Glassnode: Bitcoin holds at $20,000 despite weak metrics

Speculators are using rebounds to sell Bitcoin amid weakness in on-chain metrics. The price has not retraced to its lows due to the lack of significant selling pressure, according to Glassnode analysts.

Near-term weakness continues to haunt numerous #Bitcoin fundamentals, with prices faltering below $20k late last week.

In our latest newsletter, we assess this persistent market weakness, which is putting the bulls on the back-foot.

Read our analysis 👇https://t.co/CGUvEyiNL7

— glassnode (@glassnode) August 29, 2022

Bulls still cannot establish a sustainable uptrend due to weak demand, and spending patterns indicate the persistence of bearish sentiment.

Hodlers stay steadfast. Glassnode expects to reach the bottom-forming range, as was characteristic in earlier downcycle phases.

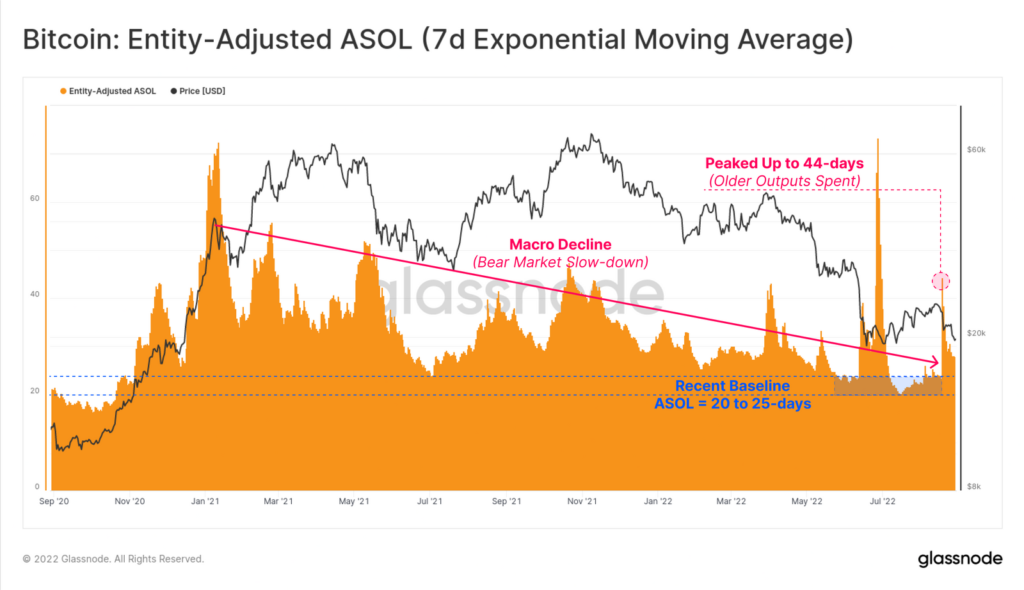

The seven-day moving average of spent output in the context of its lifespan (ASOL) after the recent spike in hodler spending continues to decline. Along with the fall in Bitcoin’s price, this suggests demand is being absorbed by supply.

The metric that accounts for the volume of spent coins, Average Coin Dormancy shows that recent activity by long-term investors was modest in volume. This confirms extremely weak demand against a backdrop of low hodler activity.

