Gary Gensler stresses the importance of regulating the crypto industry

Cryptocurrencies have a future, but only in a ‘trusted environment’, and the path to regulation will become easier as the space centralises. This was the conclusion reached by SEC chairman Gary Gensler and his predecessor in the role, Jay Clayton, during DACOM 2021.

Gensler reiterated that compares cryptocurrencies with the ‘Free Banking Era’ from 1837 to 1863. In his view, there are many projects attempting to circumvent regulation.

“I don’t think that’s the right approach. It looks like the Wild West,” said the head of the SEC.

Keeping the industry outside the regulatory perimeter could erode public trust in the technology, the official added. He gave particular attention to the decentralised finance (DeFi) sector.

“I think the so-called ‘decentralised finance’ has spurred some real innovations, but there is still some centralisation in it,” said Gensler.

In late October the chair compared the DeFi situation to the era when P2P lending emerged. In talking to Clayton, he reiterated his point:

“Such activity should be subject to similar regulation”.

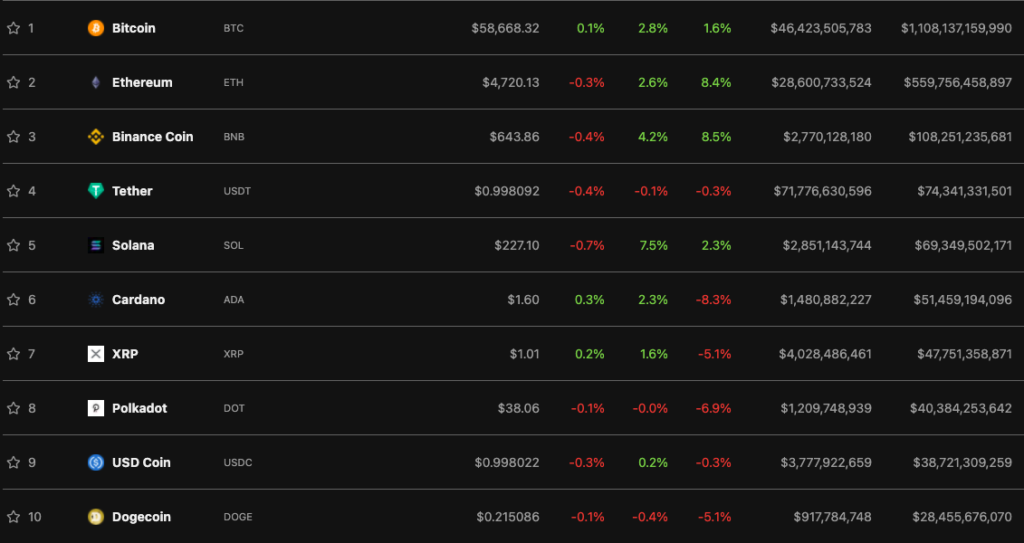

The head of the SEC’s remarks did not spark a negative market reaction. At the time of writing, bitcoin is trading around $58,745, up 2.8% over the past 24 hours (CoinGecko).

The second-largest cryptocurrency rose 2.6% in the last 24 hours, reaching $4,720. In the red among the top-10 are only USDT, Polkadot and Dogecoin.

In May, Gensler urged Congress to bring clarity to the regulatory framework for the crypto industry. He argued that legal frameworks are needed for the survival of digital assets.

Later, the head of the Commission said that platforms offering access to tokenised stocks must report to the SEC.

In August the official warned of tighter regulation of stablecoins and DeFi. In his view, decentralisation does not provide immunity from the Commission’s oversight.

In September, the regulator began studying the operation of the DEX Uniswap and, according to reports, several other DeFi-sector projects.

Also, news broke of a clash between Coinbase and the SEC over the planned launch of crypto-savings accounts on USDC at 4% annual yield. As a result, the bitcoin exchange backed away from these plans after a threat of a lawsuit by the regulator.

Earlier, Gensler said the Commission had no plans to ban cryptocurrencies, noting that this is the prerogative of the US Congress.

Follow ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!