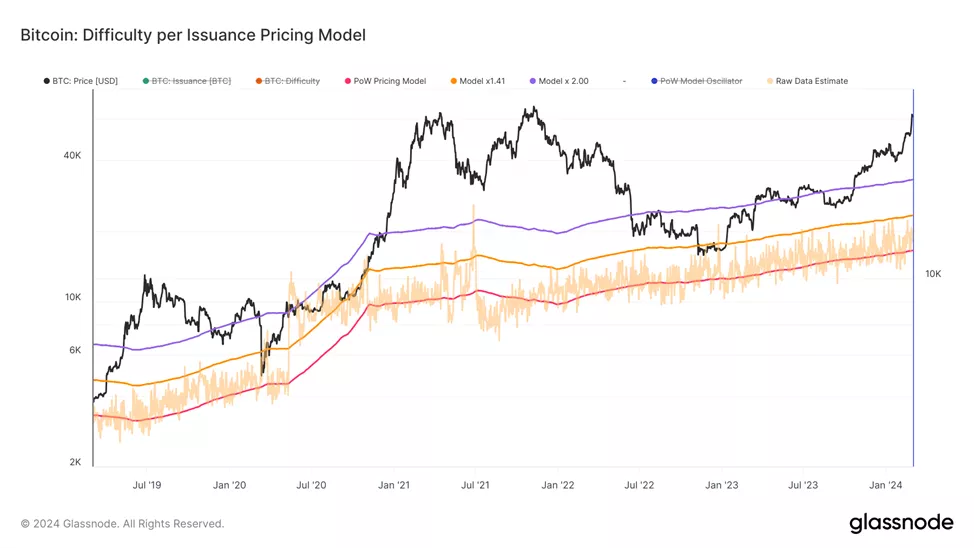

Glassnode Analyzes Bitcoin Halving’s Impact on Tokenomics

- Daily issuance of new bitcoins will drop from 900 BTC to 450 BTC post-halving.

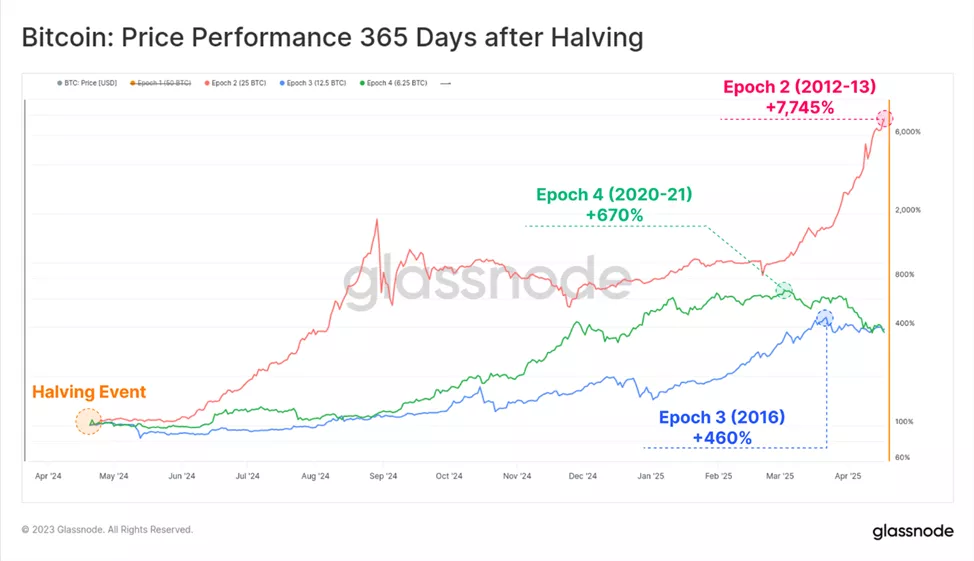

- Following previous events, prices increased by 460-7745% within a year.

- Spot Bitcoin ETFs will support upward pressure on prices.

