Experts point to restart of Bitcoin’s accumulation phase

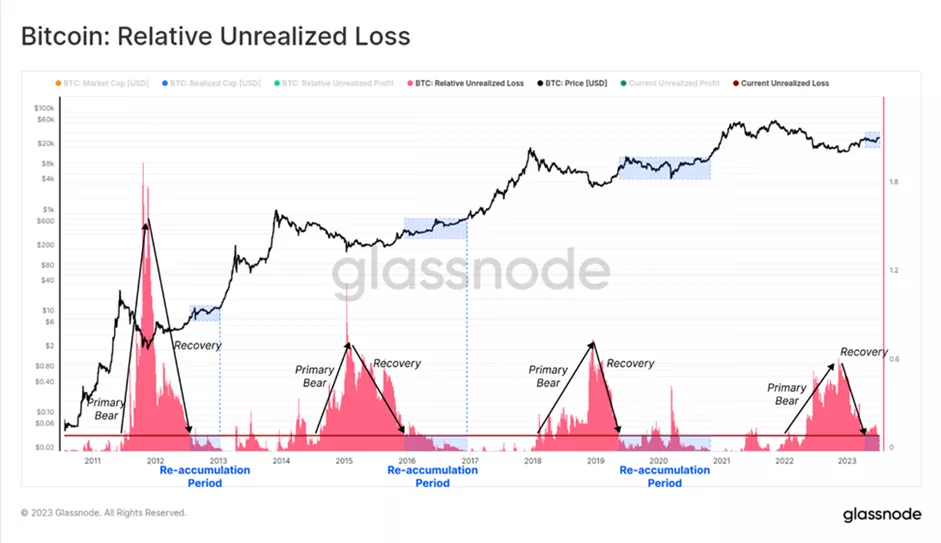

The balance of coins on the Bitcoin market is associated with the ‘reaccumulation’ phases in previous cycles. The latest cycles have been characterised by a lack of strong moves for several months, according to Glassnode.

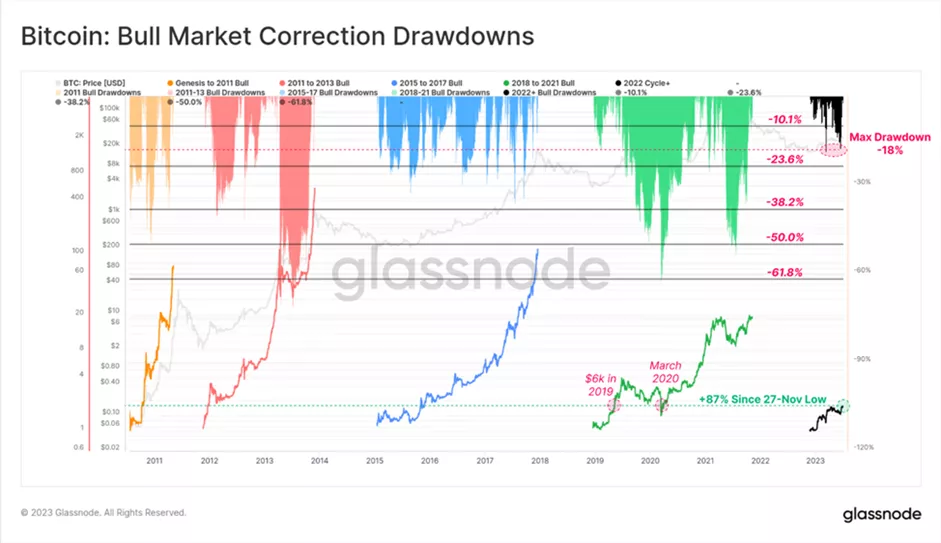

The drawdown in Bitcoin prices since the start of the year has not exceeded 18%, which is ‘surprisingly little’ compared with previous cycles. Analysts see in this a possible corroboration of strong demand.

