Glassnode analysts report a drop in miner activity amid shrinking exchange balances

Balances of exchange wallets continue to decline for the third week in a row as miners’ net position moves into accumulation. Glassnode analysts concluded as much.

The shift in behavior from distribution to holding coins has become characteristic for other categories of participants in the crypto market as well.

As volatility squeezes out of the #Bitcoin market, it is starting to feel like the calm before the storm.

This week we analyse a range of metrics seeking bull/bear triggers for

— Miners

— Exchanges

— Derivatives

— InvestorsRead more in The Week On-chainhttps://t.co/HHjjHethbY

— glassnode (@glassnode) July 12, 2021

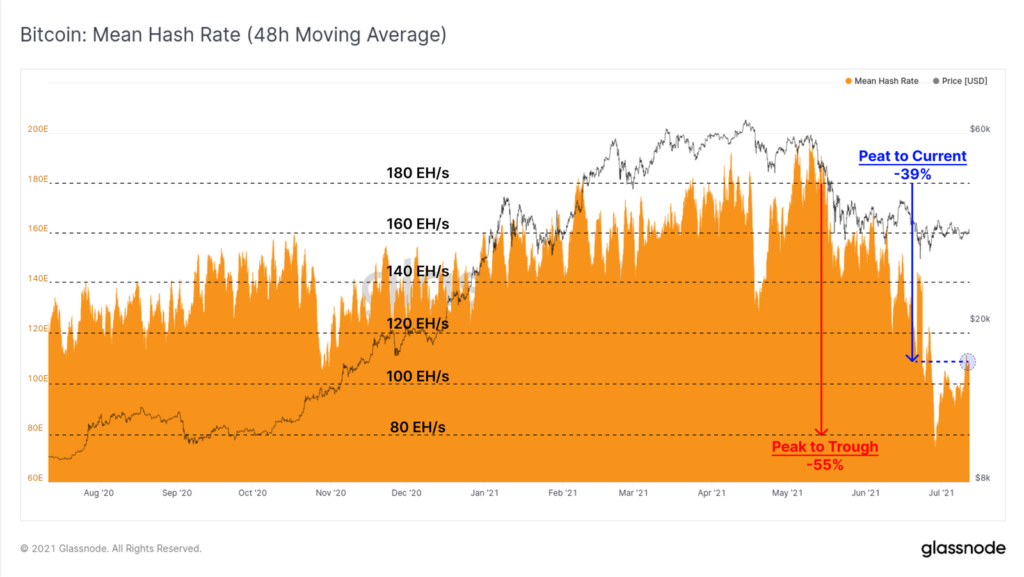

The two-day moving average of the hashrate rose and is currently down 39% from its ATH after a 55% decline in late June.

The recovery of 29% of previously offline capacity could be explained by partial relocation of Chinese miners and/or the resumption of use of previously unused equipment.

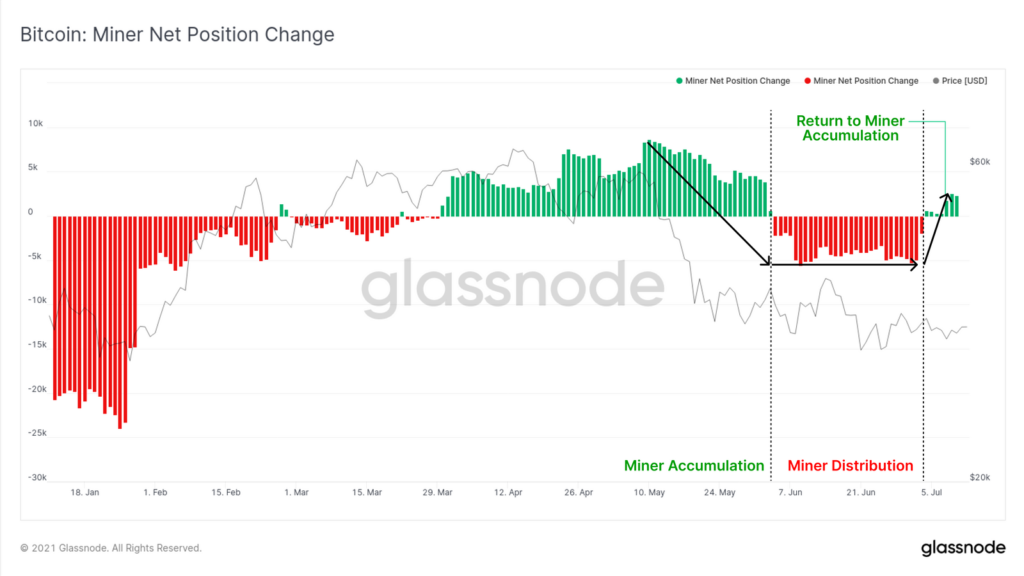

The miners’ net position metric has moved into accumulation territory. Experts explained the shift as a result of active miners ceasing to sell Bitcoin. This offset the impact of rivals who are selling holdings to resume operations.