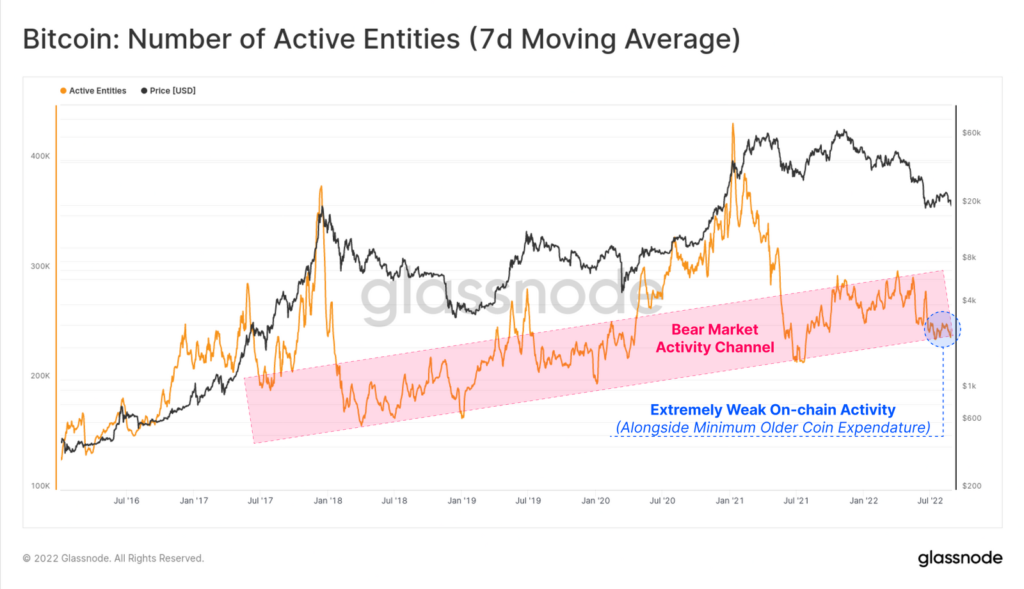

The seven-day moving average of active addresses (excluding related addresses) is testing the lower bound of the bearish channel. Further declines in the metric would signify a ‘painful deterioration of the user base, not seen for many years,’ the analysts said.

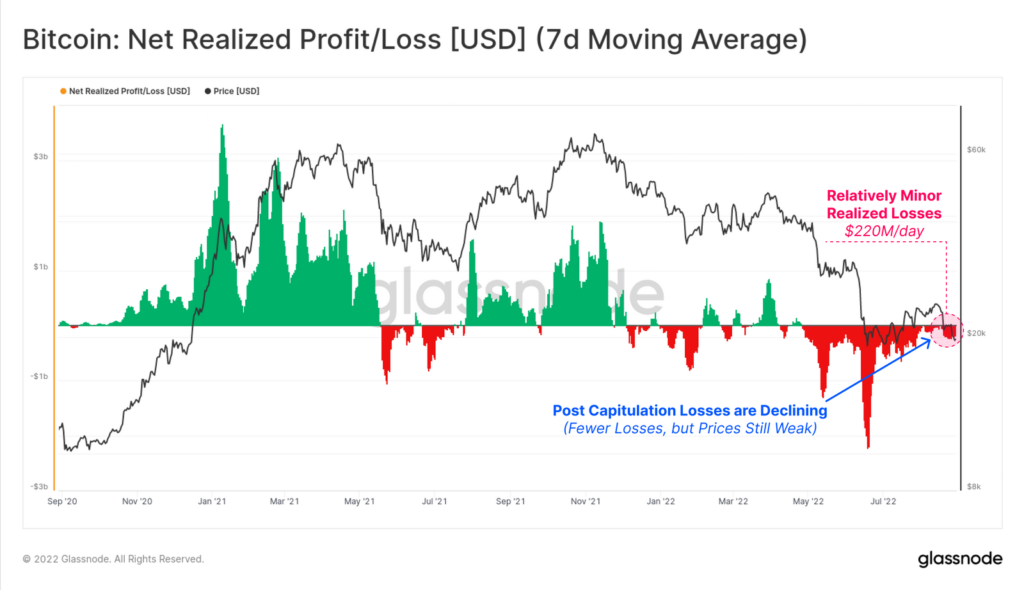

While hodlers have reduced activity, and among speculators the stance of ‘get your money back without losses’ (to sell at or above the purchase price) prevails, market participants as a whole report daily losses of $220 million.

This is a relatively modest figure compared with recent capitulations, when the metric reached several billions of dollars.

The return of the net realized profit/loss metric (30-day moving average) to positive territory would be a sign of potential market strength and a pickup in demand.

