Glassnode flags bitcoin’s “remarkable” resilience amid a trade war

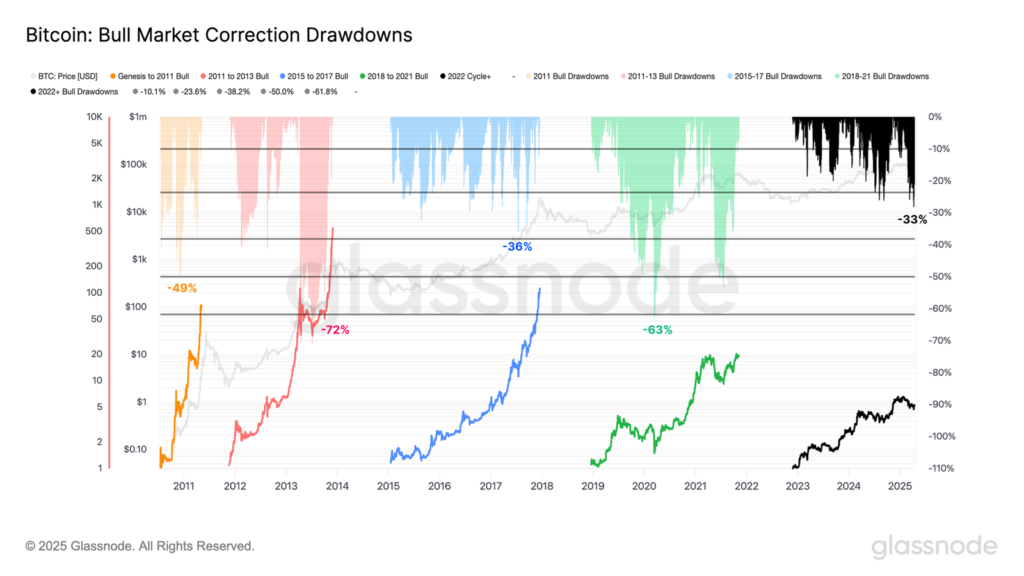

- The current correction has deepened to 33%, compared with 50% or more in previous cycles.

