Glassnode: In anticipation of the halving and an ETF, hodlers have hoarded a record number of coins

Despite the active rebound of digital gold since the start of the year, coin supply remains extremely limited due to hodlers’ actions. Many metrics, describing “Bitcoin inactivity,” have reached ATH, according to Glassnode.

The #Bitcoin Supply is historically tight, with an all-time-high in coins held by Long-Term investors, and impressive rates of accumulation taking place.

Discover more in the latest Week On-Chain?https://t.co/3wTXOHoRmd pic.twitter.com/f6nf30Nld7

— glassnode (@glassnode) November 7, 2023

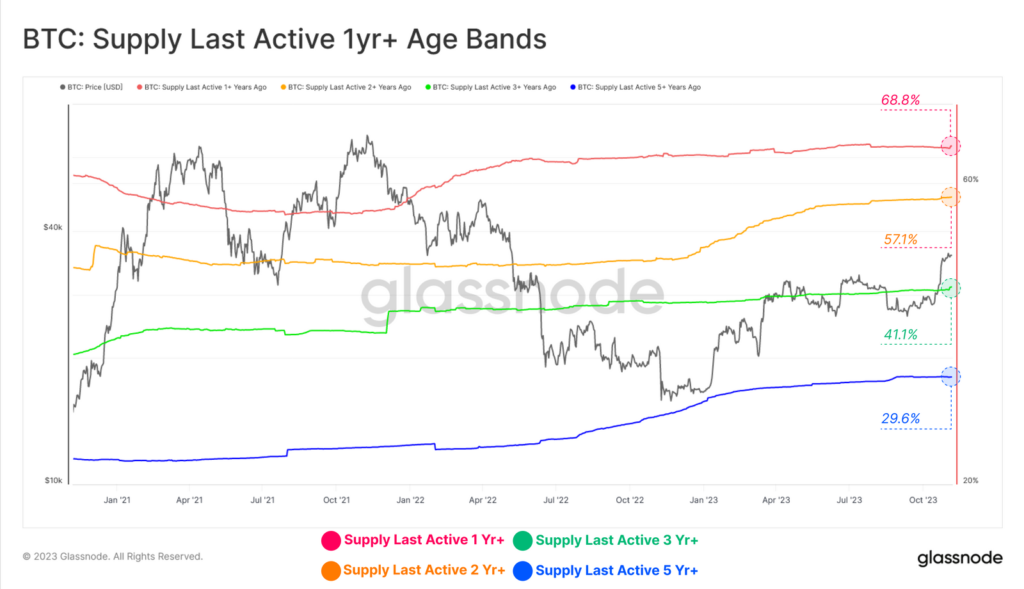

The chart below shows various “age” cohorts of coins aged one year and older up to five years and more, with no activity during the indicated periods.

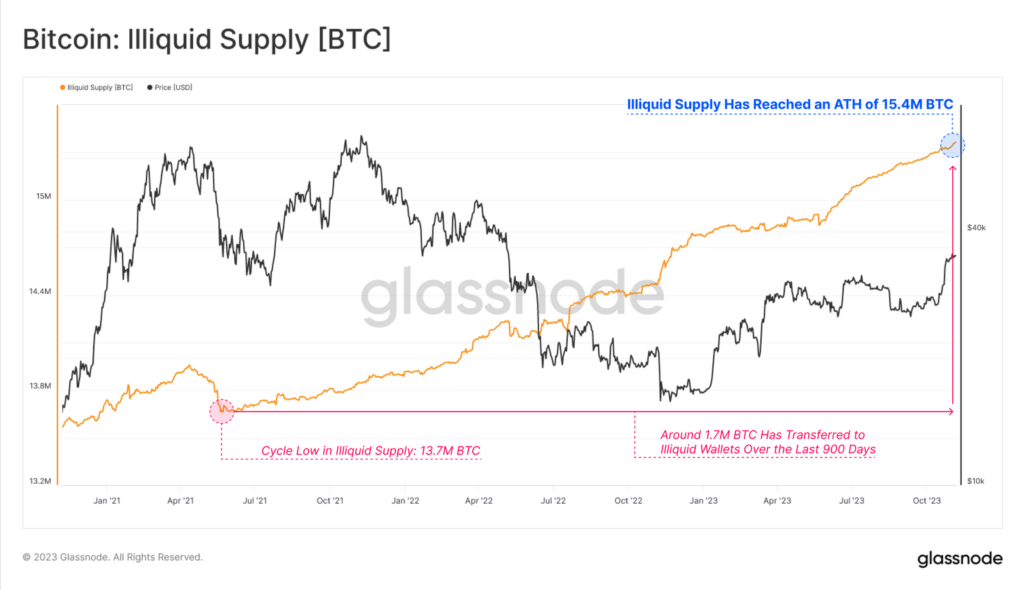

The illiquid supply indicator — the number of coins stored in wallets with minimal history of spending — reached a record 15.4 million BTC.

