Expert Labels Bitcoin as the ‘Naked King’

Bitcoin is predicted to collapse within 7-11 years, says Justin Bons of Cyber Capital.

The first cryptocurrency is predicted to collapse within the next 7-11 years, according to Justin Bons, founder of the European company Cyber Capital.

BTC will collapse within 7 to 11 years from now!

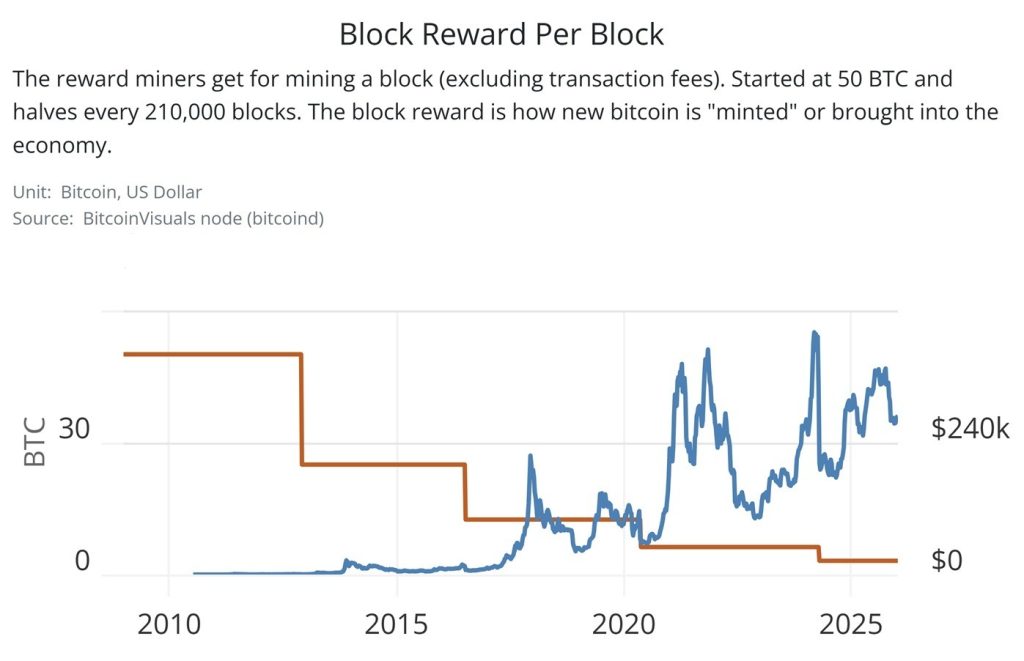

First, the mining industry will fall, as the security budget shrinks

That is when the attacks begin; censorship & double-spends

Core will then have to increase inflation beyond 21M, splitting the chain & that will be the end! 🧵… pic.twitter.com/HqFmhW480L

— Justin Bons (@Justin_Bons) January 15, 2026

The problems will begin with a collapse in mining, as the network’s security budget shrinks, leading to attacks such as double-spending and blockchain reorganizations. Bons believes this will result in a chain fork.

In its current form, Bitcoin must either double in price every four years or significantly increase the volume of collected online fees.

“Code and mathematics do not lie; all of this can be independently verified. We must prioritize the truth, no matter how much we like the idea of Bitcoin—it is the naked king,” the expert stated.

In his view, the level of network fee volume is unable to keep pace with the necessary rates.

To maintain network security, the token price must double during the four-year halving cycle. In the current system, Bitcoin must either grow at the planned rates or the volume of fees must increase significantly.

“This is why BTC’s security will inevitably continue to decline until attacks on it become profitable. We can roughly estimate the timing of this collapse (7-11 years) as it is based on the halving cycle,” the expert stated.

He identified a risk zone during the next 2-3 block reward reductions.

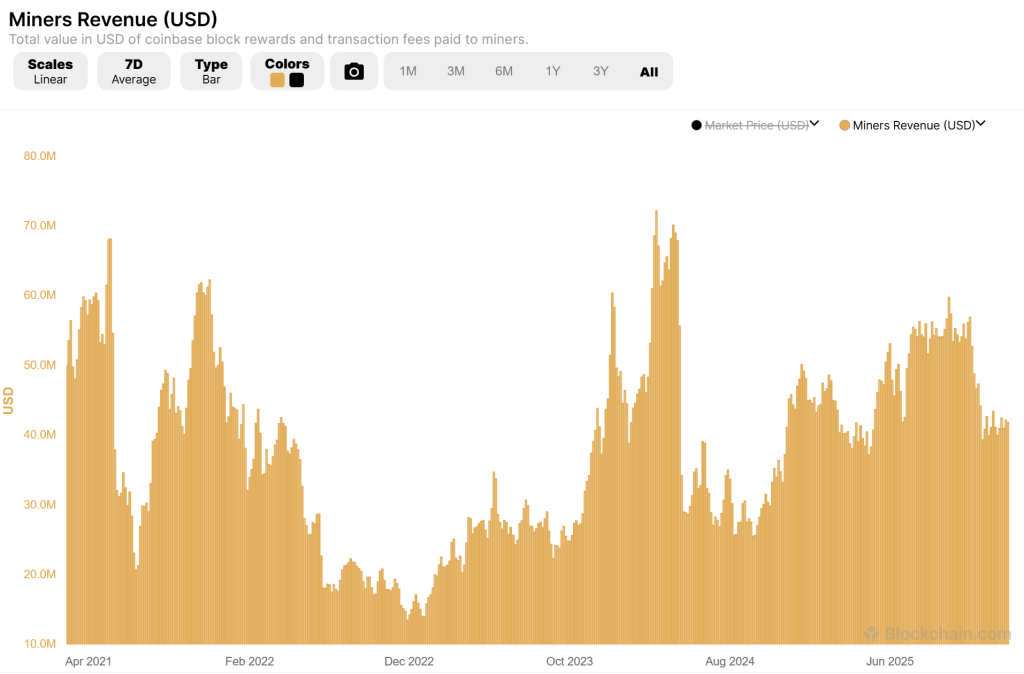

Referring to miner revenue, Bons claims that the indicator shows Bitcoin’s security is currently lower than it was five years ago.

In this context, the expert considers miner revenue a more significant metric compared to hashrate.

“Computational power does not equal security. Most Bitcoin influencers do not understand how PoW (Proof-of-Work) operates, leading to a deep public misunderstanding of BTC’s security model flaws. This is because hashrate is mostly a meaningless indicator when assessing risks,” Bons asserts.

One potential solution, according to the expert, is removing the 21 million coin limit for Bitcoin issuance.

Earlier, analyst David Eng suggested that the first cryptocurrency will surpass gold as the primary store of value, based on the mathematics of limited supply.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!