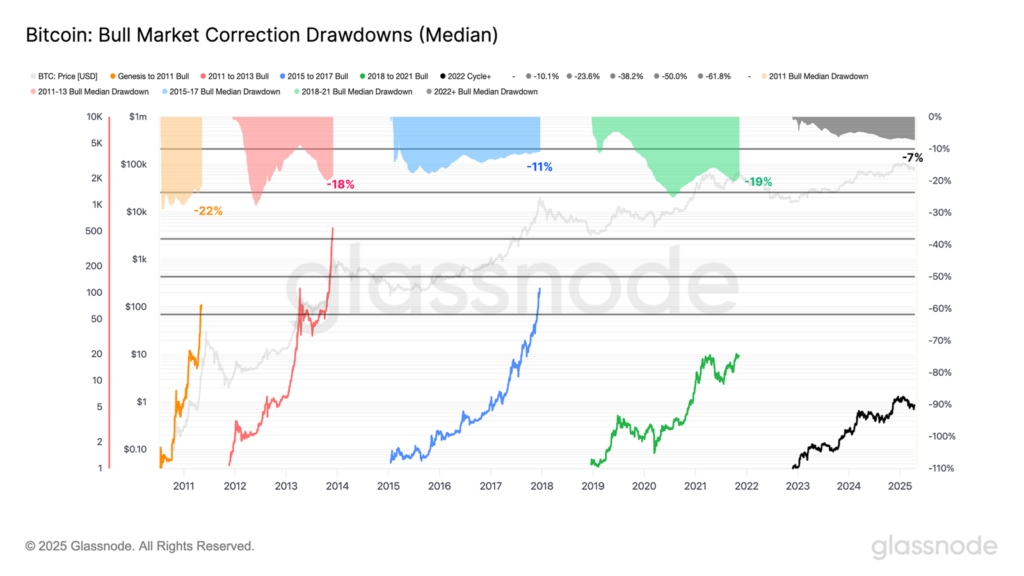

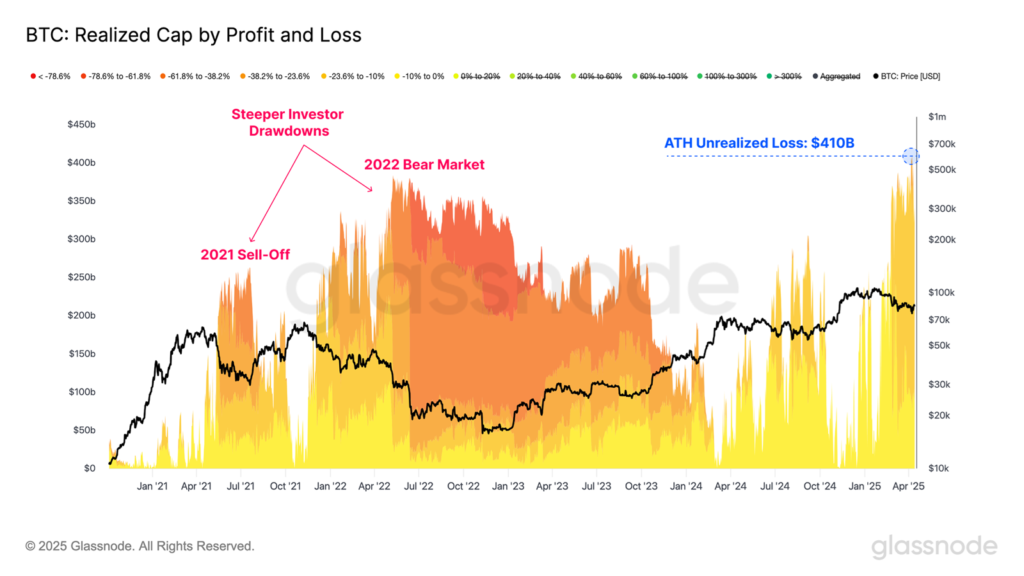

- Most investors endured drawdowns of up to -23.6%; in earlier cycles, losses reached 61.8-78.6%.

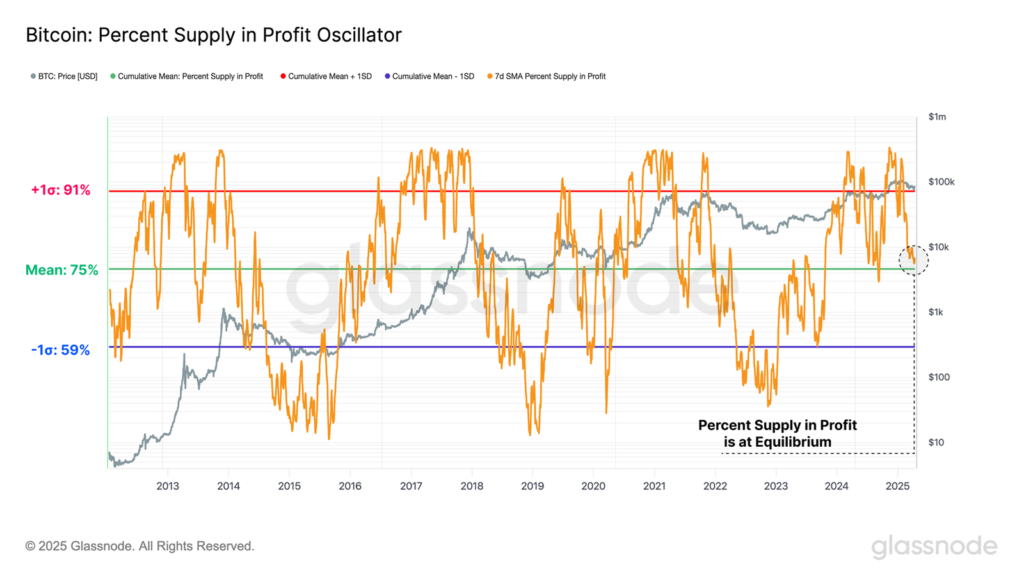

- The share of coins in profit remains high at an equilibrium 75%.

Bitcoin trades above $80,000, keeping the drawdown this cycle well below those in previous periods, Glassnode said.

