Experts See Threat to El Salvador’s Credit Rating From Bitcoin Legalisation

Experts warn of threat to El Salvador's credit rating from Bitcoin legalization.

Bitcoin’s legalisation in El Salvador has “immediate negative consequences” for the country’s credit rating, as “the risks of adopting cryptocurrency outweigh potential benefits,” according to rating agency S&P Global.

Analysts said that widespread adoption of digital gold in the country is unlikely. They pointed to a survey by the Salvadoran Chamber of Commerce and Industry, which found that more than 90% of respondents were opposed to forcibly integrating cryptocurrency into the financial system, and 75% said they would continue using the US dollar.

S&P Global also noted the large-scale protests that took place before and after the law’s passage. The Comptroller’s Office has asked the government-established Bitcoin Fund to examine its activities.

#ElSalvador | The Court of Accounts of the Republic has notified us of the admission of the complaint Cristosal filed on the 10th of this month to conduct an audit of the Bitcoin Trust’s execution. We share a fragment of the document received. 👇 pic.twitter.com/FXlkrWhCD3

— Cristosal (@Cristosal) September 16, 2021

According to experts, Bitcoin could have a substantial impact on El Salvador’s economy, given its relatively small size. The country’s GDP does not exceed $25 billion, with international trade accounting for 60% of this amount and remittances for 25%, according to S&P Global.

“This means that if Bitcoin is widely used for cross-border transactions, the impact of the cryptocurrency’s high volatility on the economy will be significant. […] On the other hand, as a means of hedging against US sanctions and other sovereign risks, moving to Bitcoin does indeed have some advantages”, the report says.

According to the agency, potential advantages of cryptocurrency are unlikely to materialize in the short term. Analysts acknowledged that Bitcoin could increase the population’s access to financial services and reduce the costs of international operations. However, these possibilities will only be realized if there is broad trust in the instrument, whereas polls show the opposite.

Experts at S&P Global also noted that in the absence of effective anti-money-laundering measures and other illicit activity, legalising Bitcoin could fuel a rise in the volume of criminal operations.

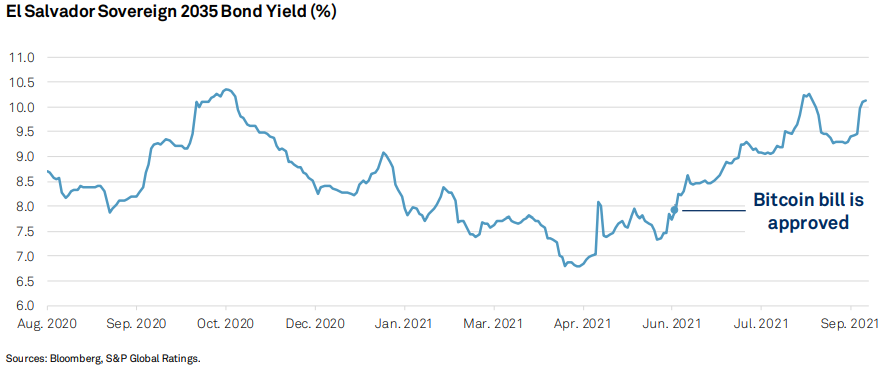

“The potential erosion of financial integrity due to Bitcoin indirectly encourages illicit financial activity. […] However, in practice, with limited oversight, all of this activity can also be conducted through US dollars. The sovereign bond yields of El Salvador rose after the Bitcoin law was enacted,” added S&P Global.

Earlier, the cryptocurrency’s legalization led to sell-offs of sovereign bonds.

Analysts again stressed that the introduction of the first cryptocurrency jeopardizes reaching an agreement with the IMF. El Salvador is hoping to receive $1 billion in financial assistance from the IMF.

In July Moody’s likewise expressed the view, cutting the country’s long-term foreign-currency credit rating to Caa1 with a negative outlook.

On September 16, IMF spokesperson Gerry Rice told a press briefing that the organization is still discussing a potential support program with El Salvador. However, it has not changed its position that the consequences of adopting the cryptocurrency could be “horrific”.

The government has announced plans to exempt foreign investors from capital gains tax and income tax on Bitcoin transactions.

100495308 by ForkLog on Scribd

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!