Glassnode analysts assess the likelihood of Bitcoin’s continued correction

The November correction in Bitcoin is unlikely to persist, given the high share of “profit-taking” coins and a balanced stance in the crypto-derivatives market. These conclusions appear in a Glassnode report.

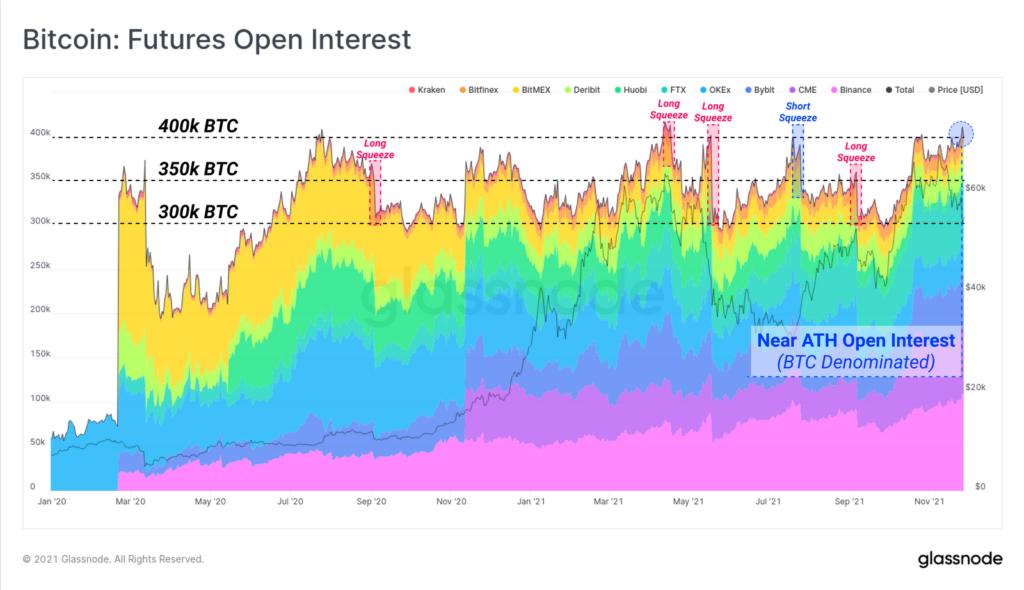

Leverage across #Bitcoin derivatives markets reached ATHs this week, suggesting a squeeze in either direction may play out.

Meanwhile short, and long-term holders own more profitable $BTC supply than during September’s dip.

Read more in The Week Onchainhttps://t.co/uHD3AEp6MA

— glassnode (@glassnode) November 29, 2021

The sharpest pullback this year occurred between May and July, when Bitcoin declined by 54%. In September the decline reached 37.2%. The January, February and April corrections at their peak were 24.2%. The current one barely surpassed 20%.

Open interest (OI) in Bitcoin options in October–November ranged from $12 billion to $14 billion, before dipping to $10 billion after the November 26 expiration.

In BTC terms, which isolates price movements, OI sits not far from the extremes above 400,000 BTC. Earlier, these levels signalled risks of liquidations.

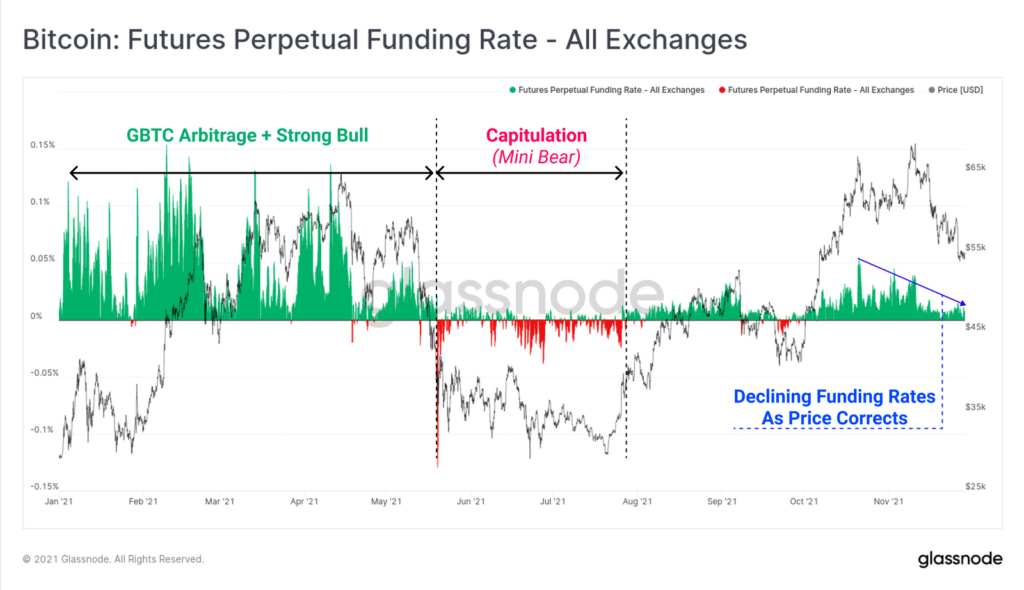

Perpetual contract funding rates indicate only a slight tilt toward long positions. The indicator declined along with the price drop, signaling a more cautious mood among traders.