Changes in the indicator often occur in tandem with withdrawals from exchanges. Since May 2021, investors have moved more than 1.7 million BTC in this way. Monthly outflow rates reached 71,000 BTC.

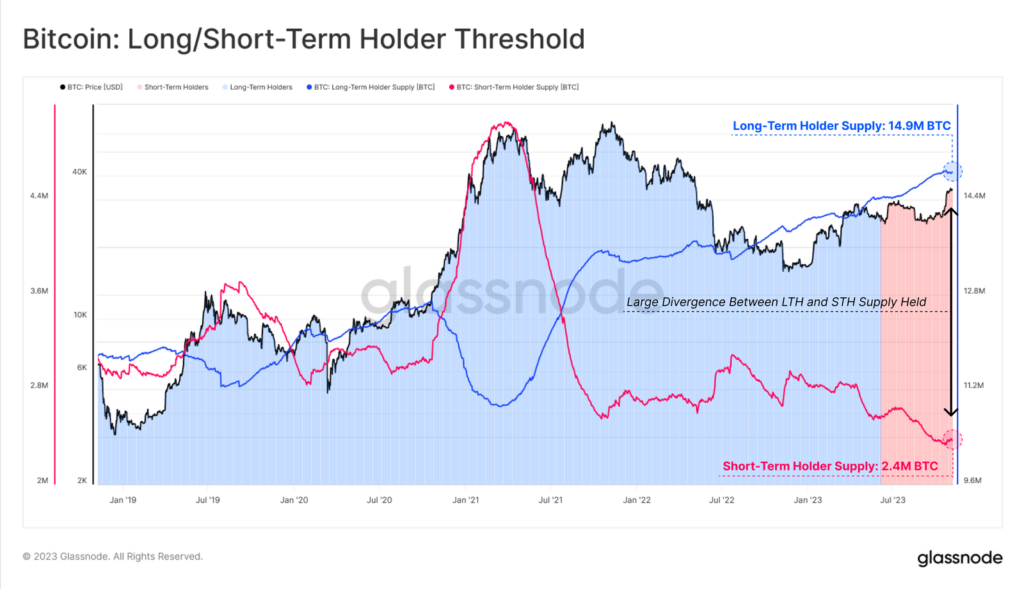

There is a growing divergence between the supply held by long-term investors, which is approaching a historical maximum, and the supply held by speculators, which has approached a record low.

The dynamics show growing supply constraint as existing holders are not rushing to part with their assets.

