Expert Clarifies Market Impact Differences Between Bitcoin ETFs and Corporate Reserves

Inflows into ETFs based on the leading cryptocurrency continue to affect its price, whereas firms with digital asset reserves exert minimal influence. This was stated by Vetle Lunde, Head of Research at K33.

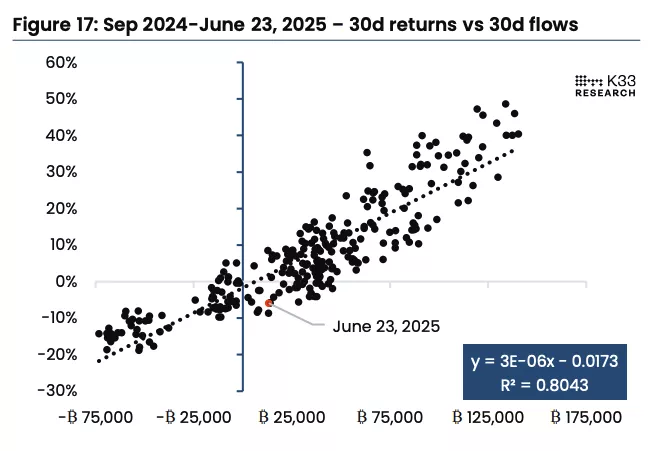

According to the report, the coefficient of determination (R²) between the price of Bitcoin and inflows into spot exchange-traded funds stands at 0.8. This accounts for about 80% of the variance in Bitcoin’s 30-day returns.

According to Lunde’s observations, Bitcoin ETFs collectively added 13,000 BTC over the past month, marking the weakest 30-day inflow since April 23. This situation accurately reflects the dynamics of digital gold itself, which is currently in a sideways trend.

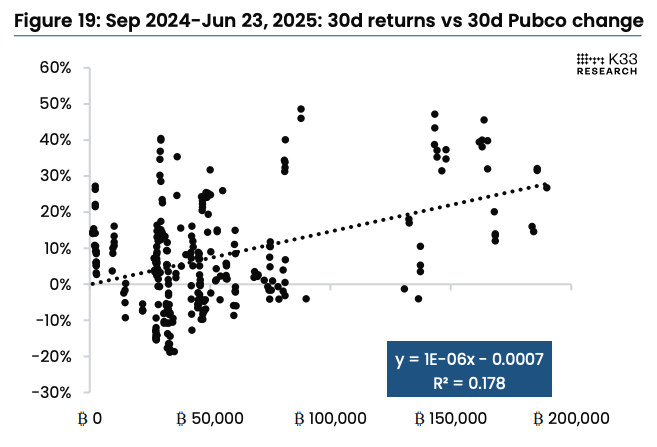

Meanwhile, the growth of companies with cryptocurrency reserves had a less significant impact on prices. Data shows a weak correlation between firms acquiring Bitcoin and its price.

While organizations like Strategy continue to purchase coins directly from the market using borrowed or equity capital, influencing demand, many new participants adopt a different approach. The K33 analyst noted that over the past three months, more than 50 new treasury initiatives have been launched, many of which acquired Bitcoin through in-kind stock exchanges with major holders.

For instance, the company Twenty One, which accumulated 37,230 BTC, acquired assets by exchanging its securities for Tether and Bitfinex coins. This model generates virtually no net market demand and thus affects prices less than ETF inflows.

“Such structures weaken the impact of inflows into treasury companies and may explain the soft R² of 0.18 between their 30-day inflows and Bitcoin returns,” added Lunde.

Other Factors

On June 22, Bitcoin fell below $100,000 amid escalating conflict between Iran and Israel, but quickly recovered to around $108,000 following de-escalation. Despite high volatility, the weekly decline was only 1%.

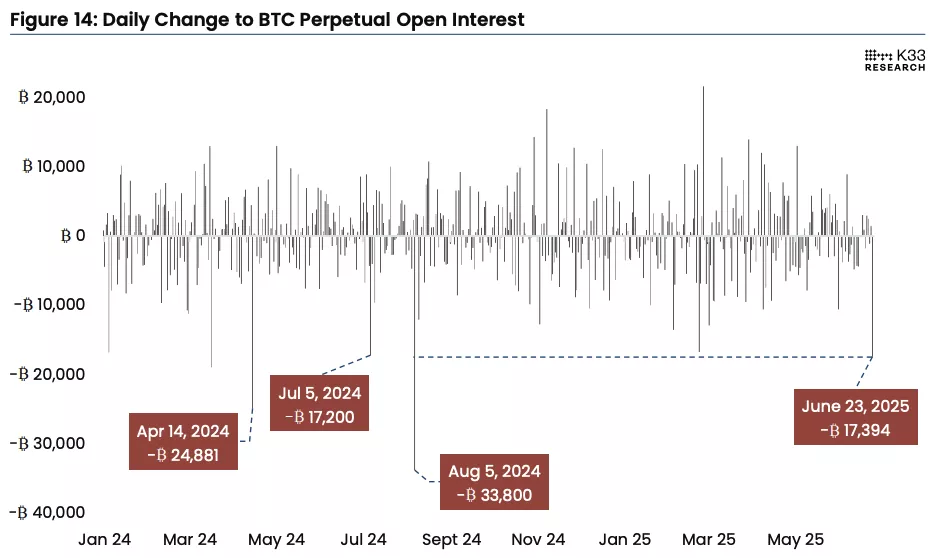

Although the impact of the armed conflict on the crypto market may seem minor, it prompted investors to reassess their risk management strategies, Lunde noted. This triggered the largest daily drop in open interest in Bitcoin perpetual futures since August 2024, with an outflow of 17,394 BTC recorded on June 23.

The sharp reduction in leverage was driven by fears of a larger confrontation and the potential closure of the Strait of Hormuz, a key artery for oil supplies.

A ceasefire will calm investors, but upcoming events in the US, including President Donald Trump’s budget bill and the July 9 tariff deadline, could trigger high volatility in the crypto market, Lunde concluded.

Analysts at Presto stated that the popularity of corporate cryptocurrency reserves marks a new era in the financial sector, comparable to the advent of leverage and ETFs, but it conceals risks.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!