Along with the correction, the number of open shorts could have risen, which in a high-leverage environment does not rule out liquidations of positions in both directions.

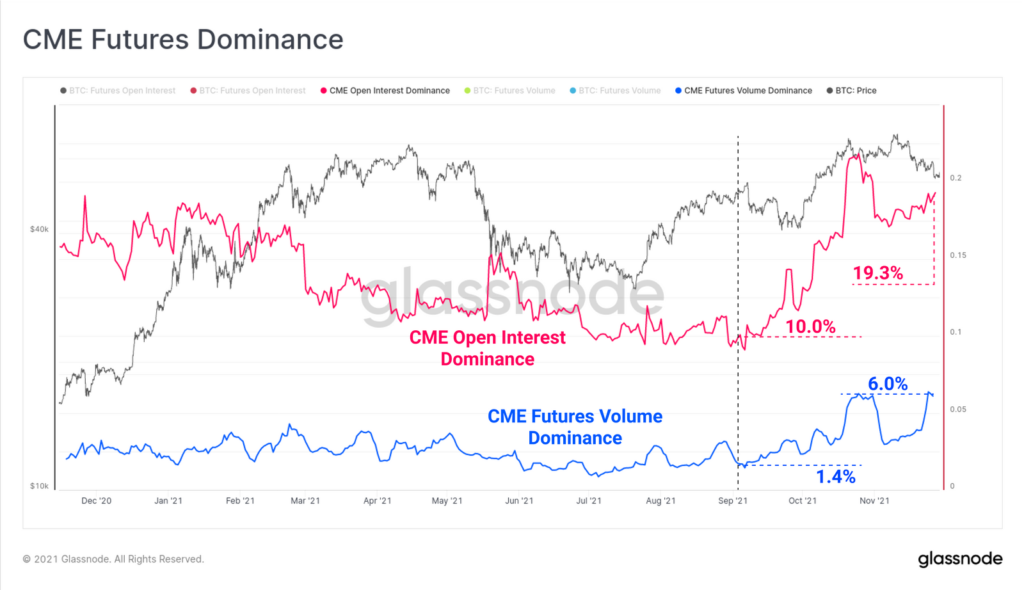

Analysts noted the increasing dominance of the CME in the Bitcoin futures market. In terms of OI, the share of this regulated platform rose from 10% at the start of September to 19.3% currently. In terms of trading volume, CME’s share over this period increased from 1.4% to 6%.

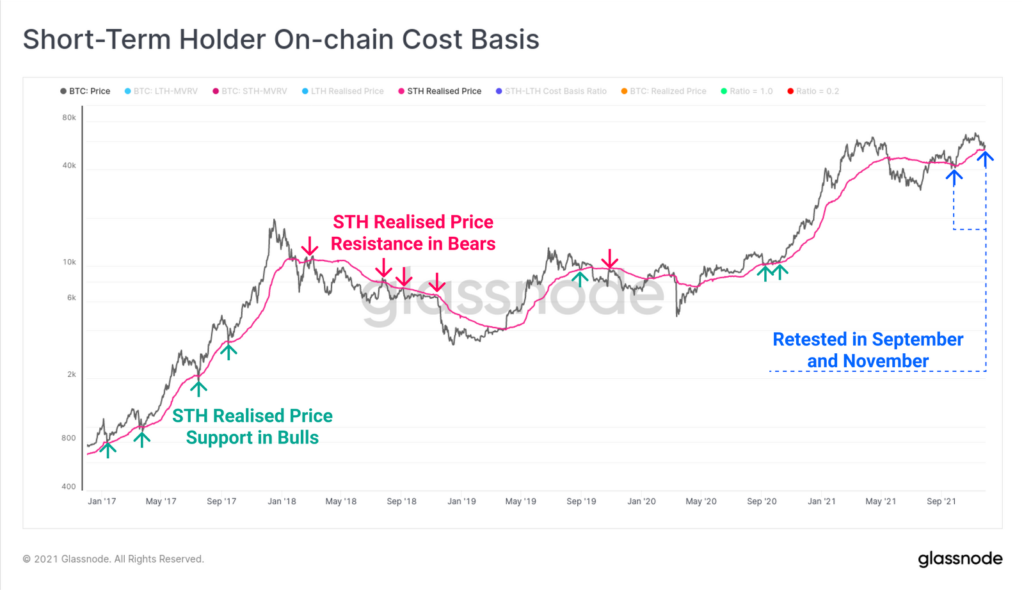

Over the past week Bitcoin tested the $53,500 level, which coincides with the price paid by short-term investors. Analysts noted that in 2017 a similar situation occurred, when the market repeatedly tested the price levels at which this category of buyers entered before a rebound.

