Glassnode Reports Increased Bitcoin Sales by Long-Term Holders as Price Nears All-Time High

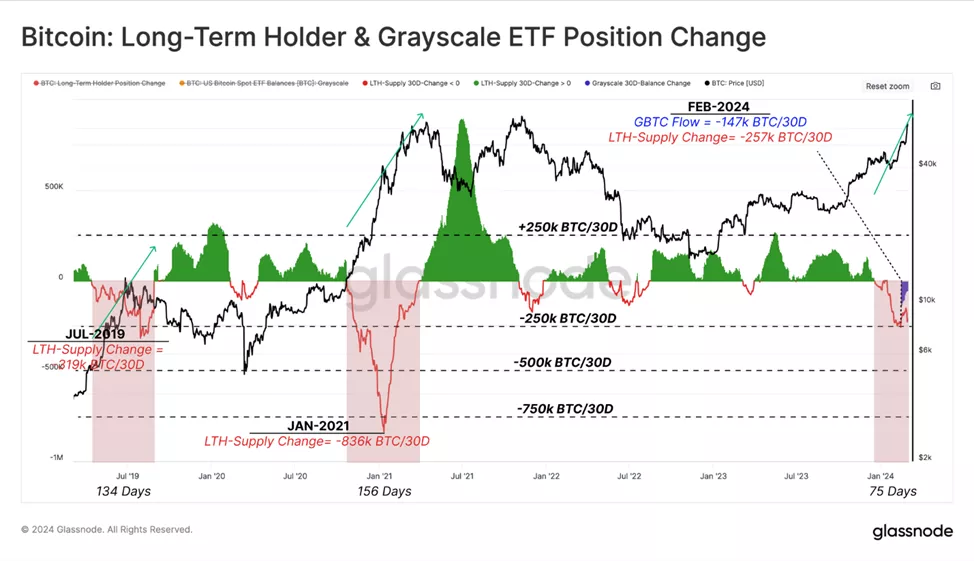

Monthly sales by long-term investors have surged to 257,000 BTC as the price of the leading cryptocurrency approaches its all-time high, according to calculations by Glassnode.

As #Bitcoin reached its ATH, a careful assessment reveals a nuanced interplay between exchange and ETF flows indicating market balance, alongside the start of the classic distribution pattern by long-term holders.

Watch the latest Week On-Chain? pic.twitter.com/yDRjUiPd99

— glassnode (@glassnode) March 6, 2024

Analysts noted that 57% of this figure is attributed to the GBTC from Grayscale. The sharp rise in the value of digital gold since the beginning of the year has prompted holders to take profits.

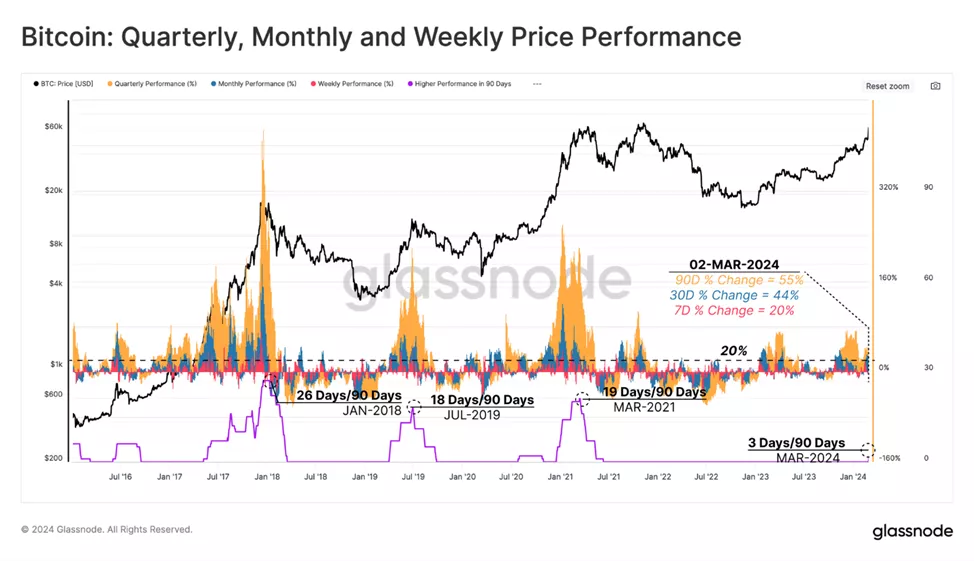

According to analysts, the weekly (+20%), monthly (+44%), and quarterly (+55%) increases have been the most “powerful” since the bull market of 2021.

