Fidelity calls Bitcoin the ‘perfect form of money’.

Bitcoin is regarded as a monetary good, and in the foreseeable future no altcoin will be able to challenge this status. Analysts at Fidelity Digital Assets concluded as much.

Our latest piece argues that bitcoin’s first technological breakthrough wasn’t as a superior payment technology but as a superior form of money. As a monetary good, bitcoin should be considered separately from other digital assets.

Read Bitcoin First:https://t.co/FNFghIXkrI pic.twitter.com/AXaACgUlzM

— Fidelity Digital Assets (@DigitalAssets) January 31, 2022

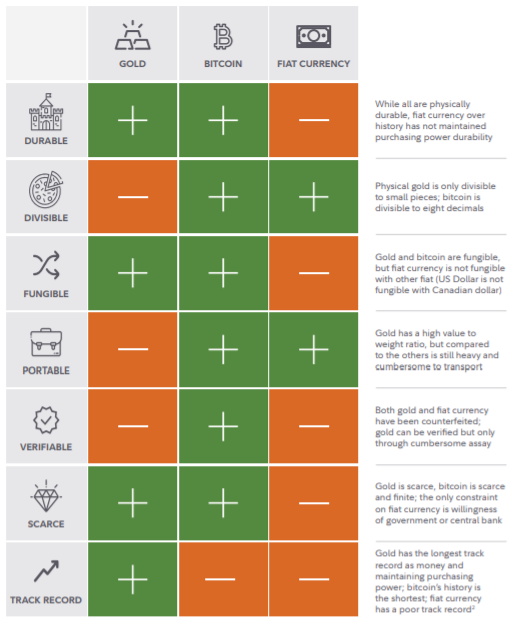

In the paper “Bitcoin First”, the experts described the first cryptocurrency not only as a technology but also as a perfect form of money. This is the safest, decentralised form of assets, and any ‘improvement’ will inevitably face trade-offs, they explained.

“Bitcoin possesses the scarcity and durability of gold with the simplicity of use, storage and transport of fiat”, the document states.

According to the analysts, the first cryptocurrency possesses all the qualities of a reliable form of money owing to the absence of an issuing entity, and of dividend payments and cash flows.

Fidelity regards BTC as a gateway to the digital assets market. The firm believes investors can use two separate mechanisms: one focused on bitcoin as a monetary good (an asset class), and the second on altcoins from a venture capital investment perspective.

Earlier in January, analysts at the organization forecasted a government purchase of bitcoin.

Earlier, Fidelity Investments’ Jurrien Timmer did not rule out that after a retreat to $35,000, digital gold could form a bottom.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!