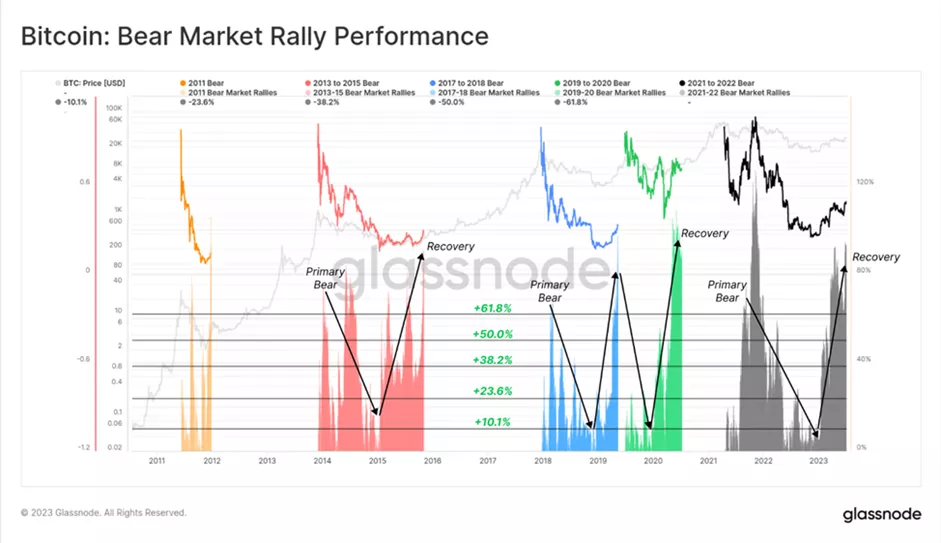

The rally from November’s lows to a peak of 91%. With the exception of 2019, all previous cycles in which a similar magnitude shift from the bottom were observed effectively marked the genesis of a new uptrend, according to experts.

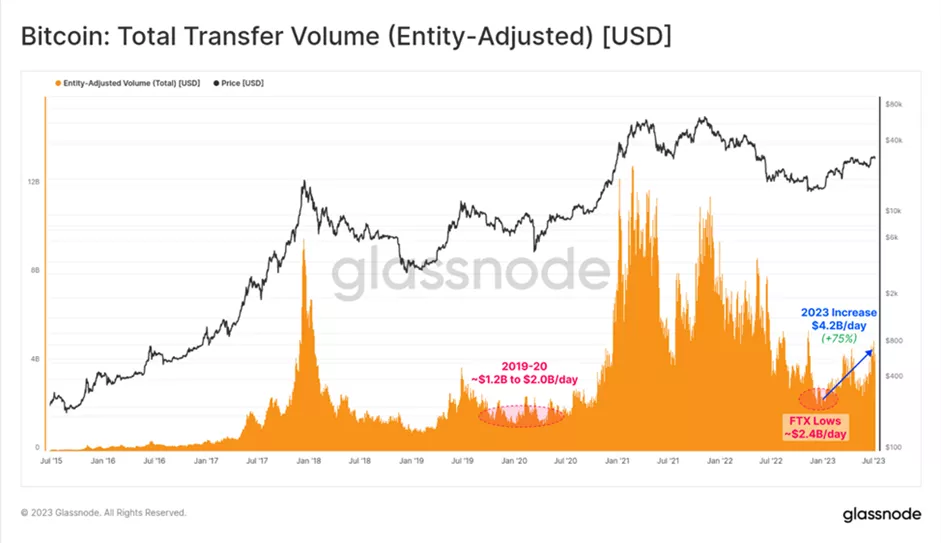

Against the backdrop of waning enthusiasm around Ordinals, network activity indicators began to point to some softening. In particular, the median transaction fee fell to $0.16, the average to $1.33. The exception is the metric of on-chain value transferred — the indicator reached $4.2 billion (+75% year-to-date).

