Glassnode doubts continuation of Bitcoin’s recovery rally

The rebound in Bitcoin and Ethereum prices in recent days is not accompanied by a fundamental improvement in on-chain indicators. This does not provide confidence in a fundamental change in the market outlook, according to Glassnode analysts.

#Bitcoin and #Ethereum have rallied strongly off the bottom, reaching above the Realized Price.

Attention now turns to whether this is a bear market rally, or whether the fundamentals are following through in support.

Read more in The Week On-chain 👇https://t.co/taOkbeVlyv

— glassnode (@glassnode) August 1, 2022

Doubts that the upside momentum after crossing above the realized price will continue are shaping on-chain indicators.

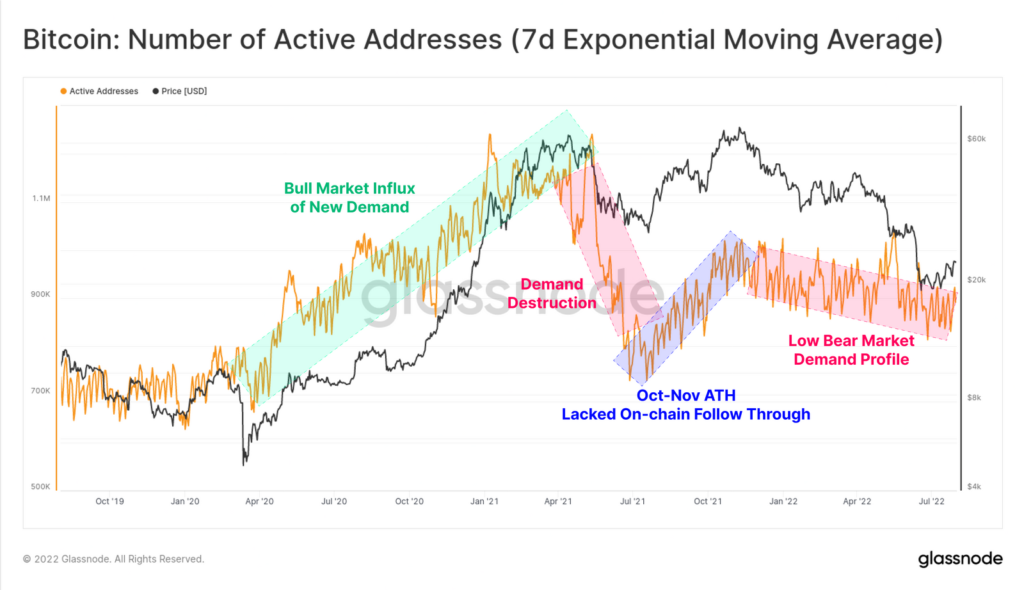

The number of active Bitcoin addresses remains within a downward-trending channel. The October–November peak was below the April 2021 all-time high ATH.

Apart from brief spikes during capitulations, network activity remains subdued, indicating only a small inflow of new demand.

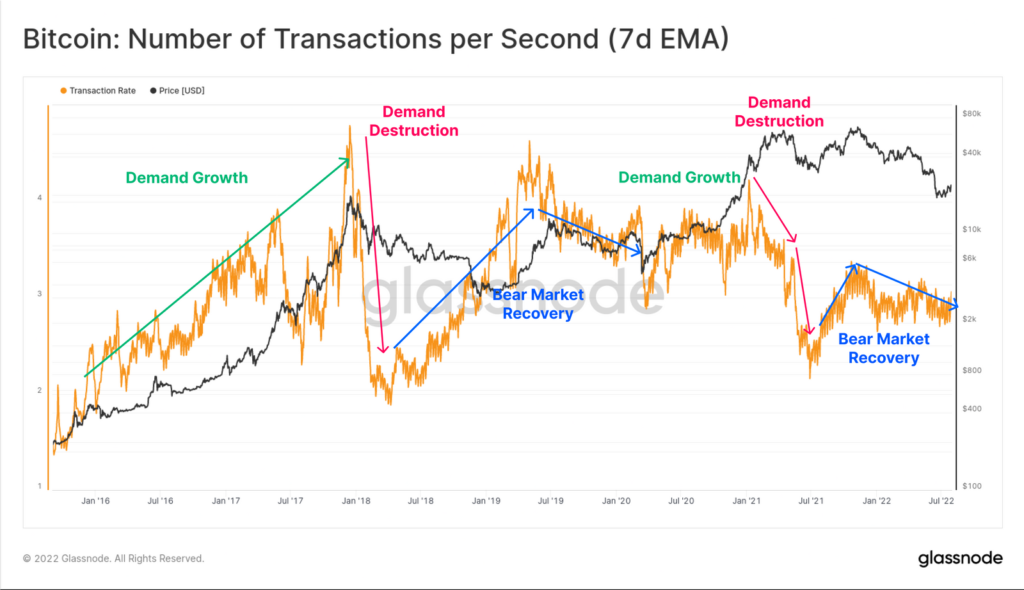

A similar pattern formed when considering transaction counts, fees and block utilization. Analysts found similarities between the current situation and events of 2018 and 2019. After the initial “washout” and destruction of demand in May 2021, transactional activity declined somewhat. This suggests only a stable base of engaged traders and investors remains.

