Fed raises key rate; Bitcoin edges higher

On Wednesday, February 1, the U.S. Federal Reserve (Fed) raised the target range for the federal funds rate by 25 basis points, to 4.50%–4.75% per year.

This was the eighth consecutive rate hike, with the rate now at its highest since 2007. At the same time, the seemingly “soft” increase proved to be the first since March 2022, when the Fed began tightening monetary policy.

The Fed noted that the latest data indicate moderate growth in spending and production. According to the agency, U.S. jobs increased significantly while unemployment remained low. Inflation, while somewhat lower, remains high.

“Russia’s war against Ukraine is causing enormous human and economic hardship, contributing to higher global uncertainty. The Committee [Federal Reserve’s Federal Open Market Committee, FOMC] pays careful attention to inflation risks,” the press release said.

On January 12, BLS published inflation data in the United States. The December CPI stood at 6.5%. The core inflation rate fell to 5.7%.

The statement said the FOMC set a target inflation rate at 2%. In the long run, the rate hikes should help achieve that target.

For determining further steps the Committee will “continue to monitor the impact of incoming information on the economic outlook.” The regulator said it is prepared to adjust its stance if risks arise that could impede the FOMC’s goals.

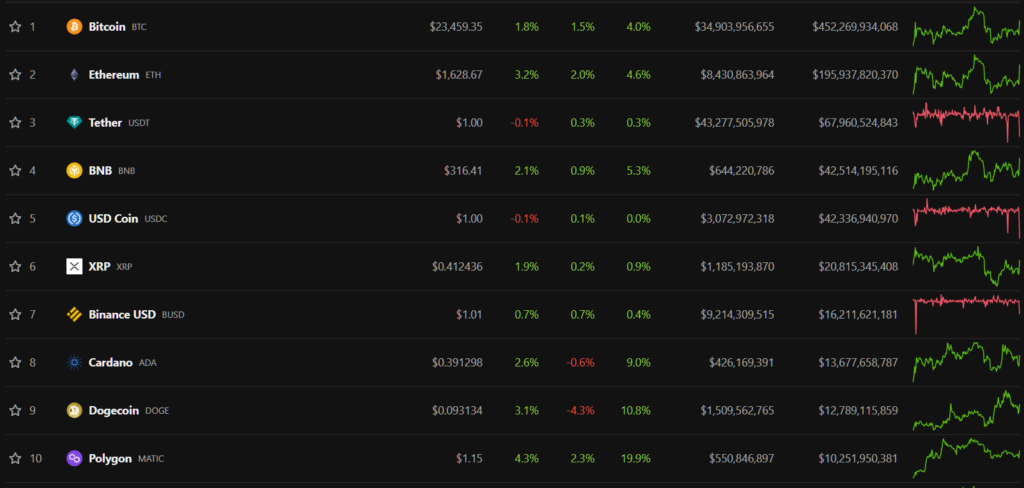

The crypto market reacted to the Fed decision with subdued volatility. According to CoinGecko, prices of the largest-capitalization digital assets did not show significant movement.

At the time of writing, bitcoin trades near $23,000.

In the last hour, Bitcoin prices rose by nearly 2%. The asset is trading near $23,440.

Major cap cryptocurrencies also show positive momentum.

In an interview with Bloomberg, KPMG’s chief economist Diane Swonk noted that the Fed remains ready to raise rates further. She said the economy finds itself in a situation where the market is likely to respond quickly to a decline in the indicator, giving the regulator ample room to maneuver.

Omar Sharif of Inflation Insights offered the opposite view. He emphasised that the slowdown in the pace of increases is a positive signal, as it indicates a dovish stance by the Fed.

At the press conference following the FOMC meeting, Fed Chair Jerome Powell stated that further tightening of monetary policy is “appropriate.” He said that in 2022 the U.S. economy “significantly slowed,” yet in Q1 2023 the agency sees signs of “modest” growth.

“Restoring price stability will likely require maintaining a restrictive stance for quite a long time,”

Powell described the latest financial data as “encouraging,” but stressed that the Fed needs “more evidence” to confirm inflation is falling. He explained that there remains a risk of the high pace of price growth becoming entrenched.

According to the official, the baseline scenario for 2023 envisages continued but modest growth in the economy.

“I still believe there is a path to bringing inflation back to 2% without a significant economic downturn or a substantial drop in employment,”

Back in December 2022, the Fed raised the target range for the federal funds rate by 50 basis points — to 4.25–4.50% per year. Bitcoin prices fell below $18,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!