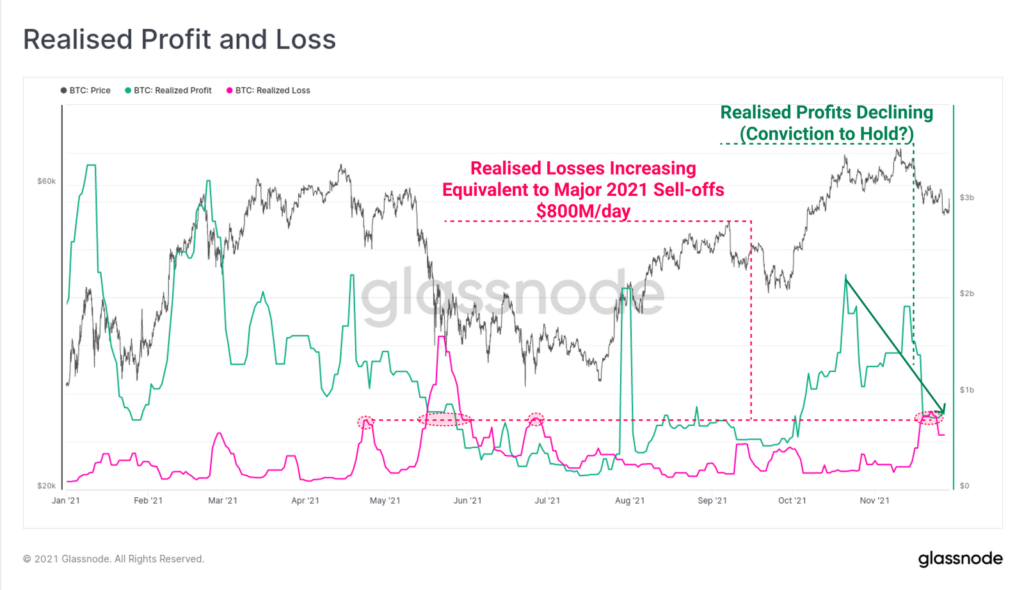

Experts emphasised that the formation of a bottom is typically preceded by mass selling of coins by short-term investors realising losses.

Earlier the daily losses of such investors rose to $800 million, which was characteristic of the April and July corrections, but smaller than in May. This does not rule out a continuation of the sell-off, but signals that many have already realised losses.

A rise in the price will reduce the probability of a negative scenario. The key will be to keep quotes above the $53,000 level, the analysts added.

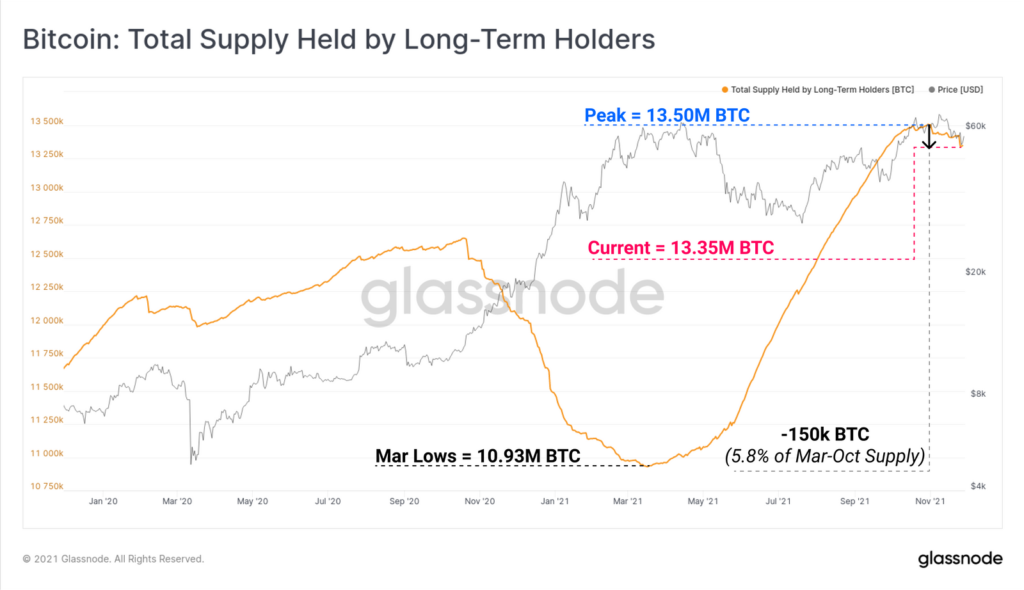

According to calculations by the experts, long-term investors have 13.35 million BTC at their disposal. From the peak in November this group has disposed of 5.8% of the coins they acquired.

The share of “loss-making” coins in the total holder supply stands at 5.8% (in October 9.65%), short-term investors — 9.6% (12.3%). In other words, since the September correction, the share of “profitable” coins among both groups has risen, reducing the risks of a further deterioration in market sentiment.

On the night of November 29, the first cryptocurrency rose back above the $57,000 level.

Earlier, SkyBridge Capital founder Anthony Scaramucci saw in the latest correction an opportunity to scale up his positions. In his view, cryptocurrencies have fundamental potential for further growth.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!