Federal Reserve Maintains Rate; Bitcoin Holds Steady

On July 30, the United States Federal Reserve left the key interest rate unchanged in the range of 4.25-4.5%.

“While fluctuations in net exports continue to affect the indicators, recent data suggests a slowdown in economic activity in the first half of the year. Unemployment remains low, and the labor market is stable. Inflation remains elevated,” the Fed commented.

The decision aligned with market expectations and the consensus forecast of analysts.

The Fed reaffirmed its commitment to achieving maximum employment and 2% inflation. The agency noted that uncertainty regarding economic prospects persists.

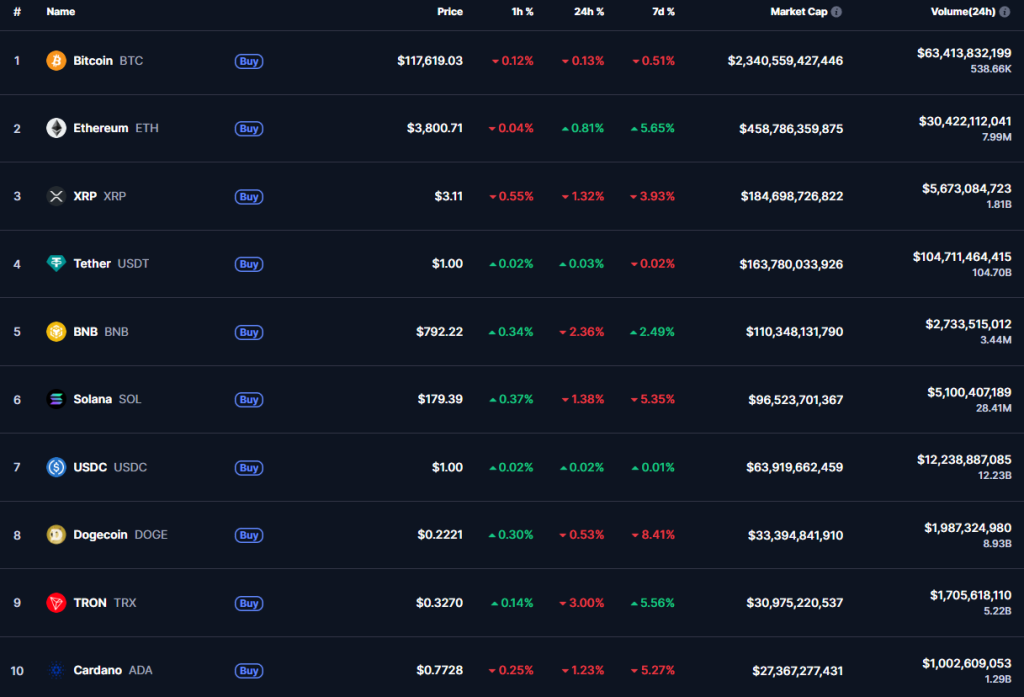

Following the release of the data, Bitcoin’s price experienced some volatility but maintained its position at previous levels:

At the time of writing, the leading cryptocurrency is trading around $117,740. Over the past day, the asset’s price has shown no significant changes.

Other high-capitalization crypto assets also showed little reaction to the decision of the American monetary regulator.

The total market capitalization of the crypto market is $3.86 trillion. Over the day, the indicator decreased by 0.06%.

Analyst and MN Trading founder Michaël van de Poppe advised traders to avoid leverage and remain calm amid the publication of macroeconomic data and the Fed’s decisions in particular.

FOMC meeting coming up, key tip: avoid leverage, don’t trade the event and just be patient.

During the speech, the first move is a fake move on #Altcoins and $BTC.

The actual move occurs in coming days.

— Michaël van de Poppe (@CryptoMichNL) July 30, 2025

“The actual move will occur in the coming days,” the expert emphasized.

Back on July 15, Bitcoin’s price noticeably declined following the release of data on accelerating inflation in the US.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!