The upcoming halving in April will reduce the daily issuance of new bitcoins from 900 BTC to 450 BTC, affecting trading strategies, market cycles, and mining. Glassnode has examined the key aspects of this forthcoming event.

With the #Bitcoin halving 47 days away, we have prepared insightful content for both market newcomers & experienced investors. Our introductory article outlines the halving’s impact on trading strategies, market cycles, and mining operations. ?https://t.co/jRQUXz3DH6

— glassnode (@glassnode) March 4, 2024

Consequences of the upcoming halving include:

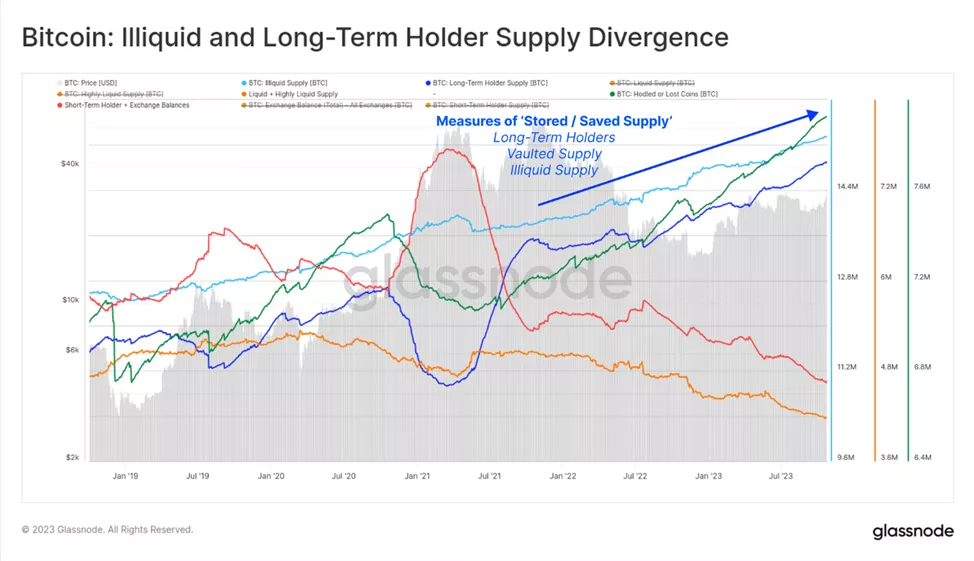

- Scarcity — halving miner rewards will reduce supply, increasing the scarcity of coins available for trading;

- Market cycles — historically, halvings have preceded bull rallies;

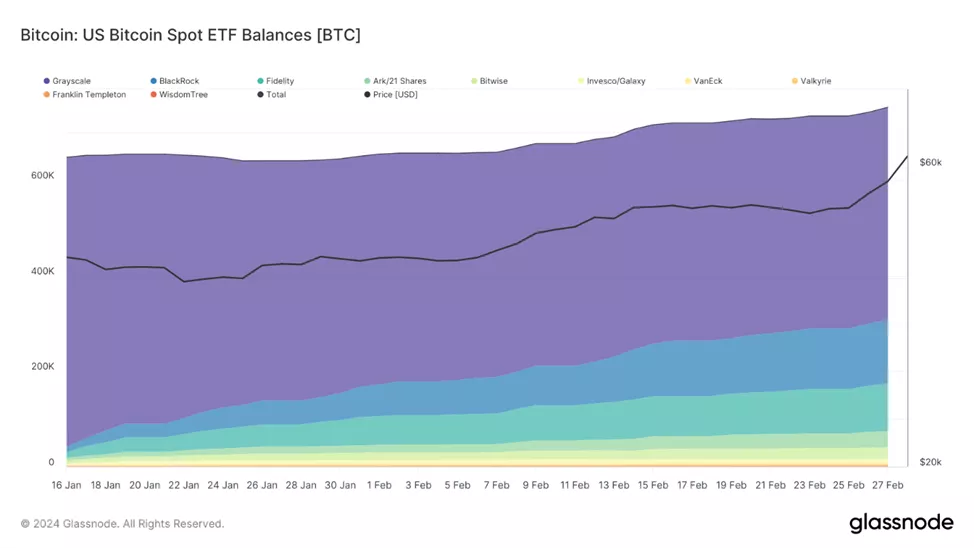

- Increased demand — active purchases of spot Bitcoin ETFs could amplify the effect;