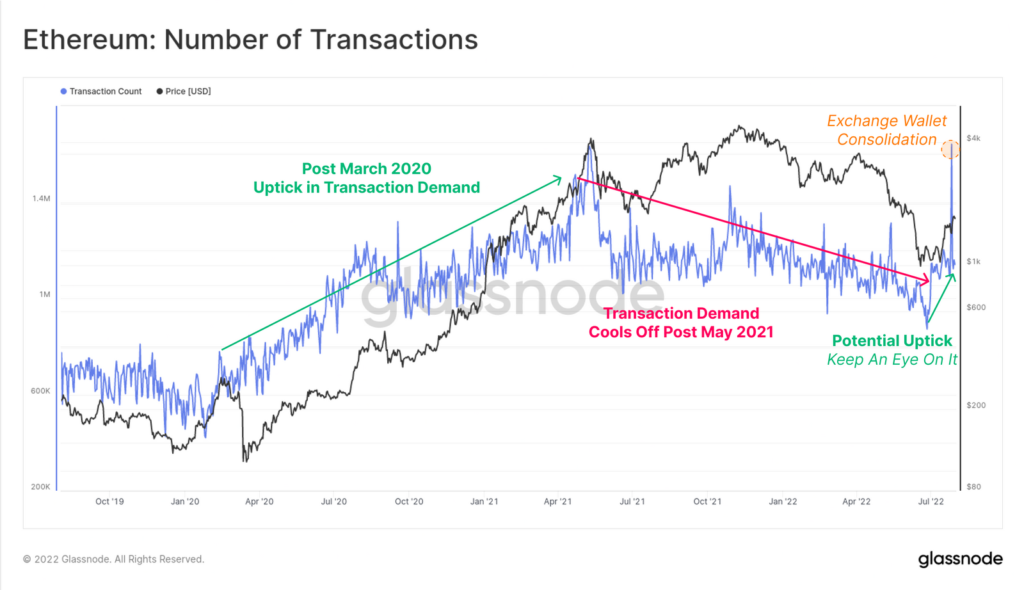

Analogous trends are observed in the Ethereum blockchain. Despite the strong price move recently, network load by transaction count has steadily declined since May 2021 to the lowest levels since the summer of 2020.

In recent weeks there has been a spike in activity linked by analysts to consolidation of coins on wallets. They noted that they would revise their view if this trend proves durable.

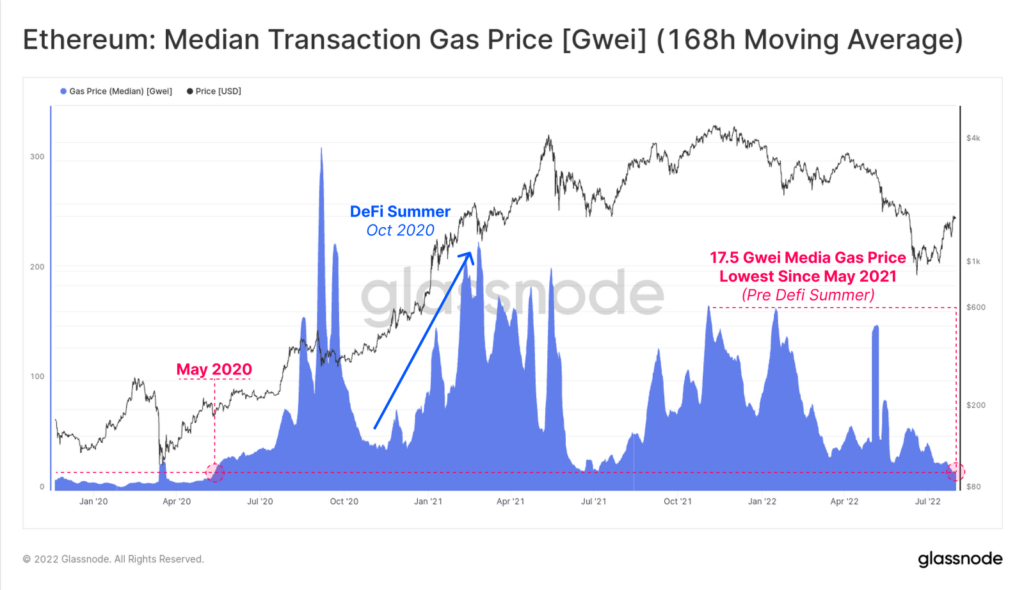

The median gas price over the last seven days fell to 17.5 Gwei — the lowest since May 2020, marking the start of the DeFi summer. In other words, there was no influx of new users. Many Ethereum activity metrics are at multi-year lows, the analysts noted.

