ETF since July.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!