Expert Declares Cryptocurrency Market Liquidity Is Drying Up

Analysts outline why bitcoin is falling and sketch the near-term outlook

While other markets climb, cryptocurrencies continue to move sideways amid a near-total absence of liquidity. According to the co-founder of the ETH Strategy protocol, known as Clouted, something “broke” after the October sell-off.

something absolutely fucking broke and some serious shit is going on since october 10 and we deserve to know real answers not just speculations and rumors

there is no liquidity and no bid on crypto since and non stop selling pic.twitter.com/l6x9B0wt7W

— Clouted (@CloutedMind) December 22, 2025

“Something serious has been going on since October 10. We deserve truthful answers, not just speculation and rumours. Since then there has been no liquidity and no bid in crypto, only continuous selling,” he wrote.

The expert stressed that quantitative easing has returned, but flows into digital assets have not. Meanwhile, equities and precious metals are in the midst of another rally.

Over the past 24 hours the S&P 500 rose almost 0.64%, while the Nasdaq Composite added 0.52%. Analysts at The Kobeissi Letter pointed to strong investor appetite for US stocks.

Investors are extremely bullish:

Bank of America’s Bull & Bear Indicator is up +0.6 points over the last few trading days, to 8.5, re-entering extreme bull territory.

The index measures hedge fund and fund manager positioning, equity and bond flows, and market breadth.… pic.twitter.com/bY7yJn8tDV

— The Kobeissi Letter (@KobeissiLetter) December 22, 2025

On December 23rd, gold set a fresh record high at $4500 per ounce. The metal is up 70% year to date.

BREAKING: Gold futures surge above $4,500/oz for the first time in history, now up more than +70% this year.

Gold is now on track for its biggest yearly gain since 1979. pic.twitter.com/m8hY2oxZmf

— The Kobeissi Letter (@KobeissiLetter) December 23, 2025

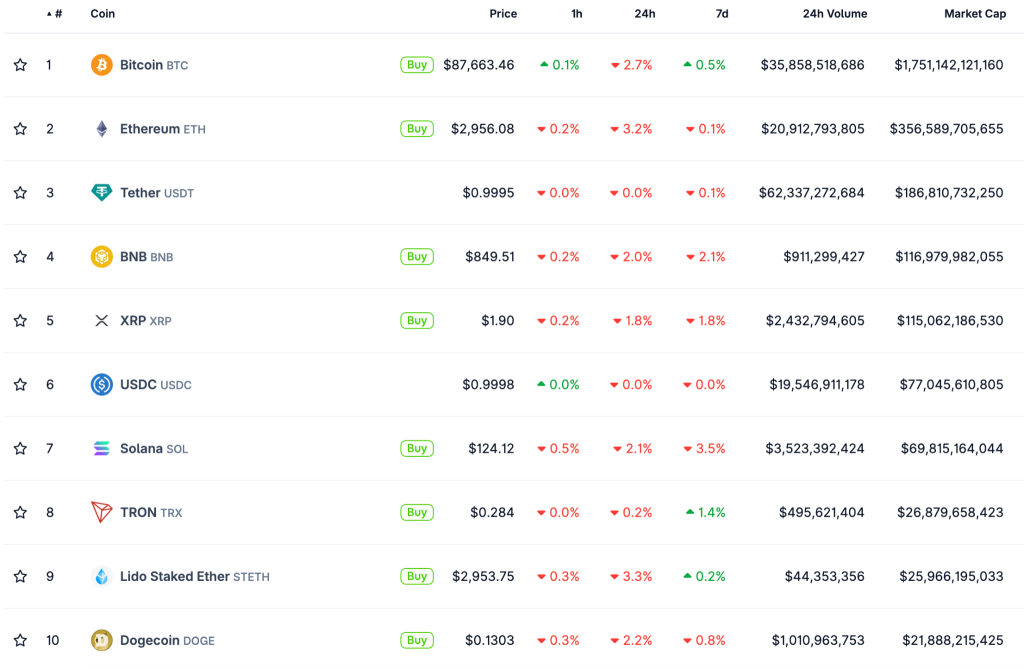

Crypto tells the opposite story: over the past 24 hours bitcoin fell 2.7%. At the time of writing it trades around $87,600, down 6.3% year on year.

Ethereum has again slipped below the psychologically important $3000 level. Every coin in the top ten by market value is in the red.

The total value of the digital-asset market fell 2.3% in a day to $3.05trn.

Clouted pointed to a paradox: the global “debasement trade” in fiat is gathering pace, yet cryptocurrencies—supposedly among the principal hedges—remain on a downward track.

“How this is even possible for an asset class whose hedge against devaluation is almost its only key value proposition is beyond me,” he noted.

QCP analysts also flagged thinning liquidity, attributing it to traders closing positions ahead of the holidays.

Open interest in bitcoin futures on major exchanges fell by $3bn overnight, and by around $2bn in Ethereum-linked products.