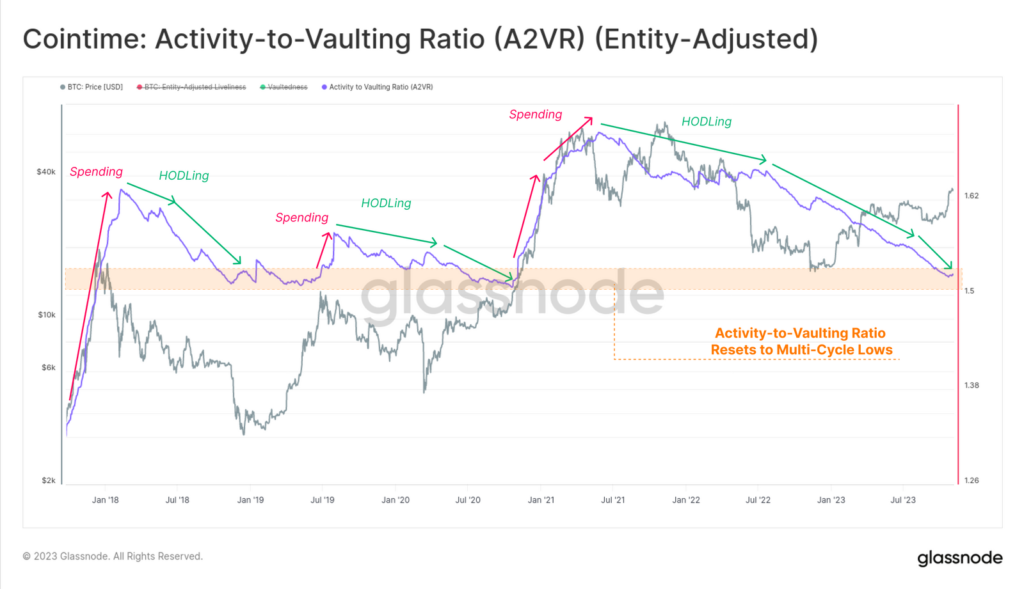

Analysts proposed a new metric of activity-to-accumulation (A2VR). It compares the balance of “activity” and “inactivity” of coins over all time, measured in units of time held by the investor (usually in Coindays or Coinblocks).

- Upward trend suggests that market participants with “old” coins are moving to spend; and sharper rises indicate aggressive distribution.

- A downward dynamic signals that investors prefer to hold bitcoins in an inactive state; a faster decline suggests stronger such behaviour.

The chart below shows a bearish A2VR trend from June 2021, with the trend intensifying after June 2022. The indicator reached the lows of early 2019 and late 2020, which preceded significant upward trends in the market.

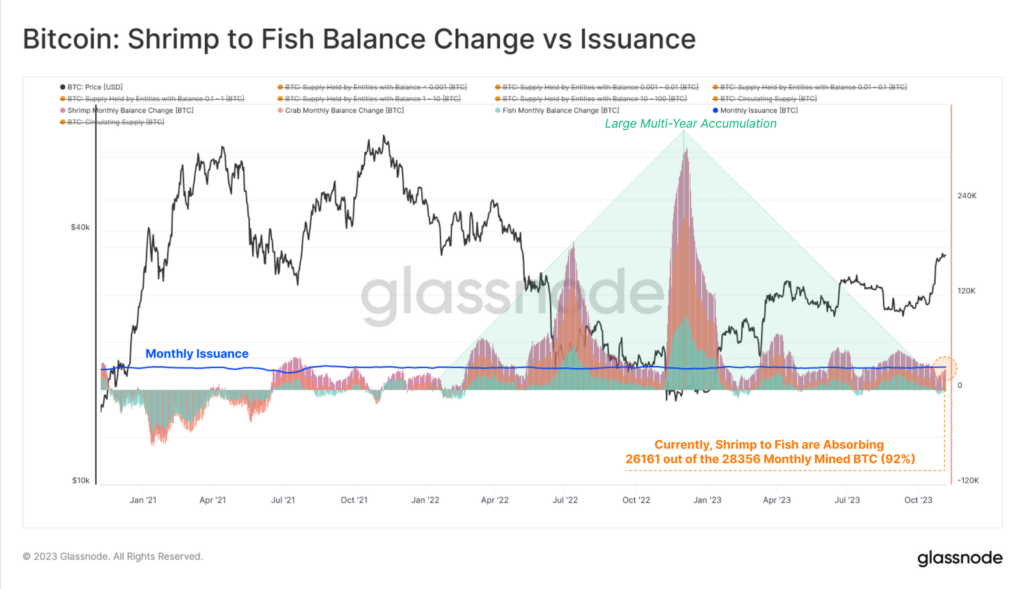

Based on wallet balances, analysts determined that 92% of mined coins move into the hands of “shrimp” (<1 BTC), “crabs” (1–10 BTC) and “fish” (10–100 BTC). This dynamic has persisted since May 2022.

