ETHZilla crypto treasury sells $74m of Ethereum

ETHZilla sells $74.5m in ETH; BitMine buys more; Strategy hoards cash.

Backed by Peter Thiel, the DAT-company ETHZilla sold 24,291 ETH worth $74.5m to retire debt obligations.

The average sale price was $3,068 per coin. The proceeds will be used to repurchase outstanding convertible notes.

About 69,800 ETH worth $206m remain on the firm’s balance sheet.

ETHZilla first disclosed asset sales in late October. At the time, the company said it intended to sell coins until the mNAV stabilised.

Over the past day, shares in the Ethereum-accumulating vehicle fell 8.7%. Since the start of the year, the price has tumbled by more than 65%.

BitMine accumulates

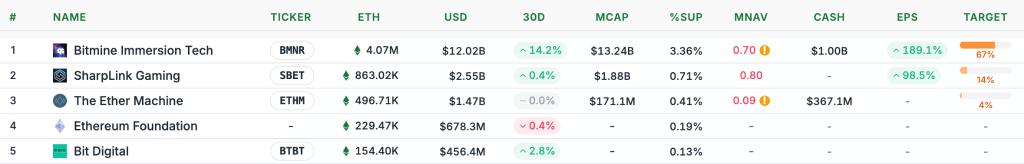

Last week the largest corporate holder of Ethereum — BitMine — bought 13,412 ETH for $40.61m. The amount of the second-largest cryptocurrency under the company’s management has exceeded 4m ETH ($12bn).

The average purchase price was $2,991 per coin.

“BitMine continues to steadily build its Ethereum reserve; over the past week the company added 98,852 ETH, and its holdings now exceed the critical threshold of 4m ETH. This is a monumental milestone achieved in just five and a half months,” said the firm’s chairman Tom Lee.

As the second-largest cryptocurrency recovered to $3,000, BitMine’s reserves turned profitable again. After the October plunge the company briefly “went into the red”.

Over the past six months the company’s shares have gained more than 570%. BitMine is one of the few DATs whose stock has benefited from a shift to a crypto-accumulation strategy.

In a press release the company emphasised that from early 2026 it plans to earn on its Ethereum reserves through staking.

“We are actively developing our solution — The Made in America Validator Network. This will be flagship, maximally secure infrastructure for staking, and we plan to launch it in the first quarter of 2026,” Lee said.

Strategy bides its time

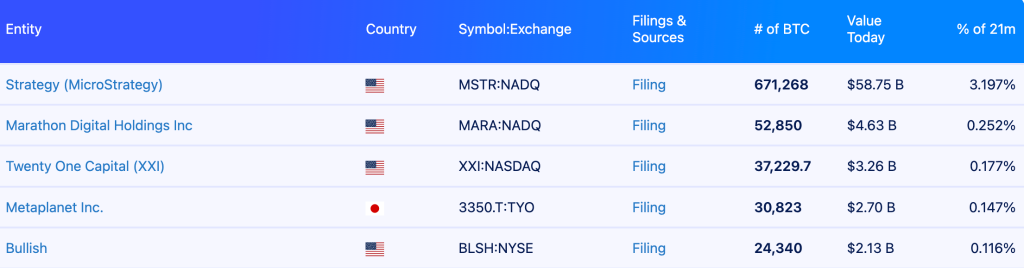

Last week, Strategy Michael Saylor paused bitcoin purchases. Instead, the company topped up its dollar reserve by $748m, increasing it from $1.44bn to $2.19bn.

The firm created this fund in early December by selling MSTR shares. The vehicle is intended for “stable and continuous” dividend payments when the price of the first cryptocurrency falls.

Strategy remains the largest public holder of digital gold. It manages 671,268 BTC worth $58.7bn.

A week earlier — from December 8 to 12 — the company bought 10,624 BTC for $962.7m.

According to TD Cowen analysts, boosting the dollar reserve signals preparation for a “prolonged crypto winter”, writes The Block.

By their estimate, the current size of the fund is sufficient to cover interest and dividend payments for 32 months. This will keep Strategy resilient even in the event of a prolonged market slump.

“This move demonstrates the strength of Strategy’s balance sheet and should dispel any concerns about its long-term viability. Strengthening liquidity in a period of uncertainty is a prudent strategy, and we believe all of the company’s stakeholders will ultimately benefit,” TD Cowen said.

The research department reaffirmed a “Buy” recommendation on the firm’s shares with a 12-month price target of $500. At the current price of about $165 (43% below the level at the start of the year), that implies upside of more than 200%.

Earlier, CryptoQuant analysts warned of the onset of a “crypto winter”. They forecast a bitcoin bottom around $56,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!