Fidelity survey shows institutional interest in cryptocurrencies remains strong.

74% of institutional investors surveyed by the investment giant Fidelity plan to acquire digital assets in the future, despite the crypto winter.

The results are in! The Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study reveals new insights into investor perceptions and adoption of digital assets across the U.S., Europe, and Asia: https://t.co/WLL5d606I0 pic.twitter.com/YnBSITusDV

— Fidelity Digital Assets (@DigitalAssets) October 27, 2022

The survey included 1,052 financial institutions across the United States, Europe, and Asia.

In the first half of the year, 58% of respondents had already diversified their portfolios with cryptocurrencies. A year earlier, the figure stood at 52%.

The largest share were from Asia (69%), with Europe (67%) and the United States (42%) trailing. The latter two figures rose by 11 percentage points and 9 percentage points over the year.

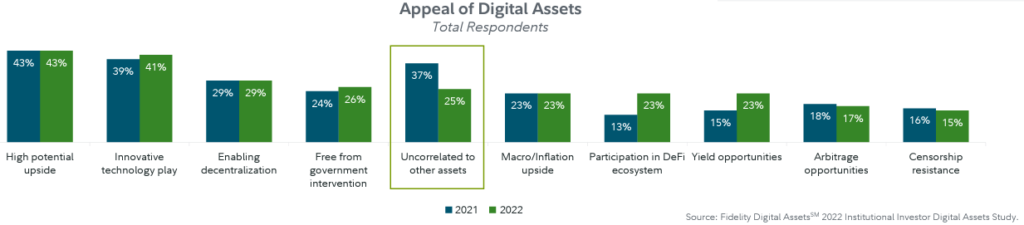

The positive shift occurred despite a decline in the share of respondents who noted no correlation between digital and traditional assets. The most frequent responses were “high growth potential”, “innovative technology”, and “the possibility of decentralisation”.

“The fundamental indicators of digital assets remain strong. The institutionalisation of the market over the past few years has enabled it to withstand recent events.” — said Tom Jessop, president of Fidelity Digital Assets.

In September, Fidelity Investments announced the launch of Bitcoin trading for retail clients of the brokerage division.

Earlier, a Charles Schwab survey showed interest from Zoomers (46%) and Millennials (45%) in adding cryptocurrencies to 401 (k) retirement plans.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!