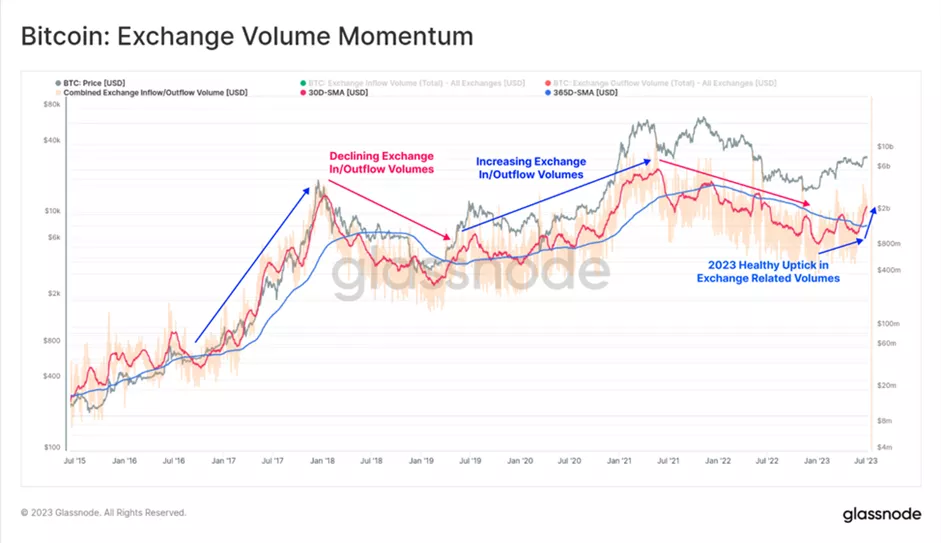

When segmenting flows to and from centralized venues, experts found that the monthly moving average of transfers exceeded the year-over-year figure. Historically, this has been a sign of growing liquidity and adoption of monetary assets.

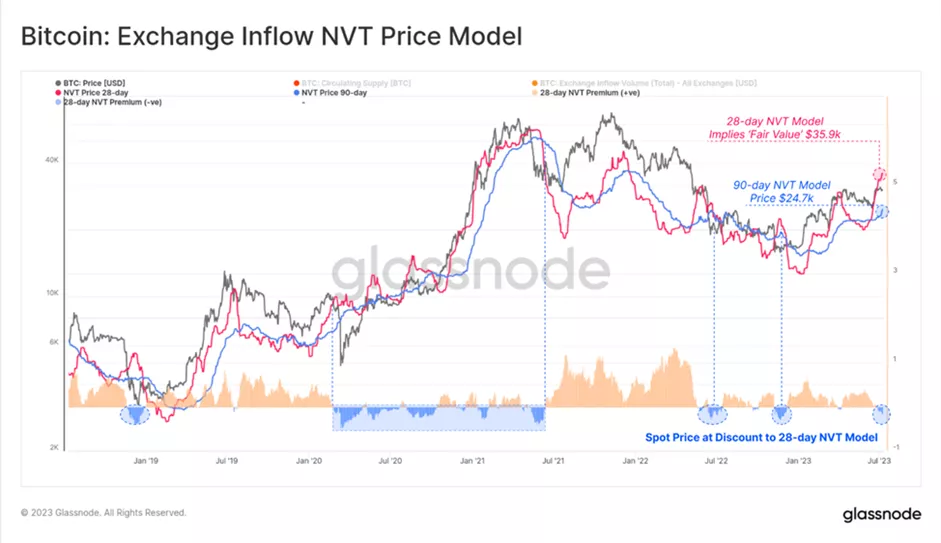

The NVT Ratio (Network Value to Transactions Ratio), based on 28DMA implies a ‘fair value’ for Bitcoin at around $35,900, higher than current prices for the first time since November 2022. The slower 90DMA metric corresponds to $24,700.

