Fed Chair’s Remarks Increase Odds of September Rate Cut

The Federal Reserve will not wait for inflation to drop to 2% before beginning to lower interest rates, warned Jerome Powell, Chairman of the Fed.

Federal Reserve Chairman Powell said on Monday that the Fed will not wait until inflation falls to 2% before starting to cut interest rates. The Fed needs more evidence of falling inflation to ensure the correctness of policy adjustments. The recent slowdown in inflation and…

— Wu Blockchain (@WuBlockchain) July 16, 2024

According to the official, the confidence of monetary authorities that the annual growth of consumer prices is moving towards the target of 2% has increased recently.

Powell reiterated that additional evidence is needed to confirm that high inflation has been overcome before they move to ease policy.

“What boosts this confidence is the good data on CPI. And lately, we are getting some of it,” he explained.

As of June, annual inflation in the US slowed from 3.3% to 3%.

Prices for services excluding housing and energy fell by 0.05% after a 0.04% decline the previous month. The Fed noted the importance of this metric in analyzing the inflation trajectory. Also, the rent indicator, important for monetary authorities, increased by 0.3% — the lowest growth since August 2021.

Powell also emphasized potential risks to employment dynamics. The official described the labor market as “no longer overheated” and warned that “unexpected weakening” could prompt a central bank response.

“Now that inflation has decreased and the employment trend has softened, we will consider both mandates. They are in much better balance,” he stated.

Separately, Powell stated that a “hard landing” scenario “is not the most likely or even a likely scenario.”

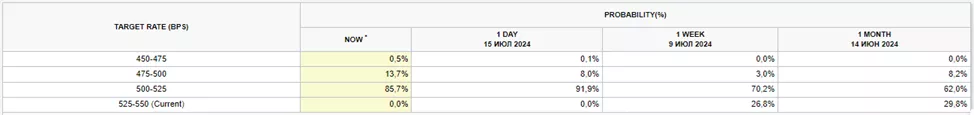

The Fed Chair’s remarks led to an increase in the probability of a key rate cut at the July meeting to 8.8% and an additional easing of 25 basis points in September to 14.2% from 8.1% the day before.

Earlier, Citi forecasted the start of a Fed policy easing cycle.

Previously, 10x Research reported expectations of Bitcoin returning to a growth trajectory amid easing inflation and the Fed approaching the start of rate cuts.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!