Experts Highlight Benefits of Crypto ETFs for Morgan Stanley

Morgan Stanley to benefit from ETFs despite low returns, says ProCap CIO.

Investment bank Morgan Stanley stands to benefit from launching its own ETFs, even if they yield low returns, according to Jeff Park, Chief Investment Officer at ProCap.

heres what most people are missing about why Morgan Stanley launching Bitcoin ETF is the most bullish thing ever-

1) it means the market is MUCH bigger than even crypto professionals anticipated, especially to reach NEW customers. It is unheard of for a vanilla ETF product to…

— Jeff Park (@dgt10011) January 7, 2026

On January 6, Morgan Stanley filed applications with the U.S. Securities and Exchange Commission to launch two spot ETFs. One fund will track the price of Bitcoin, the other — Solana. If approved, more than 19 million clients of the bank’s wealth management division will gain access to these products.

According to the expert, the financial institution is betting on long-term image benefits, not just capital inflow.

Park believes that having a spot Bitcoin ETF signals the asset manager’s “foresight and boldness.” This creates an image of a progressive company, which is particularly important in the competition for talented employees.

“This is a positive external factor that will aid in recruiting top specialists amid competition,” emphasized the CIO of ProCap.

He also noted Morgan Stanley’s plans to monetize its brokerage division ETRADE through partnerships in tokenization and cryptocurrency trading. The digital asset market has proven to be significantly larger than industry professionals had anticipated, the expert added.

Morningstar analyst Brian Armour suggested that Morgan Stanley’s “unexpected” move aims to transfer existing clients into its own funds.

“The bank’s entry into the crypto ETF sector will add legitimacy to the market, and others may follow suit,” Armour told Reuters.

ETF Inflows

At the start of 2026, the cryptocurrency market demonstrated resilience thanks to renewed inflows into spot ETFs. However, fundamental on-chain metrics continue to decline, indicating hidden demand weakness.

Bitcoin ended 2025 consolidating below the $92,000 resistance level. Prices stabilized due to institutional flows amid low holiday liquidity. On January 5, the leading cryptocurrency traded around $93,000, with Ethereum holding near $3,200.

According to BRN, from December 29 to January 2, net inflows into spot Bitcoin ETFs amounted to $459 million with a trading volume of about $14 billion. Ethereum funds attracted $161 million, and XRP-based products $43 million. The trend shift followed prolonged outflows in December.

BRN’s Head of Research Timothy Misir noted that growth is driven by external capital, while the market’s internal resources are depleted.

“Optimism has returned, but investor confidence remains conditional,” the analyst emphasized.

The fundamental picture contradicts price dynamics. At the end of December, the 30-day change in Bitcoin’s realized capitalization turned negative. This interrupted one of the longest periods of capital inflow into the network in history. Long-term holders began to rapidly realize losses despite relatively stable prices.

Misir described the situation as typical for the late stage of a cycle: volatility falls, and time becomes the main stress factor. Investors are leaving the market not out of fear, but due to exhaustion.

Analysts at QCP Capital also remain cautious. Despite positive signals in the options market and interest in long positions, liquidity remains fragile. Traders’ attention has shifted from political news (U.S. operations in Venezuela) to macroeconomic data, which will determine future rate expectations.

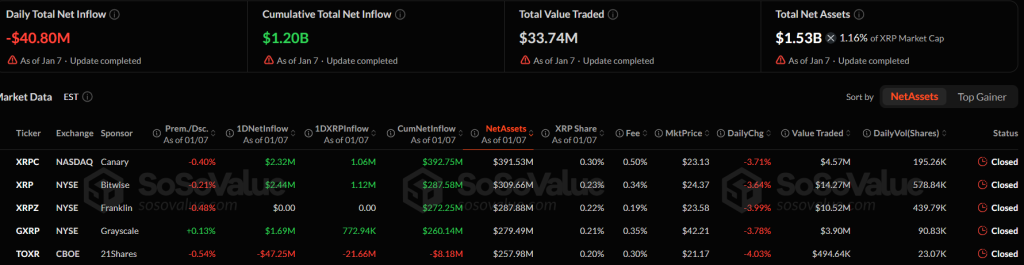

Spot XRP ETFs

American spot ETFs based on XRP ended a trading day with a negative balance for the first time. This broke a 36-day streak of inflows.

On January 7, the total withdrawal from five funds amounted to $40.8 million. Only the TOXR product from 21Shares showed negative dynamics, with investors withdrawing $47.25 million. Funds from Canary, Bitwise, and Grayscale recorded a slight inflow of $2 million.

BTC Markets analyst Rachel Lucas described the first outflow as a “notable shift,” but noted its modest scale — less than 3% of total inflows. The expert explained the situation as profit-taking after XRP’s rise from $1.8 to $2.4 and a general market correction.

Lucas emphasized that fundamental indicators remain strong: exchange reserves are at lows, and transaction volumes are high. If inflows resume, the asset could test the $3 mark.

Back in October, Morgan Stanley analysts advised financial advisors and clients to add cryptocurrencies to multi-asset portfolios.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!