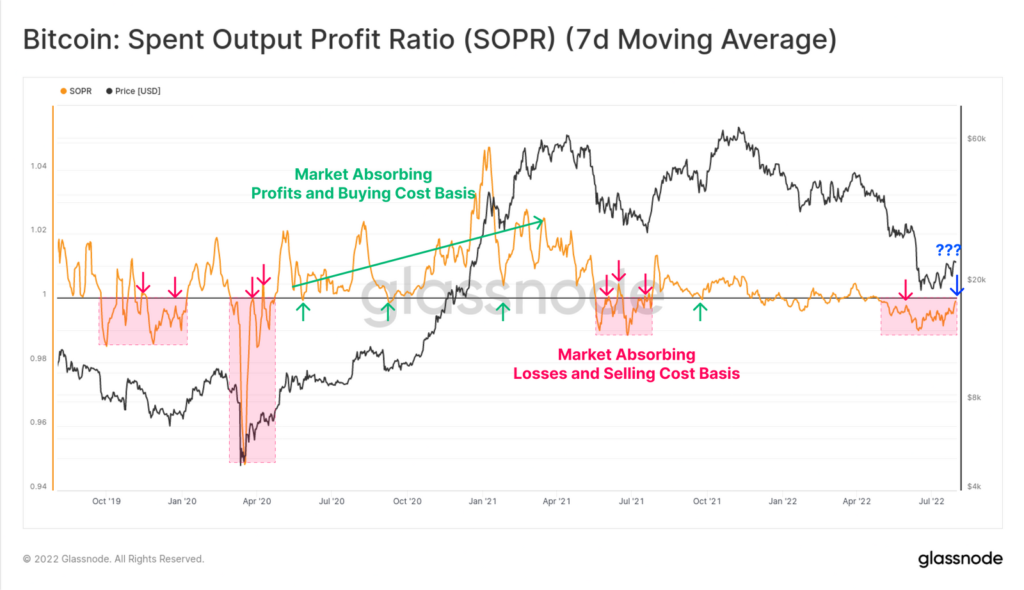

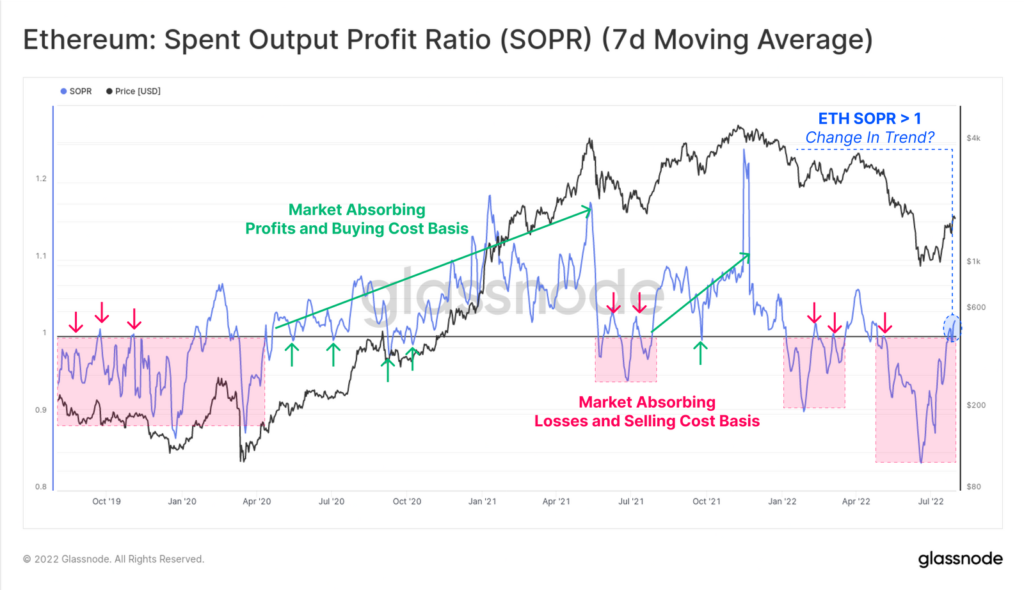

A degree of optimism for Glassnode analysts is lent by the Spent Output Profit Ratio, SOPR.

In Bitcoin the indicator, for the second time since the start of June, is attempting to breach the threshold of 1. Analysts explained that this usually does not happen on the first try. The ideal bullish scenario would be a break above this level followed by testing it as support, they explained.

In Ethereum a similar breakout with a subsequent retest as support has already occurred. Experts warned that it may prove unstable given weak network-activity indicators.

Earlier, Glassnode analysts warned that a reversal in Bitcoin’s price would require additional time.

As Grayscale analysts noted, the crypto-winter could end by the end of March 2023.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!