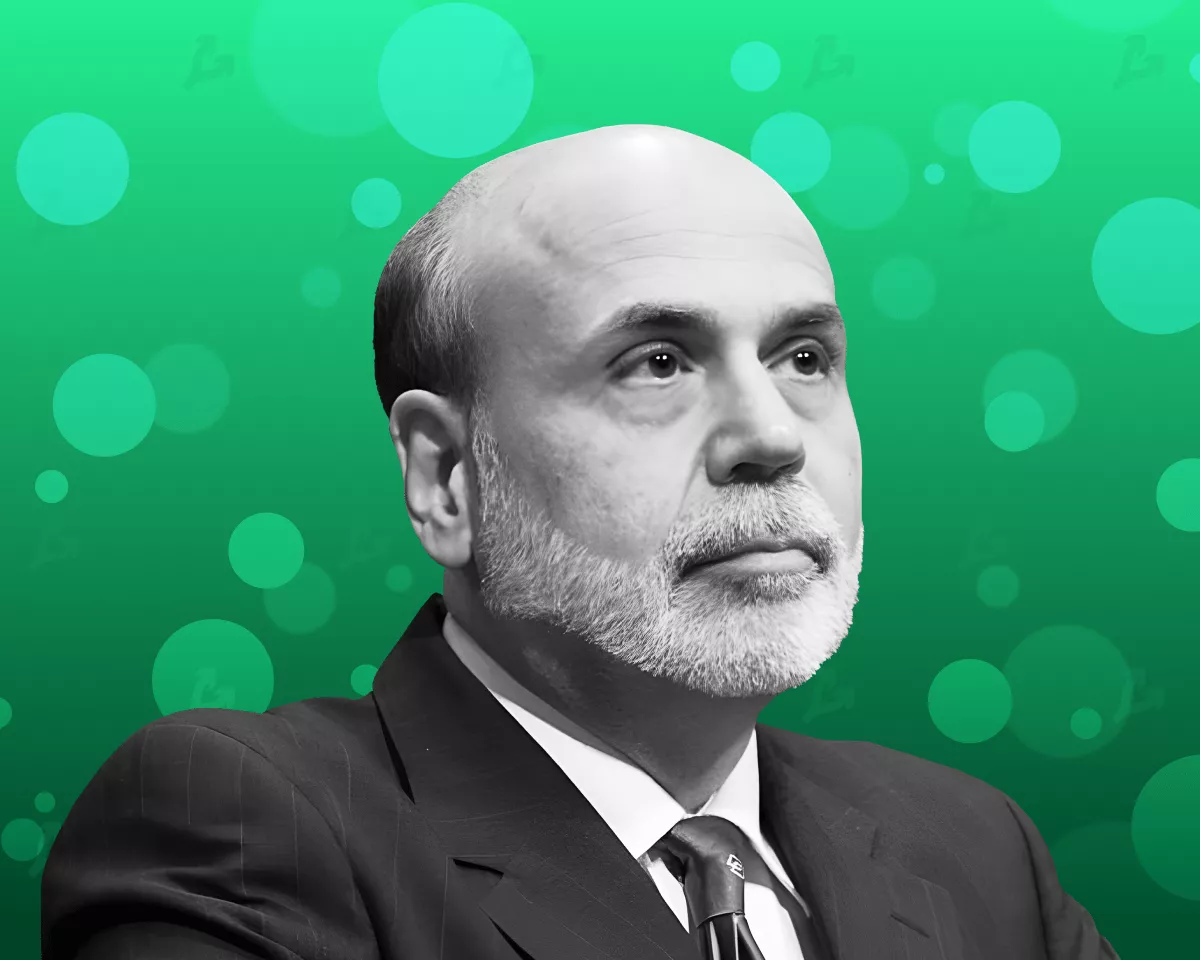

The appeal of Bitcoin and other cryptocurrencies lies in their being “successful as a speculative asset.” This was stated by former chair of the US Federal Reserve (Fed) Ben Bernanke.

«I don’t think that #Bitcoin is going to take over as an alternative form of money,» says @BenBernanke. pic.twitter.com/yl9gs6VZKX

— Squawk Box (@SquawkCNBC) May 16, 2022

In his view, digital assets were conceived as a replacement for fiat money, but have not succeeded in doing so.

«If Bitcoin were an alternative to paper money, you could use it to buy groceries. No one buys groceries with Bitcoin, because it’s too expensive and inconvenient», — Bernanke noted.

The former official also criticized comparing Bitcoin to gold. He noted that the precious metal “has a fundamental value for use,” whereas Bitcoin is “creating ransomware or something like that”.

“One of the risks associated with Bitcoin is that it could come under much greater regulation, and I think anonymity is also under threat,” the economist said.

Bernanke led the Fed from 2006 to 2014. In that role he advocated inflating the money supply by issuing dollars.

After public service, the economist joined Ken Griffin’s Citadel hedge fund as an adviser. In 2022, the latter admitted his skepticism regarding digital assets was mistaken and announced the firm’s entry into the cryptocurrency market as a liquidity provider.

Earlier the former Fed chief held a more favorable stance toward Bitcoin, according to a letter to the US Congress from November 2013. At that time Bernanke said that cryptocurrencies “may have long-term prospects, especially if innovations help create a faster, safer and more efficient payments system”.

In May 2022, billionaire Ray Dalio called Bitcoin a good hedge against inflation, but not a full-fledged alternative to gold.

Analysts at Bank of America noted the strengthened correlation between Bitcoin and the stock market, unlike precious metals.

Subscribe to ForkLog’s channel on YouTube!