Fed Rate Cut Bolsters Inflows into Crypto Funds

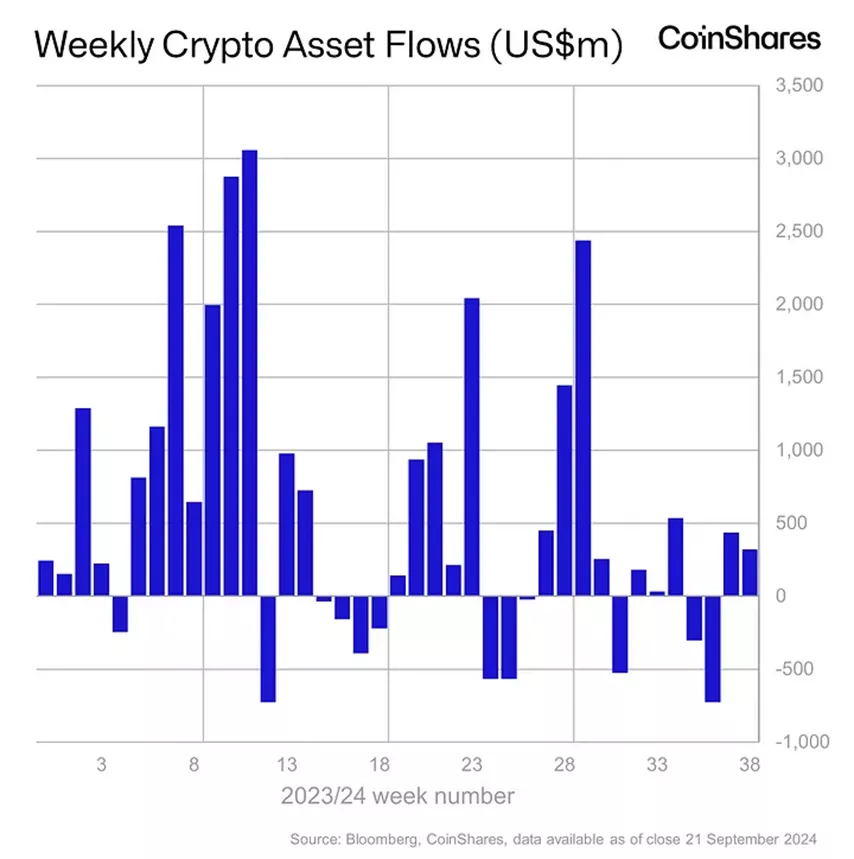

Inflows into cryptocurrency investment funds amounted to $321 million from September 15 to 21, following $436 million the previous week, according to CoinShares.

Analysts attributed the continued positive trend to the Federal Reserve’s 50 basis point interest rate cut.

Trading volume for exchange-traded products (ETP) increased by 9% to $9.5 billion.

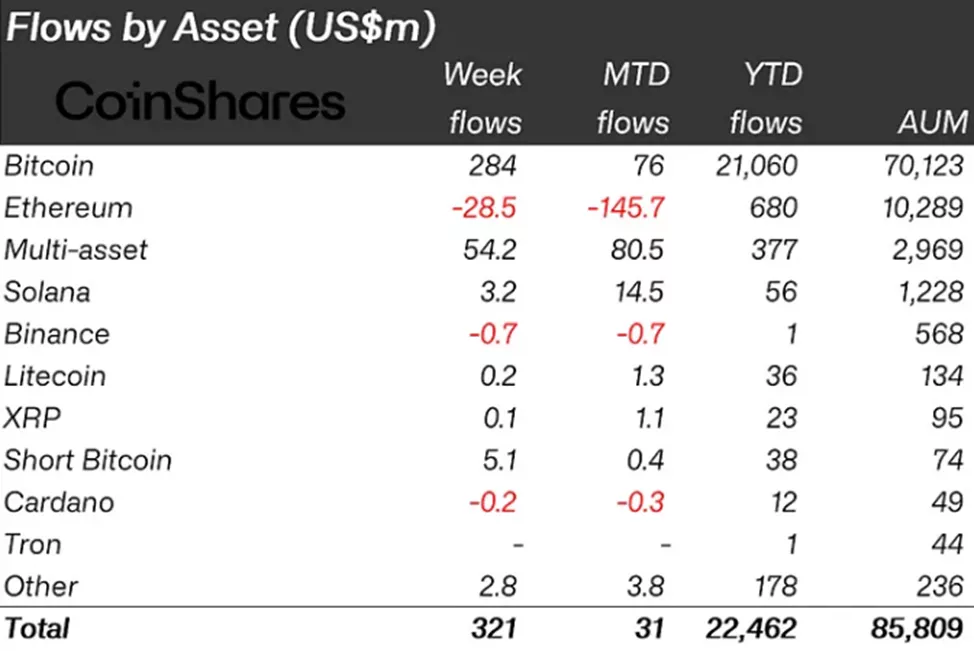

The volume of assets under management rose by a similar magnitude, reaching $85.8 billion.

Ethereum funds continued to experience negative sentiment, with outflows accelerating from $19 million to $28.5 million, marking the fifth consecutive week of withdrawals.

Clients directed $284 million into bitcoin-related instruments, down from $436 million.

Investors added $5.1 million to structures allowing short positions on digital gold, after withdrawing $8.5 million in the previous reporting period.

Solana-based products received $3.2 million (previously $3.8 million), continuing a positive streak for the fifth consecutive week.

On September 20, the U.S. Securities and Exchange Commission (SEC) approved the listing and trading of options on BlackRock’s BTC-ETF. Bloomberg analyst Eric Balchunas speculated that options for other companies’ instruments might soon be approved.

Read about the impact of these products on the cryptocurrency market in ForkLog’s article:

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!