Experts Identify Critical Bitcoin Support Levels

Some on-chain researchers and technical analysts are convinced that the potential for a decline in the price of the leading cryptocurrency is far from exhausted.

Ted Pillows and many other experts highlight the significance of the 50-week exponential moving average (50 EMA) as support—a kind of boundary between bull and bear markets, currently near the $77,500 mark.

$BTC is trying to reclaim the weekly 50-EMA level.

This has acted as a bull/bear line for BTC.

If BTC fails to reclaim it, expect a correction towards $69K-$70K (2021 highs), and even the $67K (Saylor average entry) level could be retested.

In case BTC reclaims this level, a… pic.twitter.com/CtsyZ7q3FH

— Ted (@TedPillows) April 7, 2025

The specialist believes that a price drop below this level could lead to a further decline towards the $69,000-$70,000 range. These marks correspond to the cyclical peaks of 2021.

The thesis of a high likelihood of continued correction is also supported by the “Bear Flag” technical analysis pattern, targeting $71,300.

$BTC daily chart. Bear flag is playing nicely, 71.3k is the target, exactly like weekly support. The daily S/R got broken and tested. Not much to add. pic.twitter.com/ivJAlmgavJ

— Chris (@christradesxyz) April 7, 2025

On-chain experts from Glassnode highlight the importance of the $74,000 level, where a “large cost basis cluster” of over 50,000 BTC is concentrated.

In total, investors hold around 175,000 BTC in the $70,000–$74,000 range, “forming a strong support zone.”

Another large cluster at the $71,600 level holds about 41,000 BTC, making it a likely next support point if the $74,000 mark is breached.

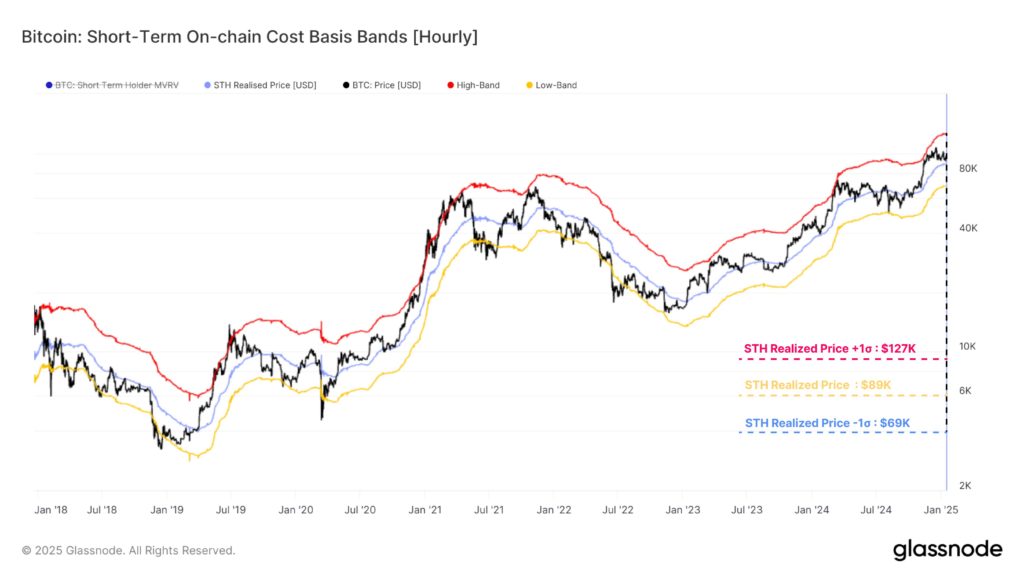

According to Glassnode, the average purchase cost for short-term holders (STH) is $89,000.

The next support level, considering standard deviation, is $69,000. Historically, it has served as a “maximum pain zone” for STH. Now it acts as a kind of “floor,” where “weak hands” capitulate, giving way to hodlers.

Patterns from past years also show that after a decisive break of the 50 EMA support, Bitcoin entered a prolonged bear market. Such corrections often led to price movements towards the 200-week average, as shown in the red circular areas below.

At the time of writing, the 200 EMA is near the $50,000 mark, indicating another potential support level.

Earlier, Bloomberg Intelligence senior strategist Mike McGlone suggested the possibility of Bitcoin falling to $10,000 amid turbulence in TradFi.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!