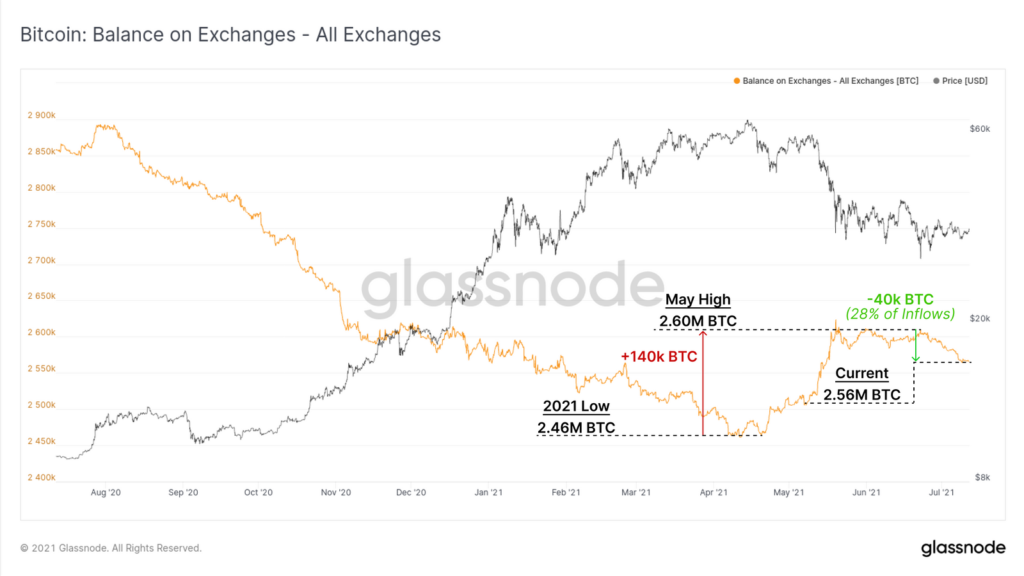

The shift of miners to accumulation has led to the withdrawal of coins from exchange wallets. The 14-day moving average of the daily metric reached 2,000 BTC. Over the past three weeks, exchange balances fell by roughly 40,000 BTC. The 140,000 BTC overhang deposited to exchange addresses since the April low has declined by 28%.

