Experts Highlight Risks of Institutional Shift from Ethereum to Bitcoin

The ETH/BTC exchange rate has reached a historic turning point, potentially increasing the risk of a correction in the coming days. Analysts at Cointelegraph have examined four reasons that could lead to such a scenario.

Their assessments are based on the ambiguous technical picture of ETH/BTC.

Experts noted the RSI entering the overbought zone and the price returning to its highs since the beginning of the year. According to their observations, this combination resembles a fractal from January 2024, which led to an 11.65% drop in ETH/BTC. They identified 0.058 as the initial target.

Technical analysis also suggests the formation of an ascending wedge pattern. Its confirmation would reflect a rollback of quotes to 0.053 (-10.85% at the time of writing). Such patterns are considered harbingers of a bearish reversal, the experts emphasized.

On the weekly timeframe, experts also found signs of a bearish reversal — quotes are still unsuccessfully trying to close above the multi-year resistance in the form of a descending trend line. The latter coincides with the 50 EMA (marked in red).

Analysts doubt that the bulls’ efforts will succeed. In their view, there is a greater chance of a rollback to 0.051. From this level, sharp rebounds were observed in June 2022, October 2023, and January 2024.

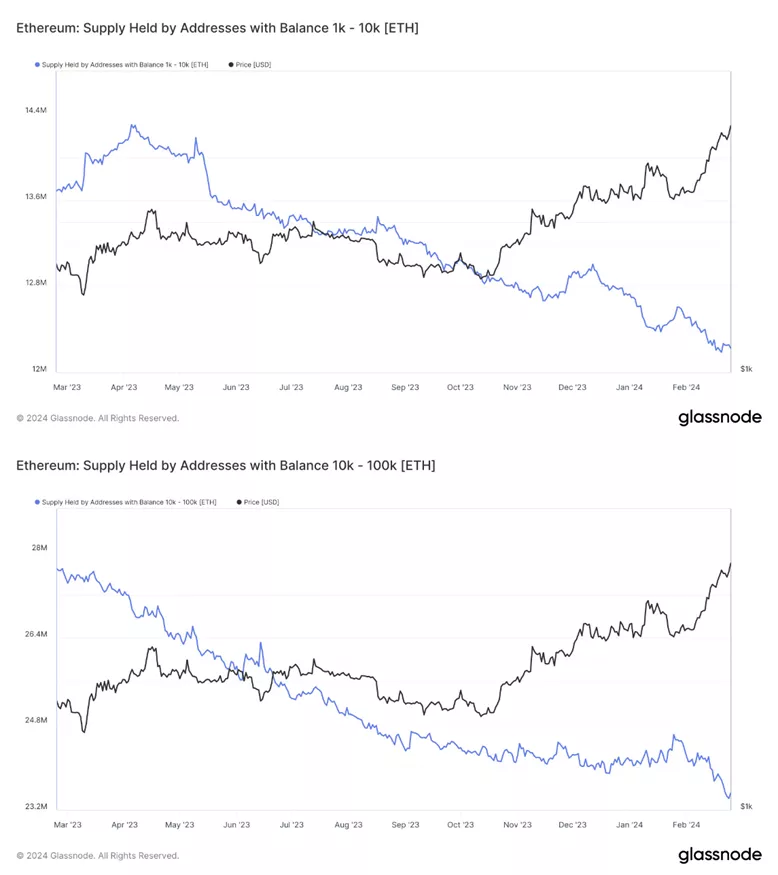

Experts also noted a decline in interest in the asset from whales. According to Glassnode, the number of holders of 1,000-100,000 ETH significantly decreased in February.

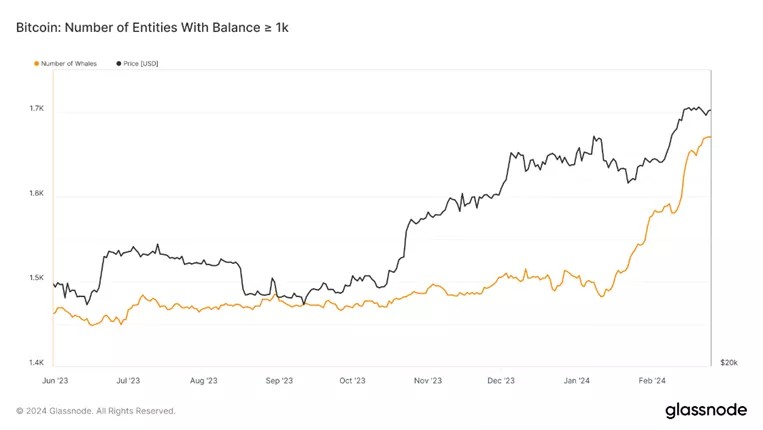

The capital of large investors may have shifted to digital gold, based on the dynamics of wallets with a balance of over 1,000 BTC.

“This indicates increased interest in Bitcoin compared to Ethereum among institutions, which reinforces the bearish trend of ETH/BTC in addition to technical factors,” the experts concluded.

Earlier, analysts at Bybit noted a sharp increase in the share of the second-largest cryptocurrency by market capitalization in the portfolios of major players (as of January 31).

As reported in Glassnode, there was a recorded shift in capital towards Ethereum, Solana, and altcoins in general following the approval of spot Bitcoin ETFs.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!