Experts Declare the End of Bitcoin’s Halving Cycle

The poor performance of digital gold following the April halving has effectively ended the previously observed four-year cycle associated with this event, according to Outlier Ventures, reports The Block.

Experts have urged investors not to rely on the previously observed pattern.

“The halving of miner rewards no longer has a fundamental impact on bitcoin and other digital assets,” the report states.

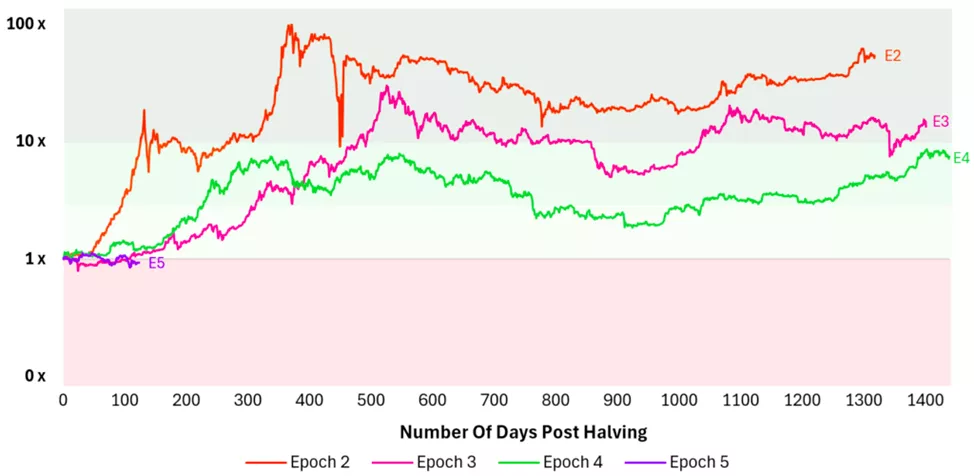

125 days after the April halving, the leading cryptocurrency had lost approximately 8% of its value.

This contrasts with previous periods over a similar timeframe. Notably, in 2012, bitcoin rose by 739%, in 2016 by 10%, and in 2020 by 22%.

Experts noted that since 2016, the halving has lost its former fundamental significance due to the maturation of the asset. However, its psychological impact on investors remains relevant.

According to researchers, daily miner rewards now equate to 0.17% of the turnover of the leading cryptocurrency, whereas until mid-2017, this figure varied from 1% to 5%.

The sharp rise in 2020 post-halving was linked by specialists to the DeFi summer effect and active central bank stimuli amid the pandemic.

In 2024, the price of digital gold reached a new ATH before the halving due to the influx of funds into spot bitcoin ETFs launched in January.

In April, analyst Peter Brandt suggested with a 25% probability that prices had already formed a historical peak within the current cycle, despite the halving.

Earlier, Arthur Hayes did not rule out a continued bitcoin correction to $50,000 before the Federal Reserve meeting on September 18.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!