Glassnode Observes Growing Optimism Among Bitcoin Investors

Bitcoin prices have broken through several critical on-chain and technical resistances, approaching the upper boundary of a seven-month volatile sideways trend, according to a report by Glassnode.

Specifically, the price surpassed the combined resistance of the 200 DMA and 111 DMA.

The 365 DMA served as strong support during the correction in early August. Analysts believe this metric defines the lower boundary of the prevailing upward macro trend.

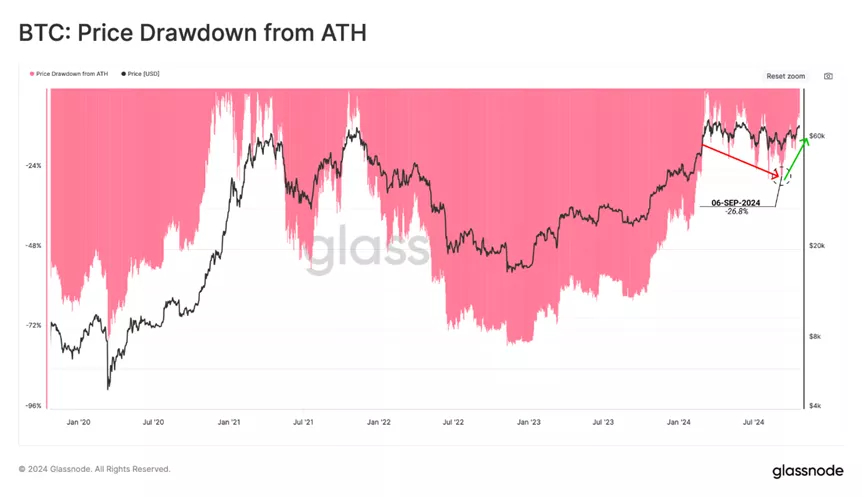

Experts noted the moderate nature of price declines after the ATH in March. Their amplitude is more in line with the upward cycle of 2021 and less with the bear markets of 2019 and 2022.

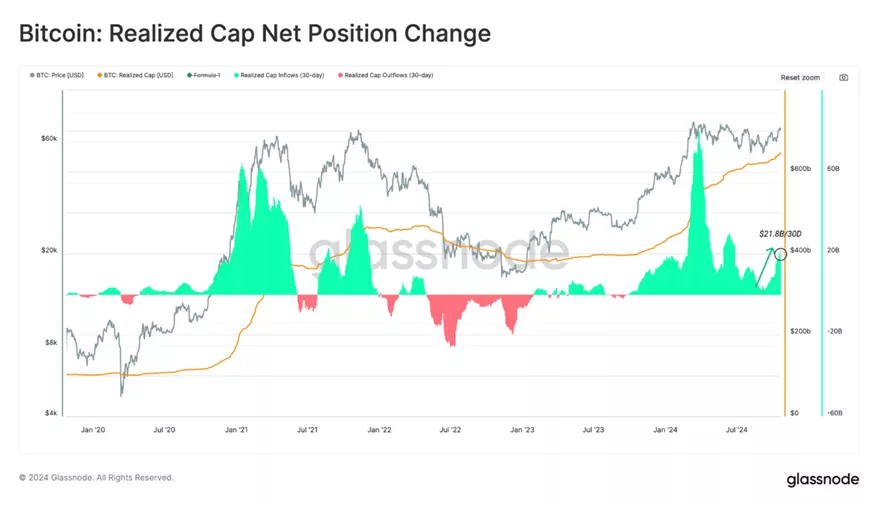

Over the past 30 days, there has been a net capital inflow into the asset amounting to $21.8 billion (+3.3%). As a result, the realized capitalization reached a new ATH, exceeding $646 billion.

Experts observed a transition of the price from the “enthusiasm mode” of a bull market (highlighted) to the “euphoria stage” (highlighted). A distinctive feature of the latter is a sustained breakout above the 2021 ATH of $69,000.

In March 2024, this level was breached, but profit-taking was too intense, necessitating a cooling-off period for investor enthusiasm.

Thanks to the rally, almost all recent buyers can boast unrealized profits. The rise in spot prices above coin purchase levels has provided speculators with “relief.” This indicator can serve as a gauge of short-term investor sentiment.

Derivatives Market

Open interest in perpetual contracts and futures reached a record $32.9 billion, reflecting increased leverage in the system.

The rise in open interest on the CME to a new ATH of $11.3 billion indicates growing interest in bitcoin from institutional investors.

According to Glassnode, current Cash and Carry strategies yield an annual return of 9.6% — nearly double the “risk-free” rate on US Treasuries.

Amid the easing of monetary policy by the Fed, the attractiveness of such practices will only grow. This will further increase bitcoin market liquidity, experts explained.

Earlier, Copper identified signs of a local peak in the price of the leading cryptocurrency ahead of the US elections.

Previously, QCP Capital noted high chances of bitcoin and Ethereum breaking through resistances at $70,000 and $2,800, respectively.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!