“Although leverage has come down, the reduction in market depth means squeeze risk in either direction remains elevated. Historically, bitcoin tends to swing 5–7% over the Christmas period,” the experts added.

Why is bitcoin falling?

CryptoQuant analysts explained that bitcoin’s correlation with the Nasdaq began to diverge in August. Its correlation with gold turned negative around July.

Bitcoin, however, is lagging.

— BTC & Nasdaq correlation began diverging around August

— BTC & Gold correlation has turned negative since July

Bitcoin is no longer moving in sync with either tech stocks or hard money. pic.twitter.com/mBHrzkNGWg

— CryptoQuant.com (@cryptoquant_com) December 23, 2025

“Bitcoin is no longer moving in sync with either tech stocks or safe-haven assets,” they noted.

They said large holders have been weighing on “digital gold” by continuing to sell; the steady whale supply has not abated since October.

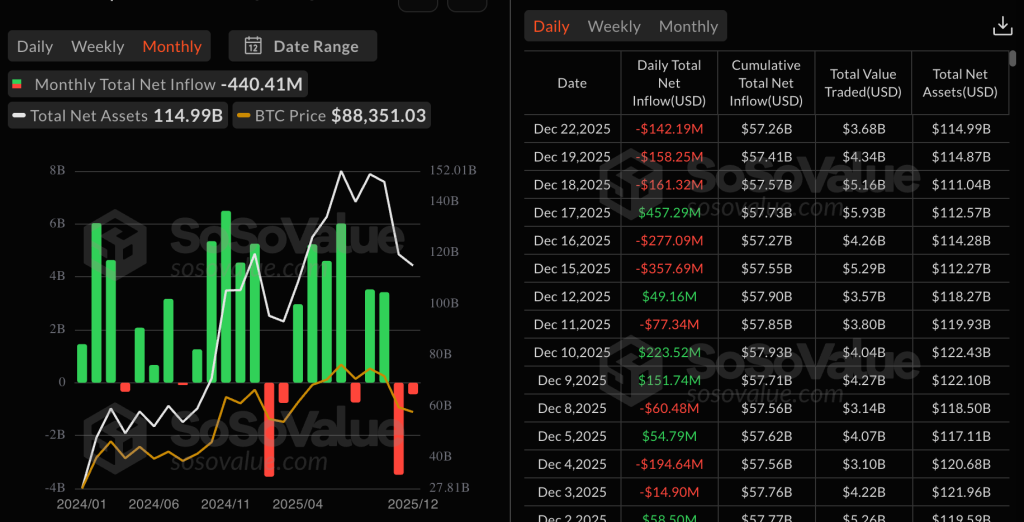

In November, spot bitcoin-ETF outflows totalled $3.4bn; in December to date, $440m.

“Capital is rotating into safe instruments like gold and silver, while equities are rising on the frenzy around AI companies. Bitcoin is squeezed: on one side, seller pressure; on the other, a lack of strong demand for risk assets,” the specialists said.

Realised losses among large investors were one driver of the drop in bitcoin from $124,000 to $84,000. But their selling now appears to have run its course, CryptoQuant said.

Whale Capitulation on Pause.

Realized losses from new whales significantly impacted the price drop from $124K to $84K.

Since the recent low, these losses have declined and are now flat. pic.twitter.com/cCn5YsUxX8

— CryptoQuant.com (@cryptoquant_com) December 23, 2025

QCP added that heightened volatility may also stem from the 26 December expiry of $28.5bn of options on Deribit. The venue’s commercial director, Жан-Давид Пекиньо, stressed that this is twice last year’s level.

Open-interest positioning shows two focal points: $85,000 strikes and $100,000 puts.

Beyond options, tax-loss harvesting in the holiday period may also weigh on price, as investors lock in losses before the tax year ends on December 31st, QCP explained.

What next?

Пекиньо described the structure as a sign of “residual optimism” about a traditional “Santa Claus rally”, albeit with low apparent conviction. The move is echoed in average funding rates, which have risen from 0.04% to 0.09%.

According to the Deribit representative, the rise indicates a resumption of leveraged long positioning despite a marked deterioration in market depth.

Experts agreed that price moves during Christmas week are often technical. Historically they tend to mean-revert in January, when full liquidity and participation return.

Analyst Michaël van de Poppe called bitcoin’s bounce off $90,000 “not a bad sign for now”. He said traders now want to turn $86,000 into support, which would “provide sufficient grounds to continue battling key resistance areas”.

#Bitcoin rejects at a crucial resistance zone and continues the sideways price action.

That’s unfortunate, but it remains to be building and upwards trend on the lower timeframes.

Rejection at $90K isn’t a bad sign, as of yet.

The markets clearly want $86K to hold as… pic.twitter.com/iBG0xqPQ7o

— Michaël van de Poppe (@CryptoMichNL) December 23, 2025

He called the crypto market’s underperformance “temporary”.

Earlier, VanEck specialists pointed to miner capitulation and a possible bitcoin bottom.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!