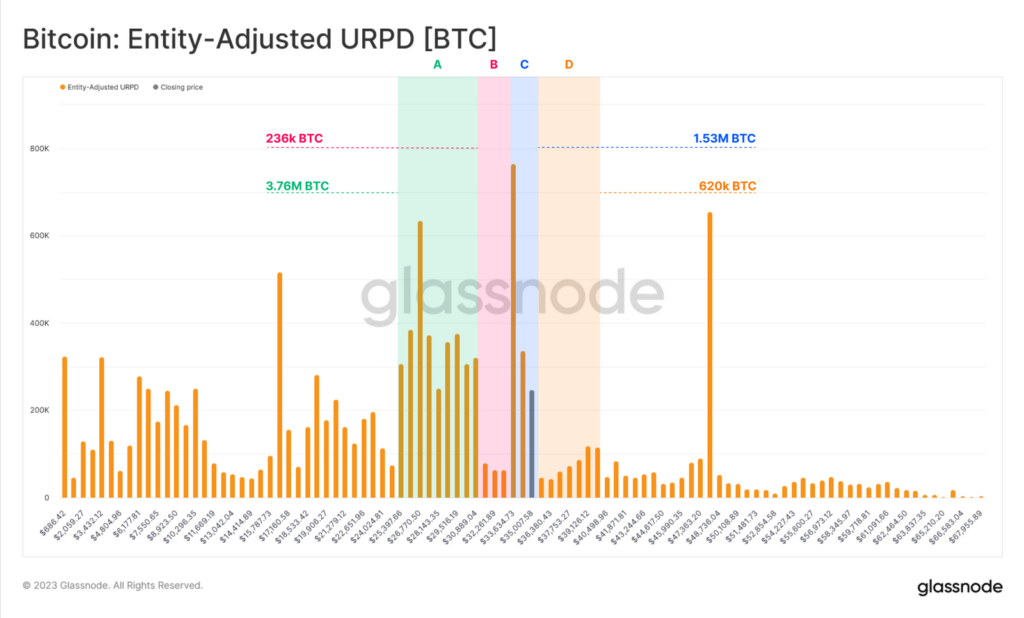

Analysts examined the structure of realized price levels in the context of UTXO (URPD) to identify areas with high cost concentration and identified four areas of interest:

- A — in the second and third quarters of 2023 a large volume of supply accumulated in the range from $26 000 to $31 000;

- B — “air gap” between $31 000 and $33 000 due to lack of price discovery;

- C — large volume of trades in the current price range from $33 000 to $35 000;

- D — ~620 000 BTC from the 2021–22 cycle have a base value from $35 000 to $40 000.

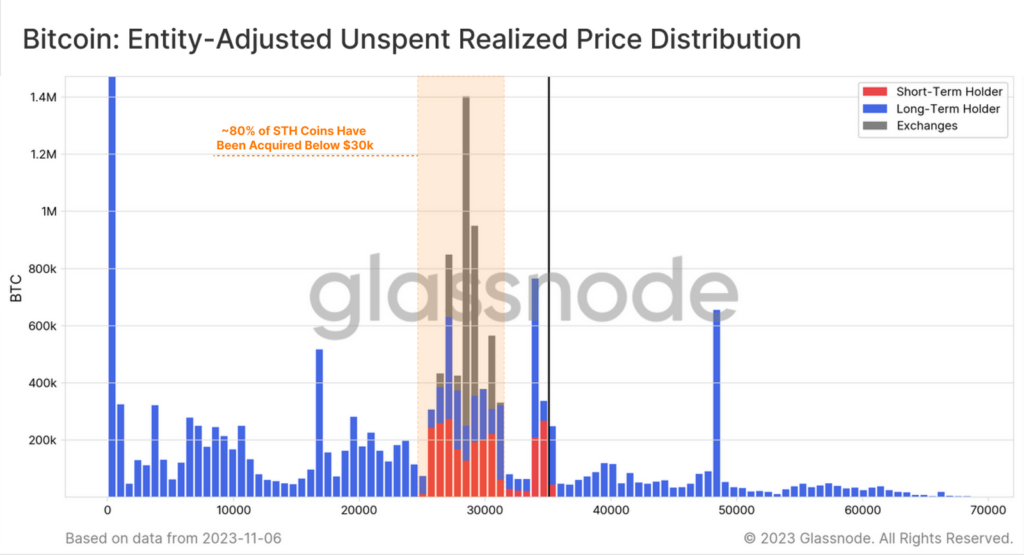

In conclusion, analysts related URPD between hodlers and speculators.

They noted that most coins owned by short-term investors are profitable with an average purchase price between $25,000 and $30,000. The increase in Sell-Side Risk Ratio is in line with a profit-taking event, after which bitcoins changed hands in the current price range.

The range from $30 000 to $31 000 is a key area of interest, as it represents the upper boundary of the largest cluster of supply and spending.

“Given the relatively small number of coins that moved toward $35 000, this raises questions about how market participants will react if the price returns to $30 000,” the specialists noted.

Earlier, major participants in the Bitcoin options market are looking for a breakout above $36 000, which could trigger a new wave of liquidations.

Earlier, Glassnode analysts pointed to the near $28 000 key barriers by the first cryptocurrency, both technically and on-chain.

Before that, experts, based on assessment of capital movement between hodlers and speculators, concluded that the current structure of the digital gold market bears similarities to the recovery phase after bear markets in 2016 and 2019.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!