- Profitability — the event will impact mining profitability and the prospects of related companies and their stock valuations.

Analysts presented the historical price dynamics of digital gold following the previous four halvings, with increases ranging from 460% to 7745%.

Experts noted that the total supply of bitcoins is capped at 21 million coins. Traditional gold does not have this property: high prices can make the extraction of previously unprofitable deposits economically viable.

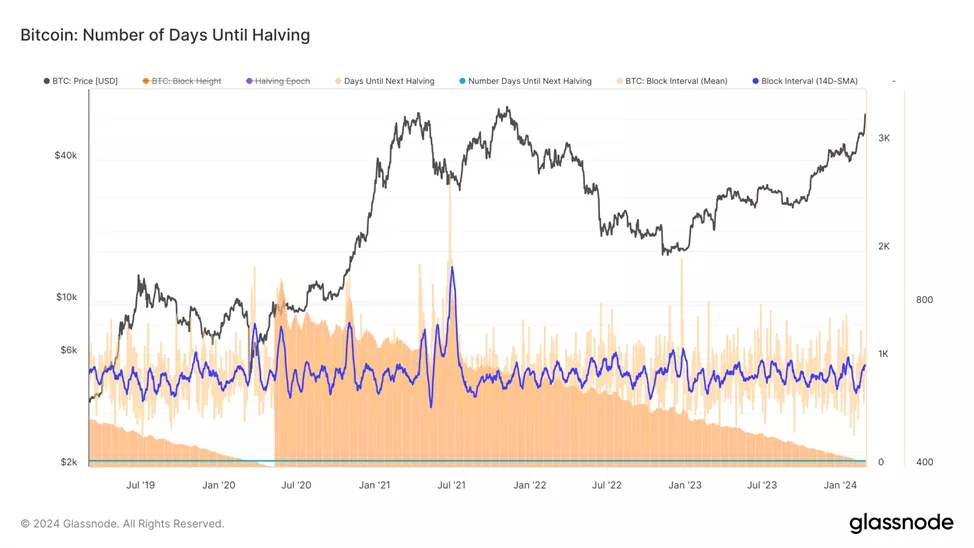

Mining of the first cryptocurrency began with 50 BTC per block in 2009, decreasing to the current 6.25 BTC. In April, this parameter will fall to 3.125 BTC.

The reward is halved every 210,000 mined blocks. Considering the changing difficulty and hash rate, a new block is formed every ten minutes.

Less than two months remain until the fourth halving. The supply of coins available for trading has reached a historically low level, significantly impacting the price dynamics of digital assets.

Spot Bitcoin ETFs have already absorbed $9 billion in BTC. Considering this factor, analysts noted the clear potential for bullish pressure on the price.

The active supply is also influenced by the transfer of bitcoins from centralized platforms to non-custodial wallets. Quarterly rates have increased to 180,000 BTC — twice the number of mined coins.

According to experts’ calculations, post-halving, the costs for the least efficient miners will double to ~$66,000. Industry participants are forced to invest in more modern equipment to maintain profitability.

Considering historical context, halvings have often been followed by periods of price increases. This could influence the strategies of players with a longer investment horizon. Short-term traders may attempt to capitalize on the volatility surrounding the event, experts indicated.

JPMorgan previously predicted a decline in Bitcoin to $42,000 post-halving. They estimate that the cost of production will rise to this level, acting as a price floor.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!