Expert Warns of Slashing Risks and Losses in Hyperliquid’s New Markets

Custom markets on Hyperliquid face scalability limits and risks, says DeFi analyst Jordi.

Custom markets on Hyperliquid face fundamental scalability limitations and carry excessive risks, according to a DeFi analyst known as Jordi.

HIP-3 markets are not sustainable.

While everyone is hyped about permissionless markets, we need to talk about the math.

Delegating $HYPE to third-party deployers for LSTs isn’t just about yield; it’s about taking on massive risks: locked capital, slashing, and conflict of… https://t.co/YzFZozJaSS pic.twitter.com/eHfuujJUcR

— Jordi in Cryptoland (@lordjorx) December 25, 2025

As part of the HIP-3 update, the platform allowed users to launch synthetic perpetual contract markets. To do so, they must stake 500,000 HYPE. All trading fees are distributed among participants.

Thus, Hyperliquid has created a new layer — Exchange-as-a-Service. In this model, numerous independent operators compete for traders using a unified infrastructure, experts from ether.fi noted.

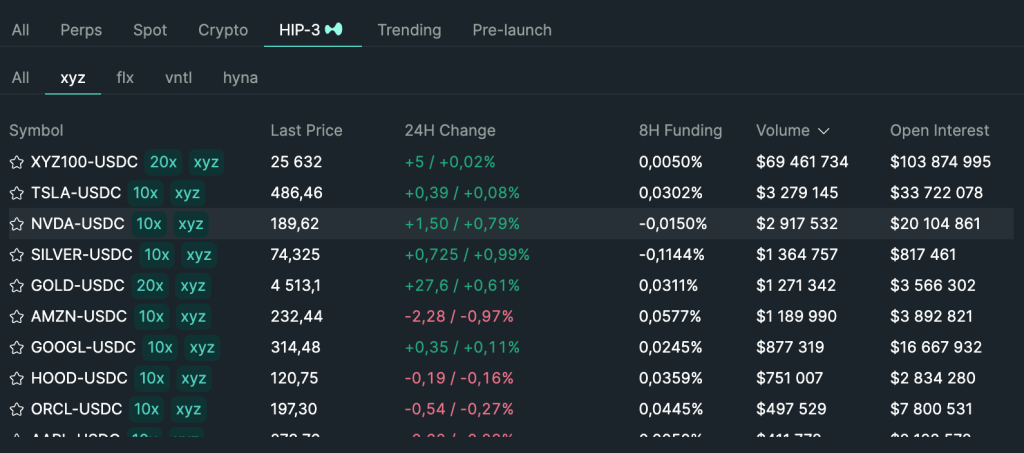

At the time of writing, four segments operate on the platform: xyz (trade.xyz protocol), flx (Felix Protocol), vnti (Ventuals), and hyna (HyENA). They focus on tokenized shares of tech companies, stock indices, experimental assets, and cryptocurrencies with leverage up to 25x.

According to Jordi, delegating HYPE to third-party developers for creating liquid staking tokens (LST) is not only about potential income but also involves significant risks: capital lock-up, slashing risk, and conflict of interest.

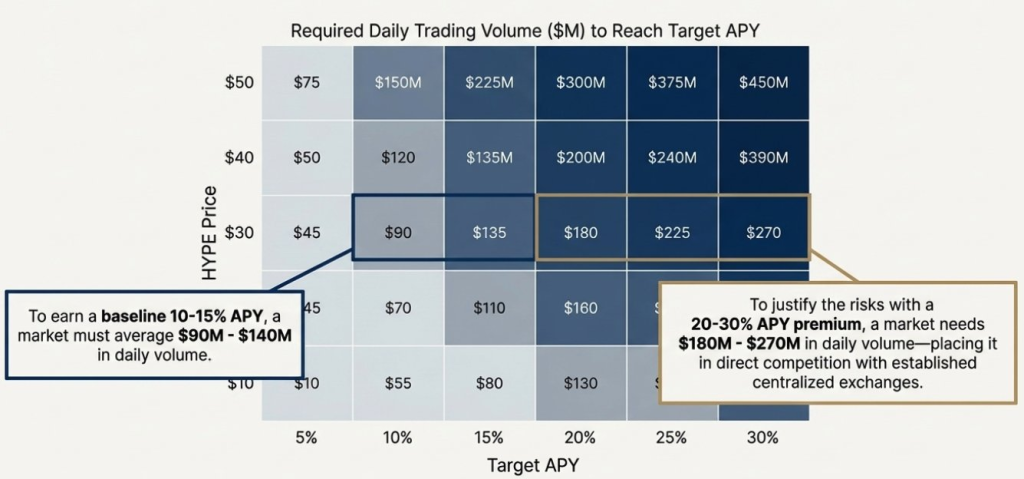

The main issue with synthetic markets on Hyperliquid lies in the yield mathematics. Native staking of HYPE yields about 2.2% annually, while complex leveraged strategies offer double-digit figures.