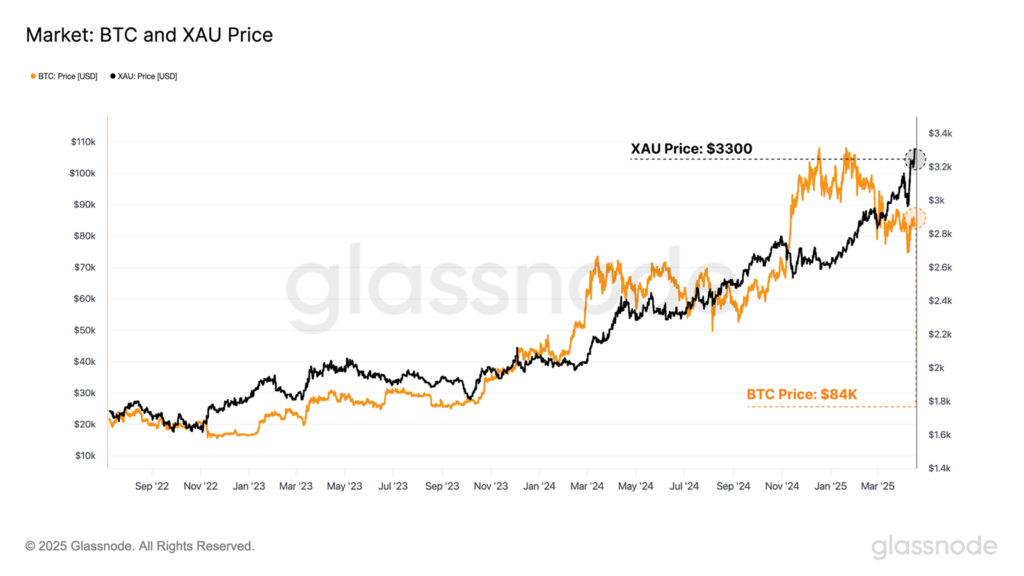

The macroeconomic environment remains uncertain as global trade relations realign. Still, the performance of hard assets remains remarkable, with gold surging to new ATH of $3300 and #Bitcoin holding above $80k. Discover more in the latest Week On-Chain:https://t.co/FWiMuimRUk pic.twitter.com/W4136o3dgx

— glassnode (@glassnode) April 16, 2025

Amid a volatility spike across US equities and Treasuries, bitcoin’s price rebounded from $75,000 to $85,000, while the precious metal set a record above $3,300.

As the world adapts to shifting trade relations, both instruments are functioning as globally neutral reserve assets, the analysts said.

The current pullback from ATH has reached 33%, whereas in the past its typical magnitude was at least 50%.

A more resilient demand profile and holder stamina are also reflected in a median pullback of 7%, versus 11-22% in prior bull runs.

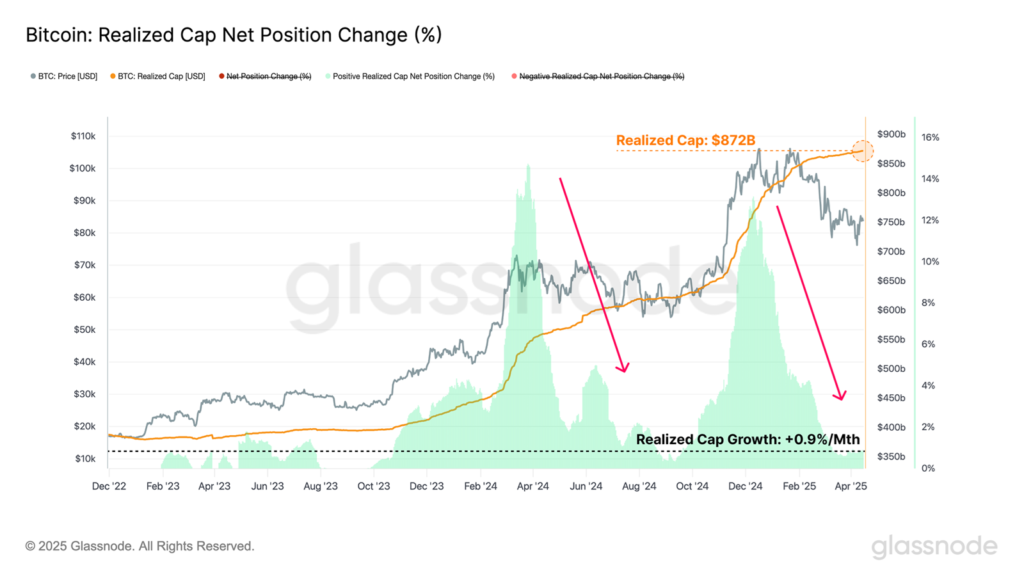

The positive trajectory of realized capital as a measure of the leading cryptocurrency’s liquidity in a fraught macro backdrop is striking, the experts added.

