Expert Advocates Buying Bitcoin Amidst Decline

The current correction in Bitcoin is “insubstantial” compared to previous price pullbacks and should be seen as an opportunity to increase long positions, according to Quinn Thompson, CEO of Lekker Capital.

I don’t usually give very short-term views, but seems like a no-brainer to be bidding this area with clear invalidation on the back of a 180 degree shift in the macro backdrop from the relative to the 3 previous similar setups. https://t.co/NzqUSEvKbg pic.twitter.com/1PlviEyf5o

— Quinn Thompson (@qthomp) October 3, 2024

“Buying Bitcoin at $61,000 is a no-brainer. The macroeconomic backdrop has significantly changed compared to previous similar episodes,” the expert explained.

Thompson highlighted three previous “similar situations” where the price sharply fell well below the 200 DMA. This time, the quotes bounced off the moving average.

The CEO of Lekker Capital’s position was supported by Santiment founder Maksim Balashevich.

“The enthusiasm from Uptober is waning as the market falls, opening up the possibility for a rebound. Whether the larger downtrend has ended remains to be seen,” the expert noted.

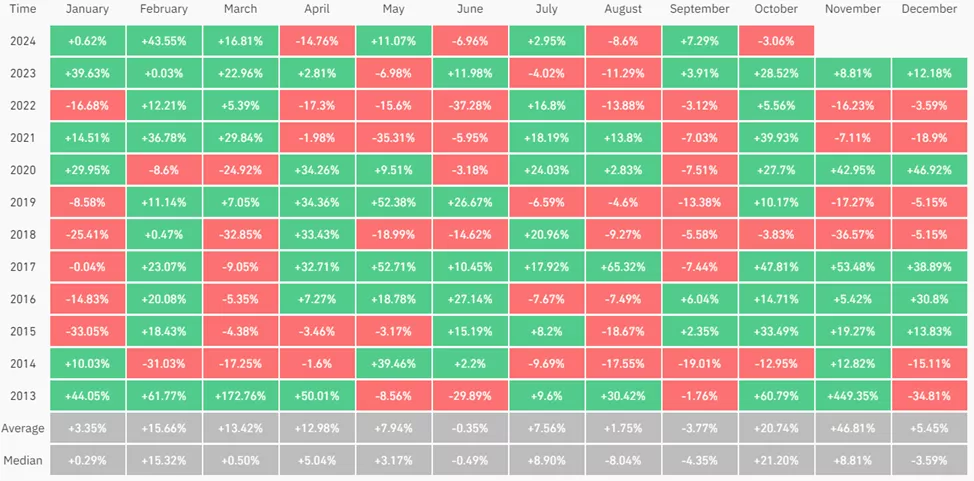

Historically, October is one of the best months for Bitcoin. Since 2013, the average return has been 20.74%.

Co-founder of Arbelos Markets Joshua Lim warned of expected increased volatility in the coming days.

In an interview with CoinDesk, the specialist referred to the nature of the implied volatility curve, which indicates that options market participants are preparing for turbulence following labor market data on October 4 at 15:30 (Kyiv/MSK) and potential retaliatory strikes from Israel.

CoinMarketCap has predicted an early end to the cryptocurrency bull market.

Earlier, Canaccord noted that a Bitcoin rally is inevitable.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!