Factors Driving Bitcoin’s Surge to $52,000 Identified by Analysts

Two primary factors led to Bitcoin breaking through the key resistance level of $48,000 in February and reaching above $52,000, according to analysts at QCP Capital.

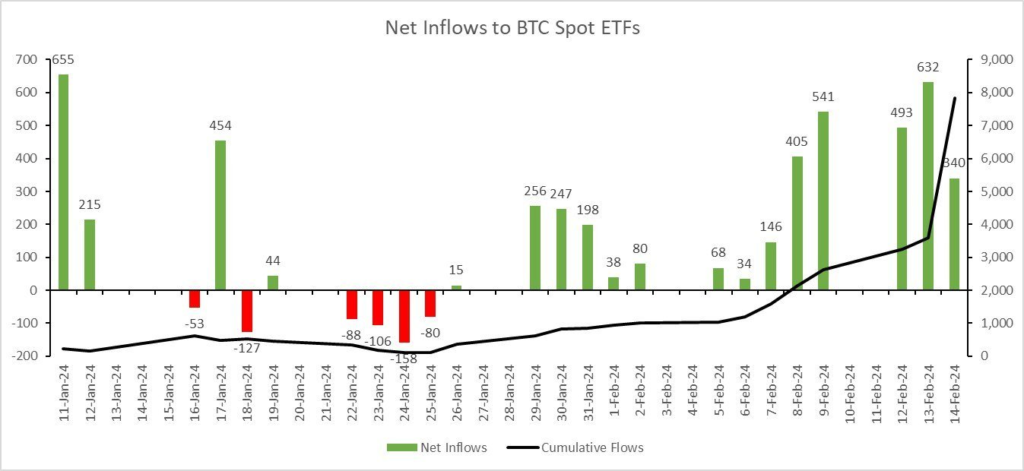

One factor was the inflow of funds into spot ETFs based on the first cryptocurrency. At the end of January, the market returned to a “net inflow territory.” On February 13, the daily figure reached $631 million, comparable to the record level of the first trading day for these products.

“The sheer size of the spot demand inevitably led to a price increase,” the experts noted.

The second driver, they believe, was the increase in CME margin requirements. BTC traders in short leveraged positions were forced to provide broader coverage in relatively low liquidity conditions due to the Chinese New Year celebrations.

“This led to an increase in both the spot and forward prices,” QCP Capital specialists emphasized.

In their view, another significant event of the week was that January inflation in the US exceeded forecasts—3.1% compared to 2.9%.

“As expected, a sell-off of risk assets began across the board. However, it was short-lived, as the market more than recovered the drop the next day, especially in cryptocurrency,” the analysts stated.

Earlier, QCP Capital predicted Bitcoin’s return to historical highs as early as March.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!