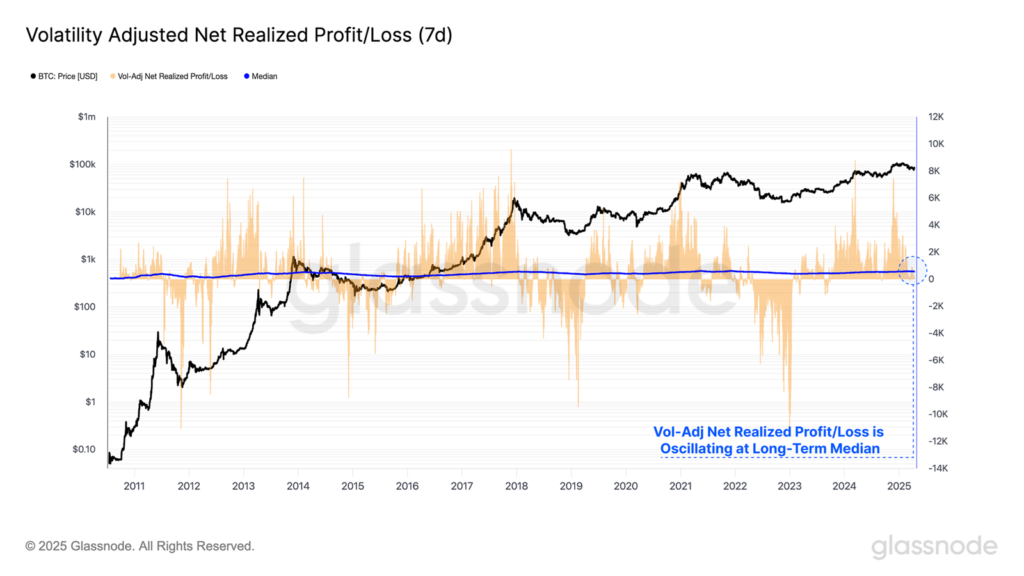

The volatility-adjusted Net Realized Profit/Loss has reverted to its neutral median, suggesting the market is at a key decision point and is attempting to re-establish support within the current price range.

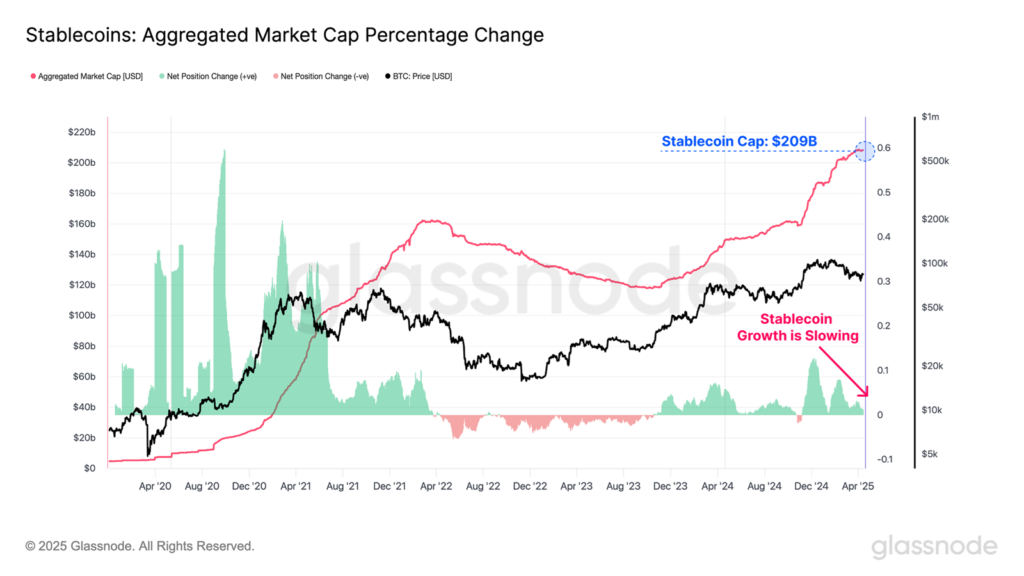

A slowdown in inflows to the digital-asset ecosystem via stablecoins provides further evidence of a broader liquidity contraction.

Unrealized losses climbed to a new ATH of $410 billion during the drop to $75,000. Most investors saw drawdowns to -23.6%. In earlier cycles, holders suffered far larger “paper” losses in relative terms—61.8-78.6%.

Despite the rise in unrealized losses, the share of coins in profit remains elevated at an equilibrium 75%. In other words, most loss-making market participants are “new” buyers who entered during the topping phase, the specialists said.

Earlier, QCP Capital questioned bitcoin’s status as a “safe-haven” asset.

Earlier, TheMinerMag reported an acceleration in miner coin sales to the highest level since October 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!