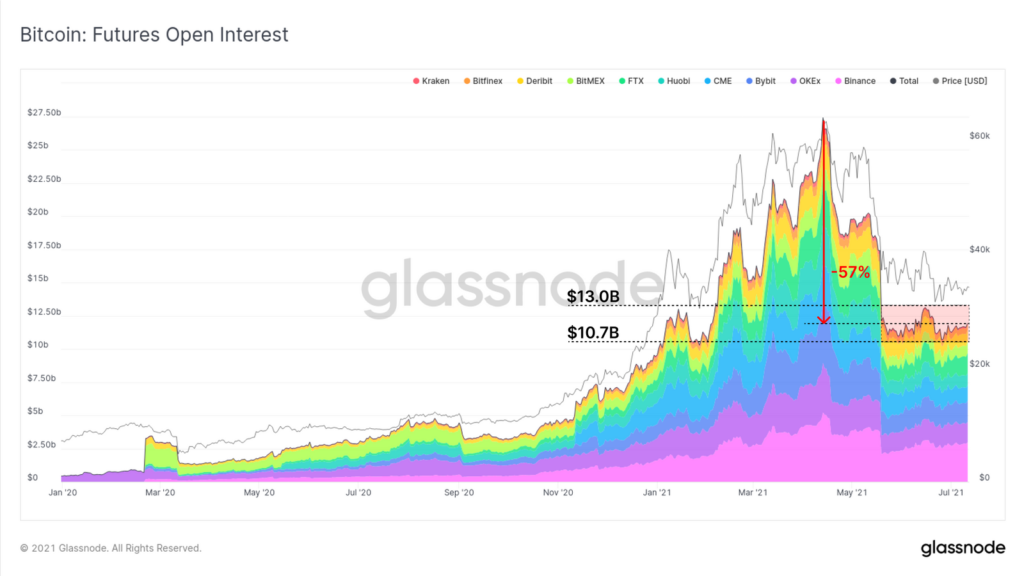

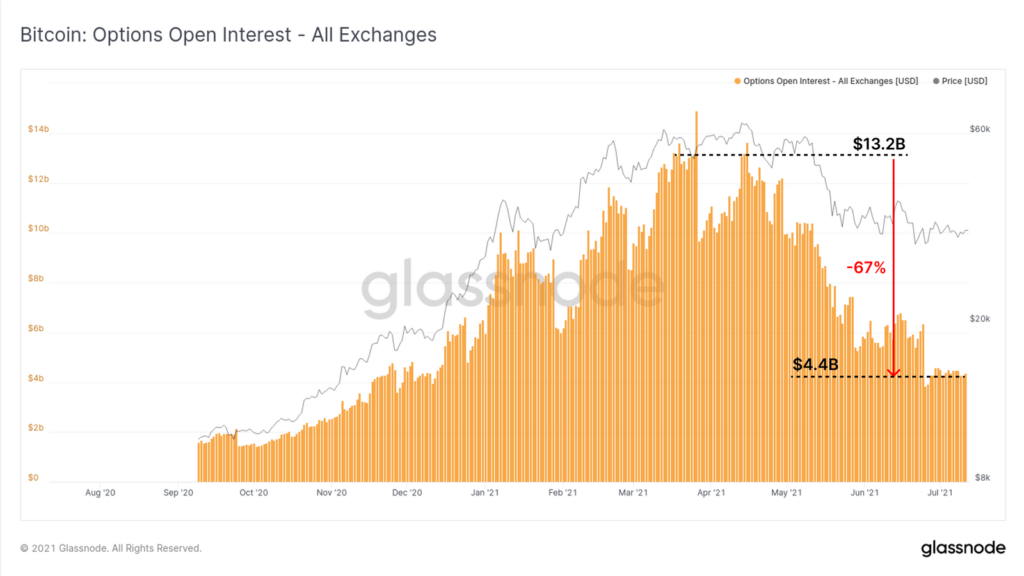

Low trading volumes of crypto derivatives indicate waning appetite among traders for leveraged speculation. Open interest in the Bitcoin futures market ranges from $10.7 billion to $13 billion after May sell-offs. The indicator is down 57% from its ATH in April.

Open interest in Bitcoin options is 67% below its ATH. The current figure of $4.4 billion matches levels seen in December 2020.

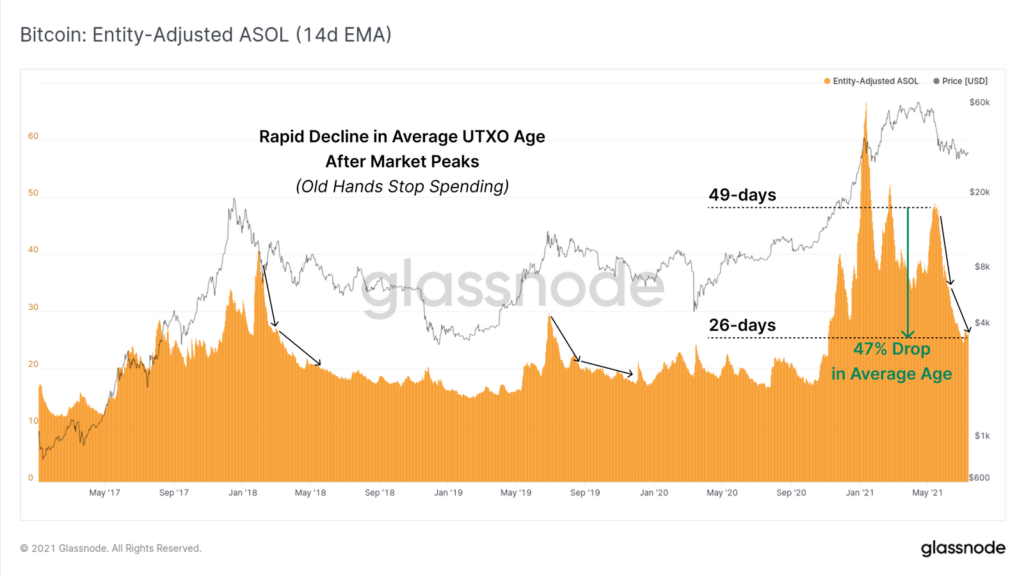

Analysts drew parallels with 2017 and 2019 and found a sharp decline in the average age of spent UTXO. In their words, this points to a return to the accumulation-and-holding model, but requires confirmation over a longer horizon.

Similar conclusions are also drawn from the analysis of HODL-waves. After May sales, cohorts aged from one week to one month, from one to three months, and from three to six months show accumulation and a shift to a more “older” status.

Two- to three-year holders, after several months, may have ceased distributing. They now own 9.8% of the supply. Holders aged from three to five years hold 13.1% of the issuance, including 5.2% that matured since March 2020.

Since April, switching from selling to holding Bitcoin has become characteristic also for investors who bought their first cryptocurrency from six months to two years ago. They currently hold a total of 22.3% of the market supply in their wallets.

“The evolution of these mid-age HODL waves over the next three months will be pivotal in determining the ‘fate’ of early institutional supply. How much is held, and what has been realized recently?”, the analysts noted.

Earlier, ForkLog published material with an analysis of on-chain indicators in the context of the current market situation.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!