Glassnode Highlights Resilience of BTC-ETF Holders Amid Market Correction

Investors remain confident in the long-term prospects of BTC-ETF, as indicated by moderate selling pressure amidst a “paper loss” on the average position, according to Glassnode.

For the first time since the ATH, #Bitcoin has established a new technical higher high, as price bounced into the $66k region.

Alongside this, there is a multitude of critical on-chain metrics that have also set higher highs, making this an interesting moment in time.

Discover… pic.twitter.com/AeOruDoPqo

— glassnode (@glassnode) October 2, 2024

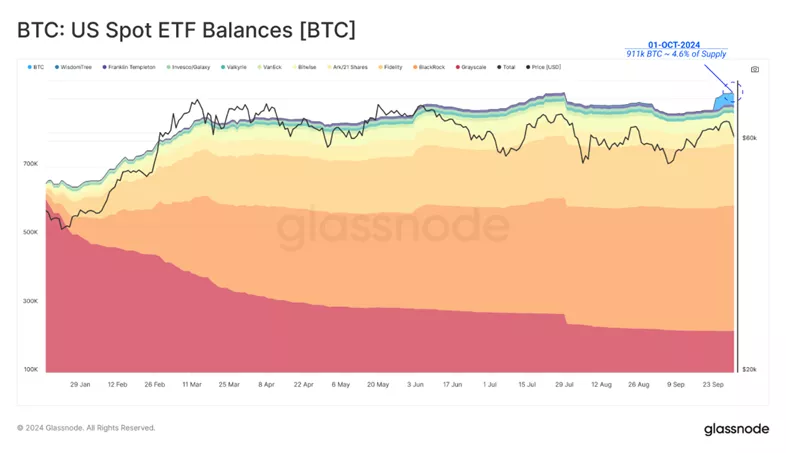

According to experts, issuers of spot bitcoin ETFs have acquired 911,000 BTC — 4.6% of the available supply of digital gold.

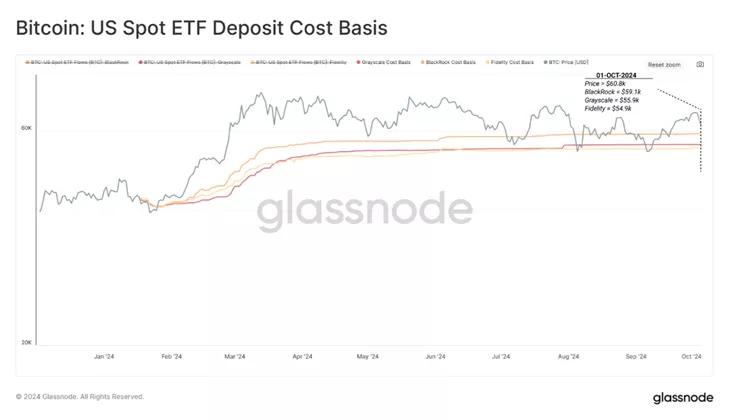

Experts linked the dynamics of the leading cryptocurrency to the depositing of funds in ETFs by sector leaders — BlackRock, Fidelity, and Grayscale — to assess the average cost of coin acquisition. The figure ranged from $54,900 to $59,100.

The resulting “cost model” allows for the determination of the breakeven point and psychological stress points for investors based on their unrealized profits/losses, analysts noted.

The provided chart shows how since July, the first cryptocurrency’s quotes have fallen below the indicated levels in three episodes.

In the next illustration, experts demonstrated the impact of ETFs on bitcoin dynamics. They compared the volume of inflows into exchange-traded funds with the net capital inflow overall based on changes in realized capitalization.

“Since January, 4-5% of the metric can be linked to coins being stored by ETF issuers. This corresponds to their share of the total supply,” concluded the specialists.

In September, spot exchange-traded funds based on bitcoin shifted from a net sale of 5,000 BTC to the highest purchase since July of 7,000 BTC, according to CryptoQuant.

Earlier, The Bank of New York Mellon with AUM of $50 trillion announced plans to enter the crypto-ETF custodial services market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!