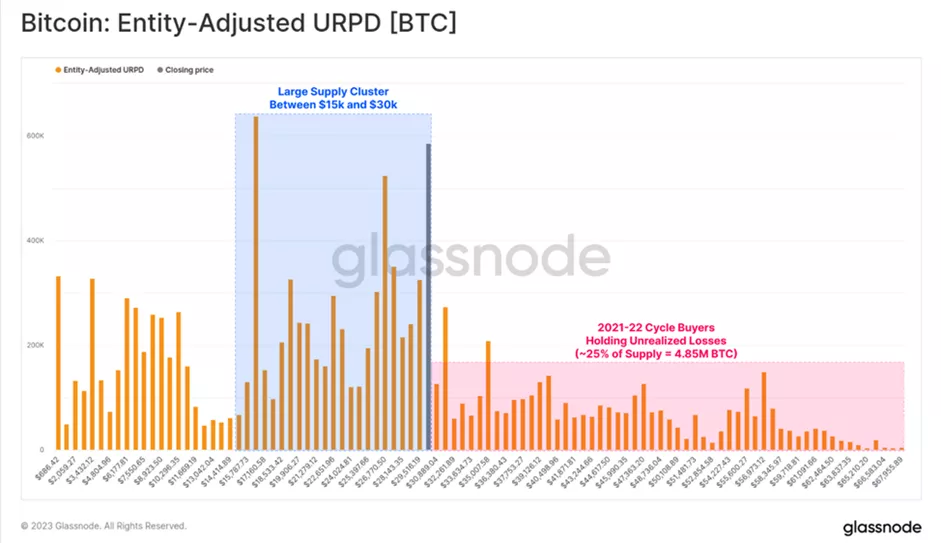

The URPD indicator, which shows the structure of realized price levels in the context of UTXO, shows a solid base of coins purchased at prices below $30,000.

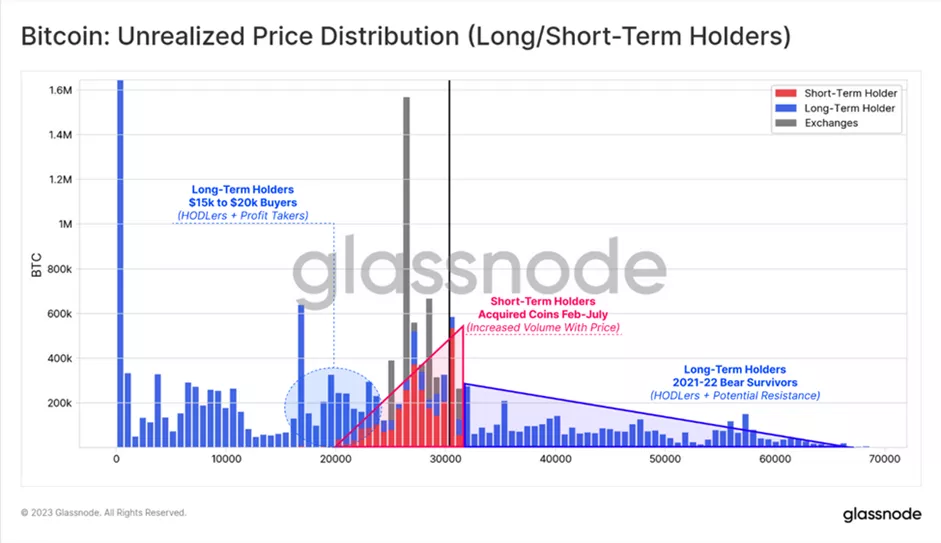

Only a quarter of the available supply was bought by investors above $30,000 during the 2021-2022 cycle. A substantial portion of hodlers’ activity occurred in purchases in the range of $15 000 to $25 000. In the corridor from $20 000 to $30 000, accumulation has been rising since February 2023, despite heightened regulatory pressure in the United States.

«Such a distribution of supply points to a ‘hard bottom’. In other words, there is a relatively solid ‘foundation’ for investments below $30 000», — the experts noted.

