Fidelity analysts see no long-term threat to Bitcoin mining

The decline in bitcoin miners’ transaction revenue may prove long-lasting. But it does not threaten the blockchain’s security, according to Fidelity.

? Is it “too late” to enter the digital assets market? Our 2025 Look Ahead shares our team’s answer and highlights potential opportunities emerging from the approval of spot digital asset ETPs and a post-election surge.

Access the full report: https://t.co/sg4W3gRXz2 pic.twitter.com/iYsI4iUknB

— Fidelity Digital Assets (@DigitalAssets) January 7, 2025

As “digital gold” is integrated into traditional finance, the investor base is shifting. Institutional players are using familiar ways to access the asset.

“Less emphasis on self-custody combined with a greater willingness to rely on third-party custodians has led to lower activity on Bitcoin’s base layer,” said research analyst Zak Wainwright in the 2025 outlook.

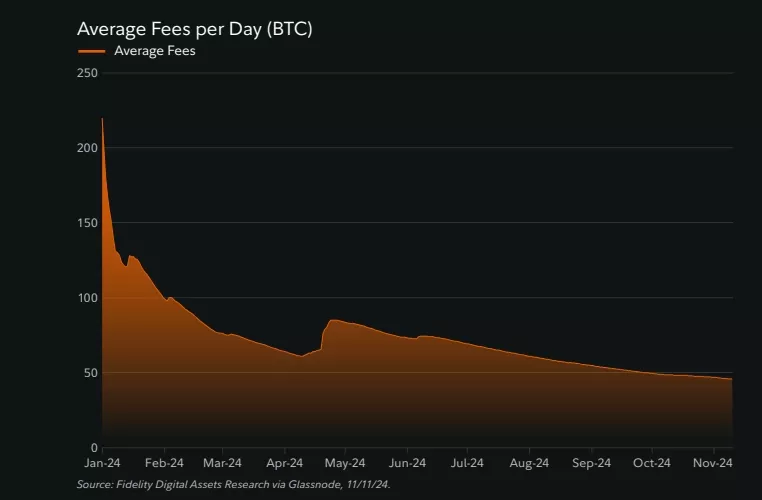

In 2024 miners faced a double bind:

- daily fee revenue fell throughout the year;

- as a result of the halving held in April, the block reward was cut in half—to 3.125 BTC.

The main driver of lower network fees, the expert argues, were the US spot bitcoin ETFs launched in January. The products have already accumulated about 5% of the market supply of the cryptocurrency, which is largely removed from on-chain activity.

Wainwright expects institutional participation to keep expanding in 2025. He sees no reason to anticipate a reversal of the downtrend in miners’ transaction revenue.

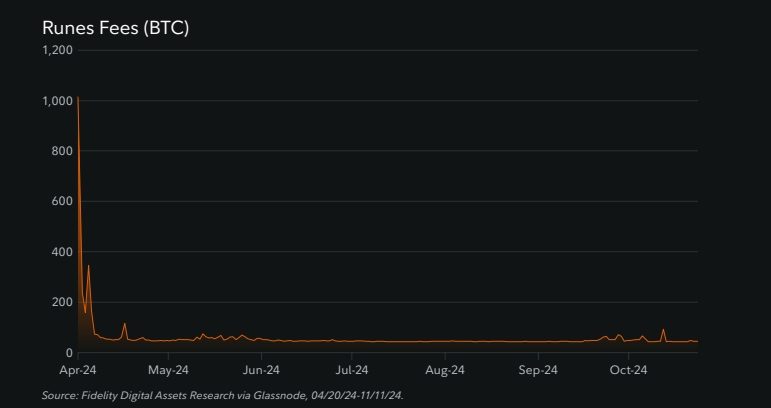

He noted that new uses of the Bitcoin blockchain—such as assets on the Ordinals or Runes protocols—have not had a meaningful impact on miners’ profitability.

The launch of Runes on halving day brought miners about $18 million in fees, but it proved a fleeting spike. Wainwright believes both initiatives look like speculative manias and will never return to their record highs.

However, the analyst argues that fears of miners shutting down because of lower revenues—and of network security weakening—are overstated.

Some high-cost miners may relocate to regions with cheaper power. In 2024 one destination for such migration was Ethiopia.

Wainwright also reckons that major exchanges, custodians and other market participants, which profit from activity in the asset itself, have an interest in keeping the blockchain reliable. They may treat mining as an operating expense, with mined coins a bonus to the core business.

“Looking ahead, participation in mining for a profitable bitcoin company or even a nation-state could prove very practical,” Wainwright allowed.

In October 2024, a researcher under the moniker Duo Nine warned of a security threat to the first cryptocurrency’s network. He pointed to bitcoin liquidity being siphoned into DeFi protocols, exchange-traded products and custodial services.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!