To remain competitive, new LSTs on HIP-3 must offer yields around 20-30% APY. However, ensuring such payouts requires an “astronomical” trading volume. As the price of HYPE rises, the required turnover increases exponentially.

“We demand volumes from small delegates comparable to those of centralized exchanges to justify the retail premium. Without a complete overhaul of the fee distribution model or risk model, many of these HIP-3 projects will face FUD or simply shut down,” Jordi emphasized.

Figures

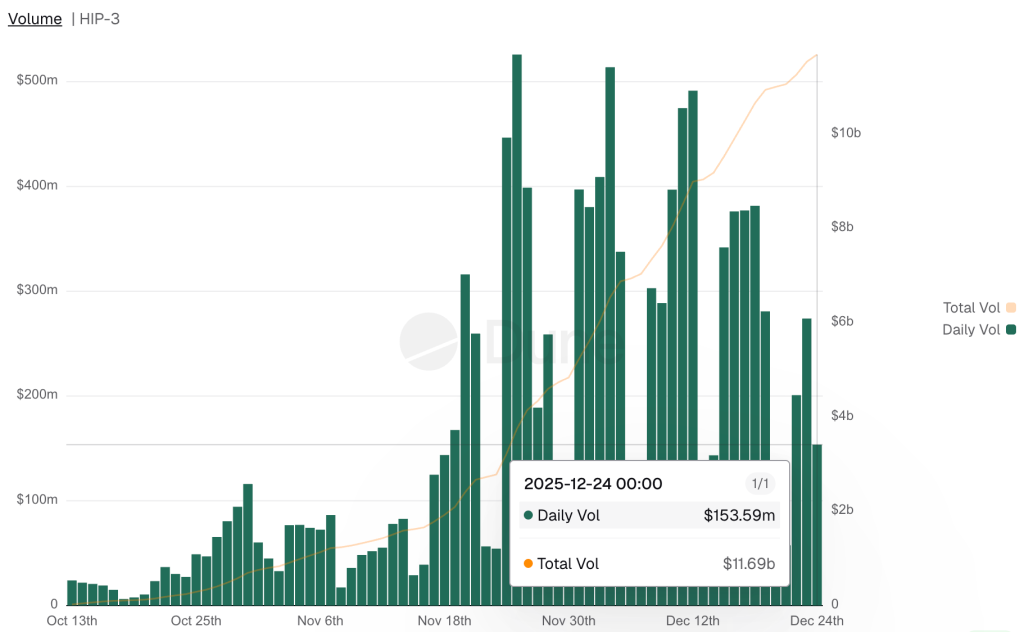

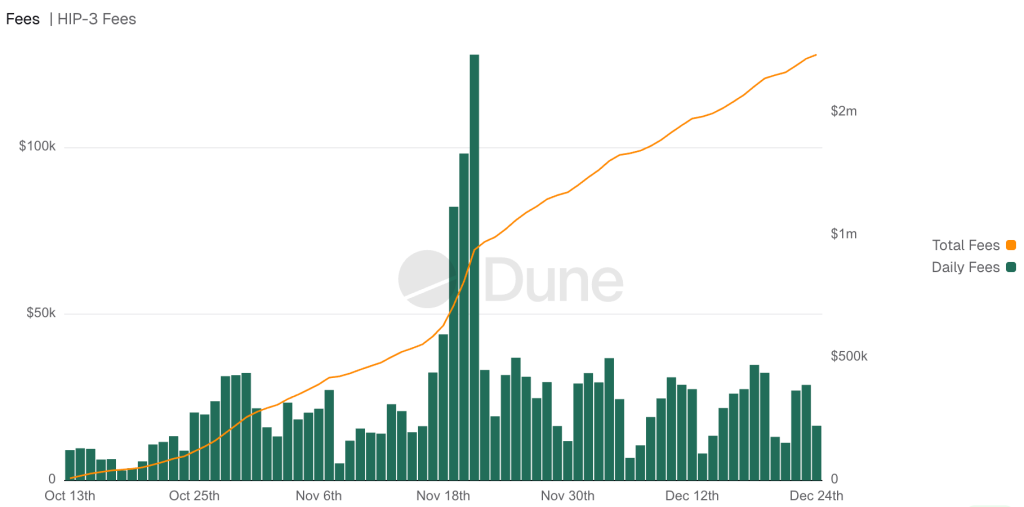

The total trading volume on custom HIP-3 markets has exceeded $11.69 billion. In the last 24 hours, the figure was $153.5 million, peaking at $525.9 million.

The majority is accounted for by tokenized indices (68.3%), followed by stocks (25.8%).

At the time of writing, the “synthetic” segment’s share of Hyperliquid’s total turnover is 4.4%.

The total generated fees have exceeded $1.7 million, with open interest at $256.9 million.

Back in December, Hyper Foundation proposed burning $1 billion worth of HYPE tokens.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!