Ethereum’s Quarterly Profit Surpasses $365 Million Amid DeFi Surge

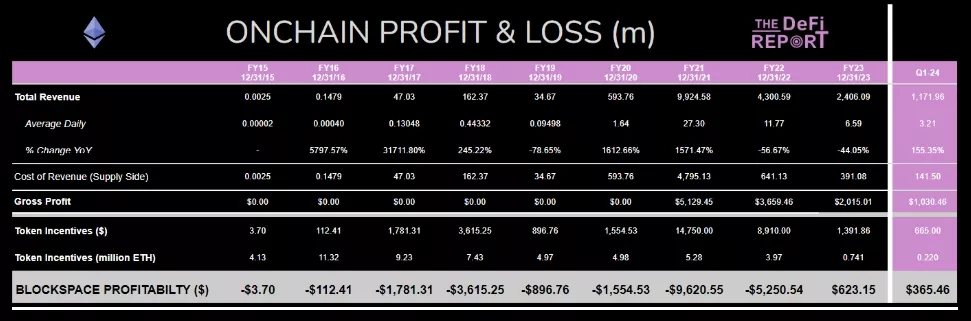

In the first quarter, the Ethereum blockchain recorded a net profit of $365.46 million, marking an increase of nearly 200% from the previous period’s $123 million, according to a report by The DeFi Report.

Analyst Michael Nadeau noted that the network’s transaction fee revenue reached $1.17 billion, a 155% increase compared to the fourth quarter of 2023.

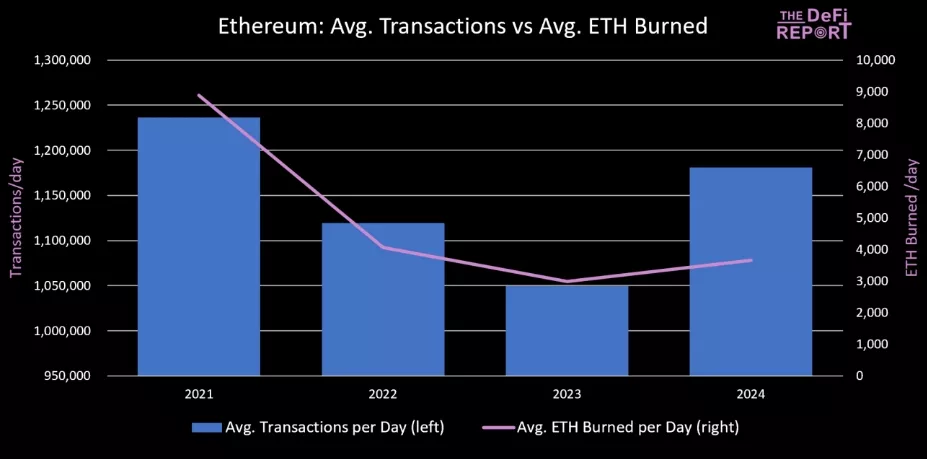

He attributed the sharp revenue increase primarily to heightened activity in the DeFi sector. Consequently, the average daily transaction count in 2024 reached 1.15 million.

This figure surpassed the levels of the previous two years and approached the 2021 peak of 1.25 million.

Ethereum has been operational for over eight years, but 2023 was its first profitable year, earning $623 million despite a 75% drop in revenue.

“This is largely due to the transition to Proof-of-Stake consensus in September 2022, which reduced miner (now validator) incentives by approximately 80%,” explained Nadeau.

