Fed Rate Cut Signals Boost Crypto Inflows to $543 Million

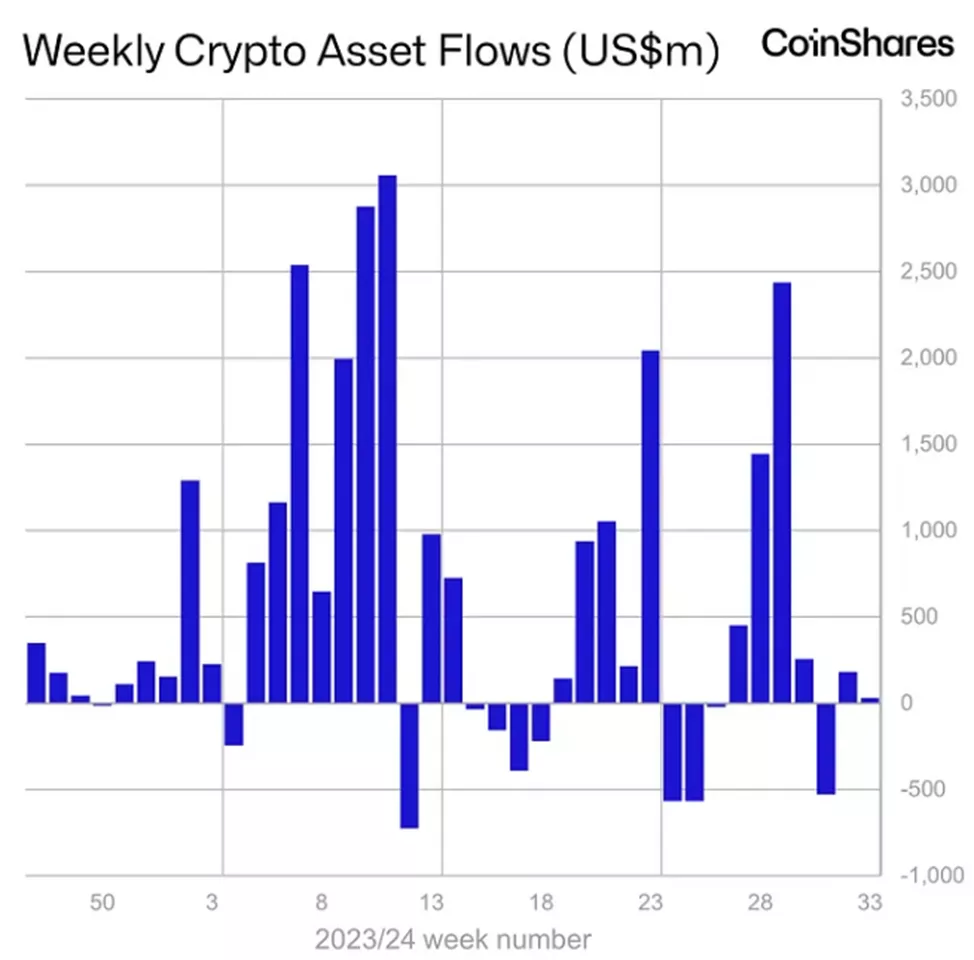

Inflows into cryptocurrency investment funds reached $543 million from August 18 to 24, up from $30 million the previous week, according to CoinShares.

Analysts attributed the strengthening positive trend to Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium, during which he confirmed the possibility of a key rate cut in September.

Exchange-traded product ETP turnover increased to $9 billion.

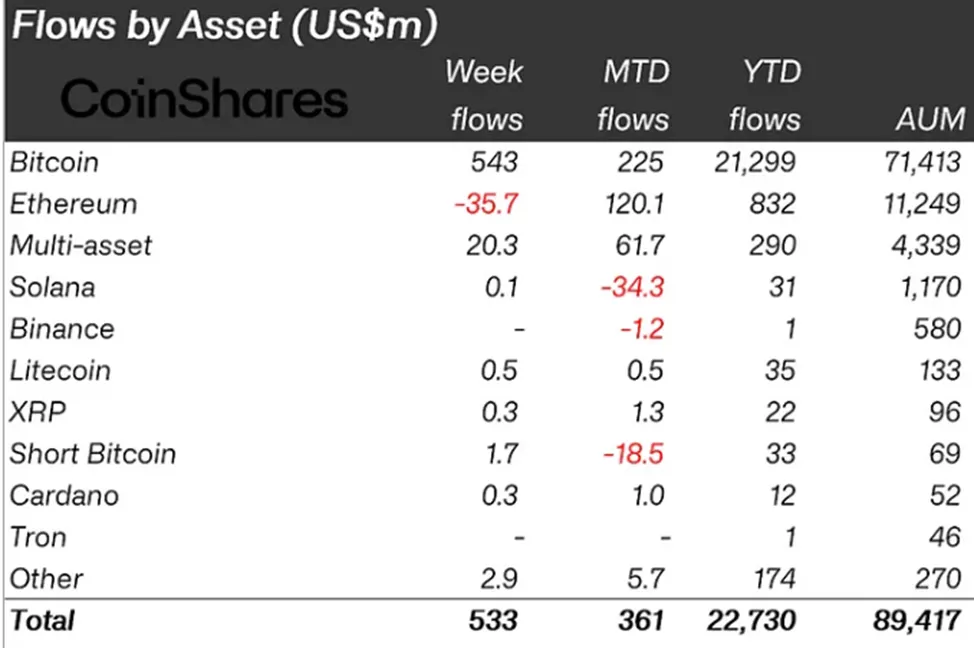

Clients added $543 million to bitcoin-related products, up from $42 million the previous week. Most of the inflows occurred on the day of the Fed Chair’s speech.

Investors added $1.7 million to structures allowing short positions on digital gold, following an outflow of $0.9 million in the previous reporting period.

Clients withdrew $35.7 million from Ethereum funds, after an inflow of $4.2 million the previous week.

Altcoin basket-based instruments attracted $20.3 million, compared to $21 million the week before.

Experts have noted several factors suggesting a potential bitcoin bull run.

Previously, former BitMEX CEO Arthur Hayes downplayed the importance of the US election outcome for the prospects of digital gold. Earlier, the entrepreneur described the first cryptocurrency as a more reliable safe-haven asset than the primary precious metal, due to the absence of national control.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!