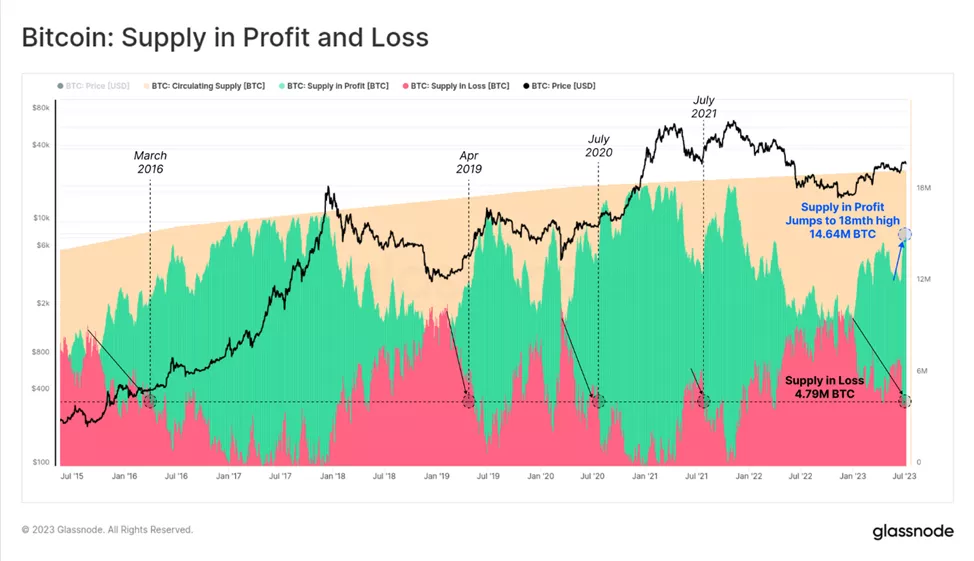

Active buying during the recent correction to $25,000 led to a reduction in ‘unprofitable’ coins to 4.79 million BTC — the lows of July 2021, 2020, April and March 2016. The number of ‘profitable’ bitcoins rose by 2.47 million BTC (equivalent to 12.7% of total supply).

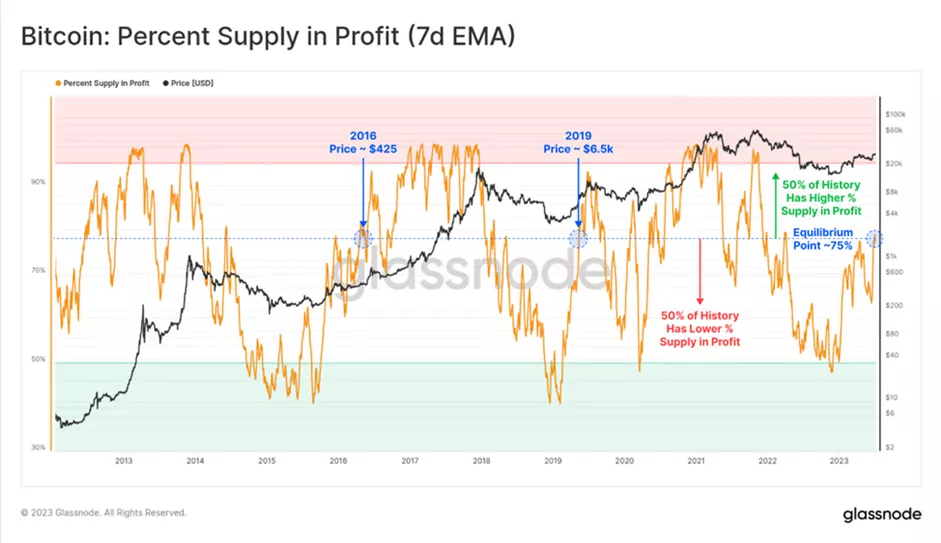

With current consolidation near the midpoint at around $30,000, about 75% of bitcoins are held with paper profit, 25% with loss. In fact, such a ratio has been observed in 2016 and 2019. In half of all trading days the ratio of positive to negative financial outcomes was higher, and in the other 50% lower.

Historically the market has needed time to digest this equilibrium point and re-consolidate around it, the experts explained. Many describe this phase as a period of ‘reaccumulation’. It often coincides with the approach of halving.

«Previous periods led to trading in a sideways range (and volatility) for several months. […] It remains to be seen whether, this time, a similarly long and unstable process will be required to overcome its [equilibrium point], — the experts concluded.

Earlier in Nansen came to the conclusion, that for the onset of Bitcoin’s bull market regulatory clarity in the US and a sustained decline in core inflation are required.

Analysts at Standard Chartered have forecast the price of the first cryptocurrency to rise above $50,000 this year and $120,000 by the end of 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!