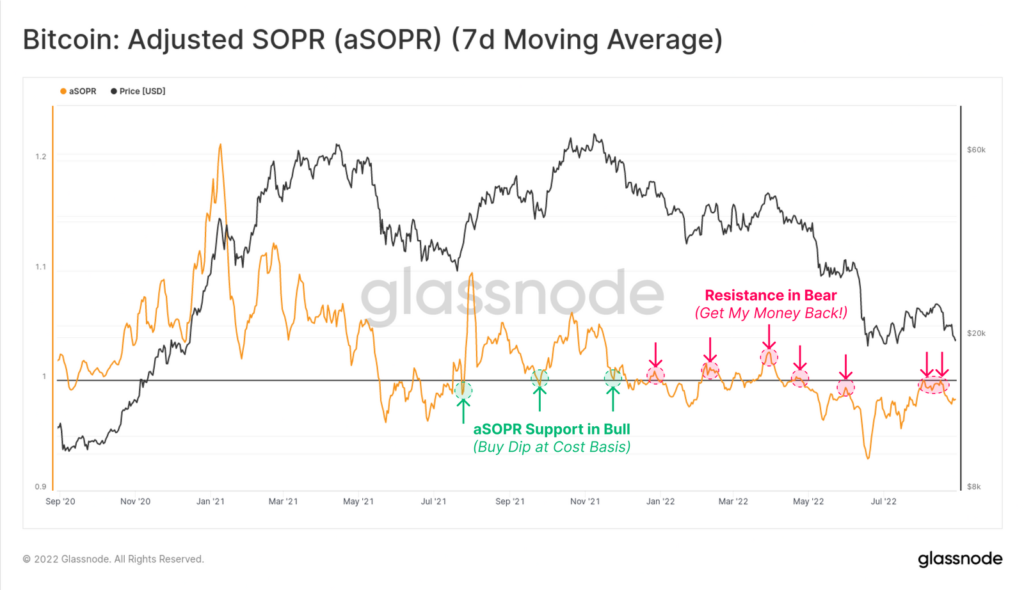

The adjusted profitability of spent output (SOPR), which is filtered to coins aged less than 155 days, has not breached the 1 level as Bitcoin traded around $24,000. Speculators are closing positions with little to no loss, or with relatively small losses. A move above 1 would confirm demand recovery.

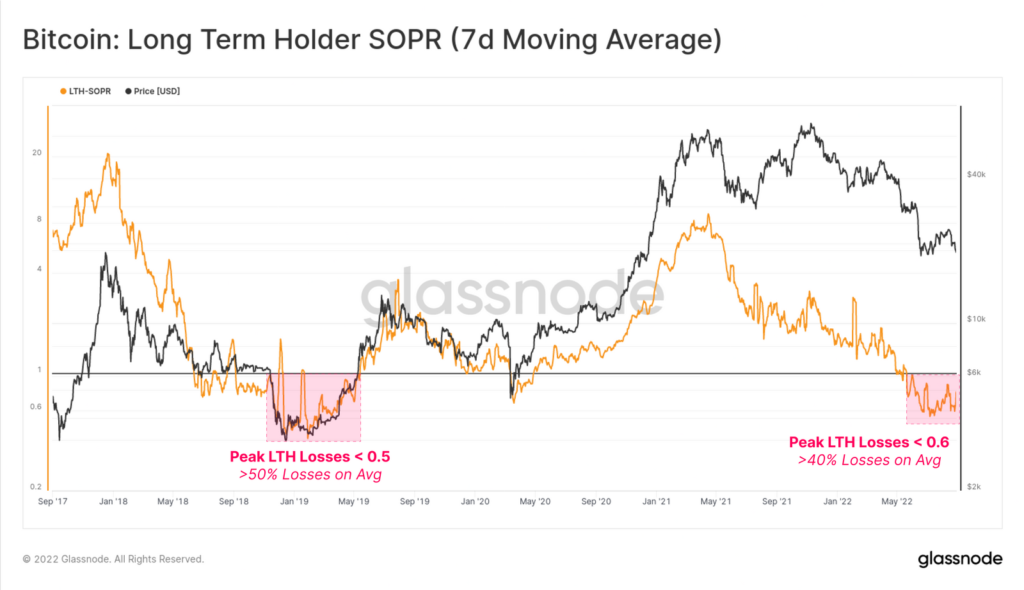

The LTH-SOPR indicator, filtering coins aged less than 155 days, remains in the 0.6-0.65 range. This points to the greatest selling activity by buyers in the 2021-2022 period. A move above 1 would be a constructive signal, but this could take months, the analysts concluded.

As noted, Genesis Trading’s head of derivatives Joshua Lim named три причины слабой динамики биткоина.

Earlier, Look Into Bitcoin founder Philip Swift pointed to a likely drop in Bitcoin’s price based on the Whale Shadows indicator.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!