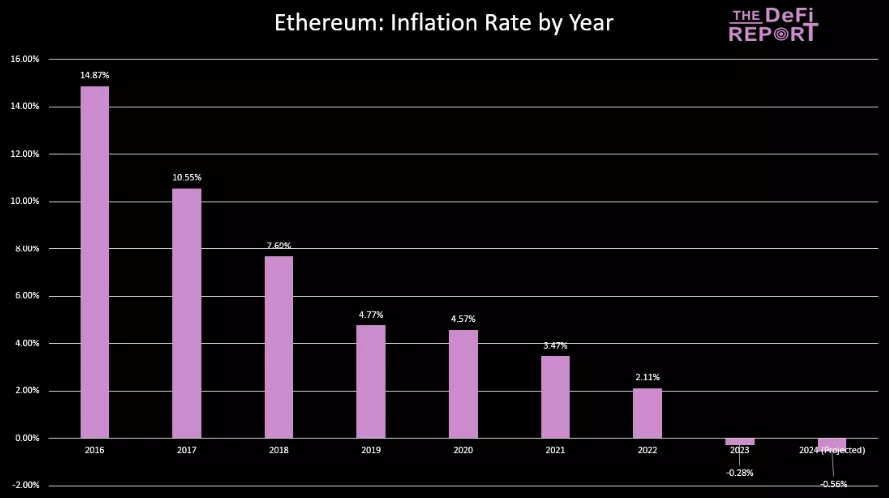

In August 2021, the London hard fork introduced a mechanism for burning a portion of fees, laying the groundwork for a deflationary model. However, 2023 was the first year with negative inflation for Ethereum. Increased activity in the first quarter of 2024 and the implementation of the Dencun upgrade led to an accelerated reduction in coin supply by 0.56% annually.

DeFi Driven by Liquid Restaking in Ethereum Ecosystem

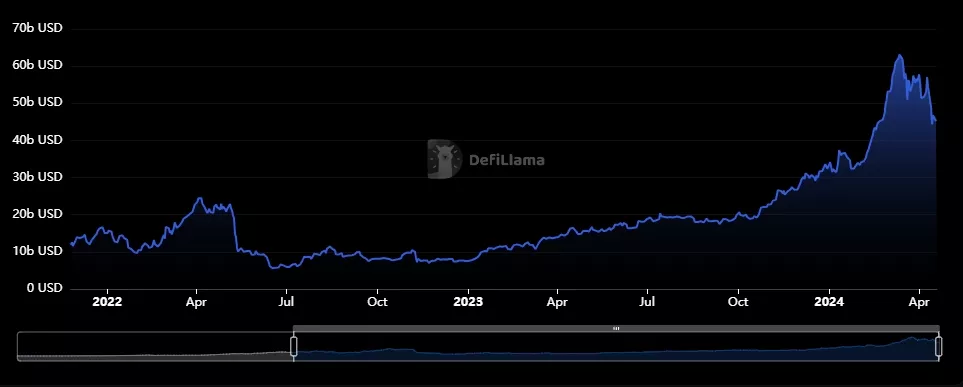

In the first quarter of 2024, the total value locked (TVL) in DeFi protocols rose by 65.6% to $101 billion, according to analysts at Messari.

In Q1 2024, the trend of DeFi went in one direction, up ⬆️

DeFi TVL increased by 65.6% QoQ to reach $101 billion, this uptick was primarily driven by asset price appreciation and liquid restaking.

Explore the full report on the State of DeFi ⬇️ https://t.co/6ZoyFJTv6w pic.twitter.com/awOtGZV5u1

— Messari (@MessariCrypto) April 18, 2024

“This is primarily due to price growth and liquid restaking, which led to a 71% increase in Ethereum’s TVL,” analysts stated.

Experts at QuickNode echoed this sentiment, confirming in a report that various staking offerings were catalysts for the “explosive growth of DeFi.”

On March 13, the combined TVL of liquid staking protocols reached a peak of $63.1 billion, according to DeFi Llama.

Lido remains the leader, with the platform’s figure exceeding $28 billion at the time of writing.

During the first quarter, the popularity of liquid restaking protocols like EigenLayer surged. As of April 1, their TVL reached $8.6 billion.

Specialists at QuickNode also noted that a significant 291% increase in user activity over the quarter “rekindled hopes” for a second “DeFi summer.”

Earlier, Andre Dragos, head of research at ETC Group, suggested that Ethereum could outpace Bitcoin in price growth in 2024. He cited technological advancements and the network’s position as the leading smart contract platform as key factors.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!