Experts noted that following the approval of spot ETFs, Bitcoin rose by 58%. This dynamic disappointed many skeptics who believed that this factor was fully priced in.

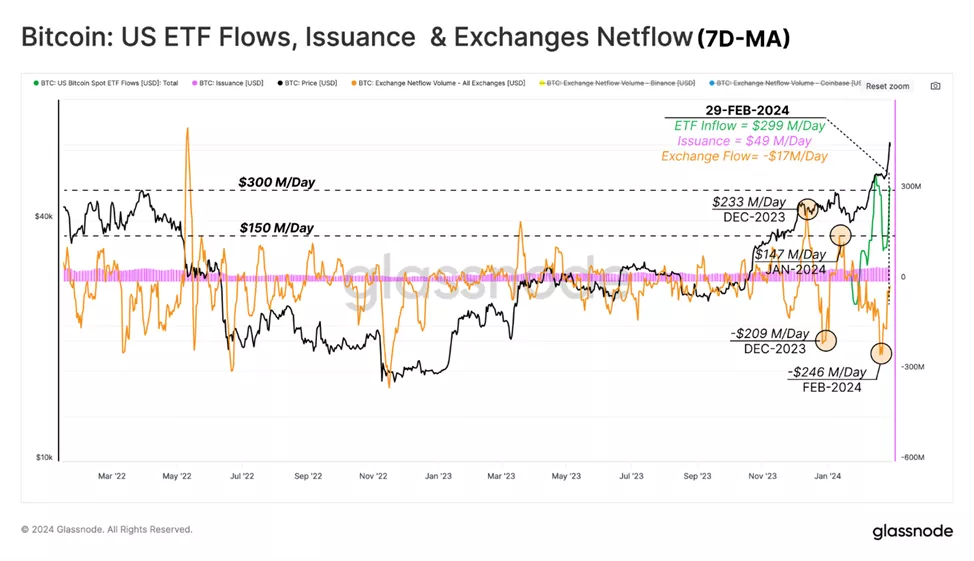

There was a “significant phase shift in market dynamics and a justified explanation for the leap towards ATH.” Specialists estimated the daily net capital inflow into the leading cryptocurrency at $267 million.

The mentioned figure was derived from the following components:

- network issuance ?: total miner rewards (presumed sales) — $49 million;

- net inflow to centralized platforms ?: after the ETF launch, inflow to CEX momentarily reached $246 million, then turned into an outflow of $17 million;

- net inflow to US spot ETFs ?: despite pressure from GBTC holders in the initial weeks, demand later prevailed, raising net inflow to $299 million.

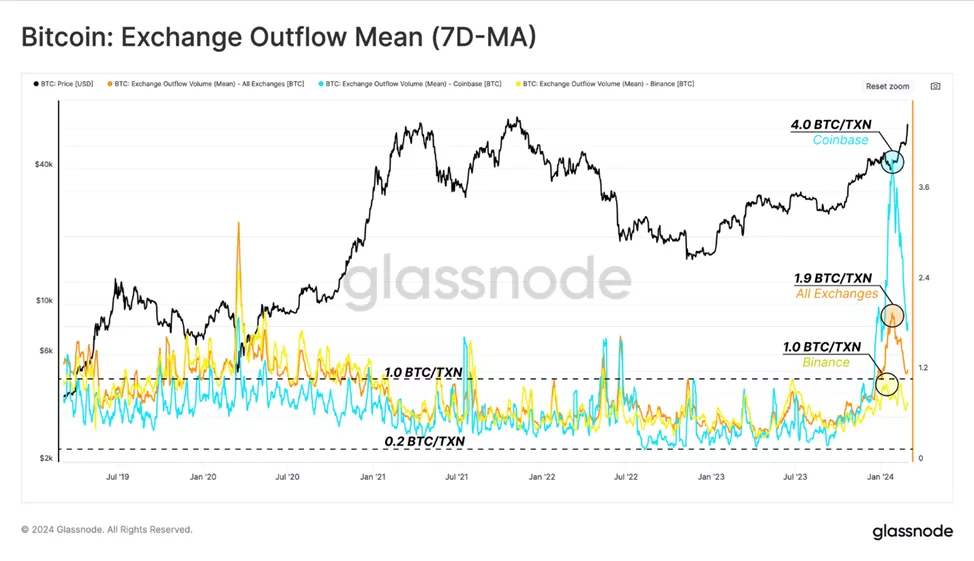

Experts separately examined the structure of flows to centralized platforms in general ?, as well as Binance? and Coinbase? individually. They recorded a jump in the average size of such transactions on the latter exchange to 4.3 BTC at the time of product approval. For comparison, the historical range since 2019 was from 0.2 BTC to 1 BTC.

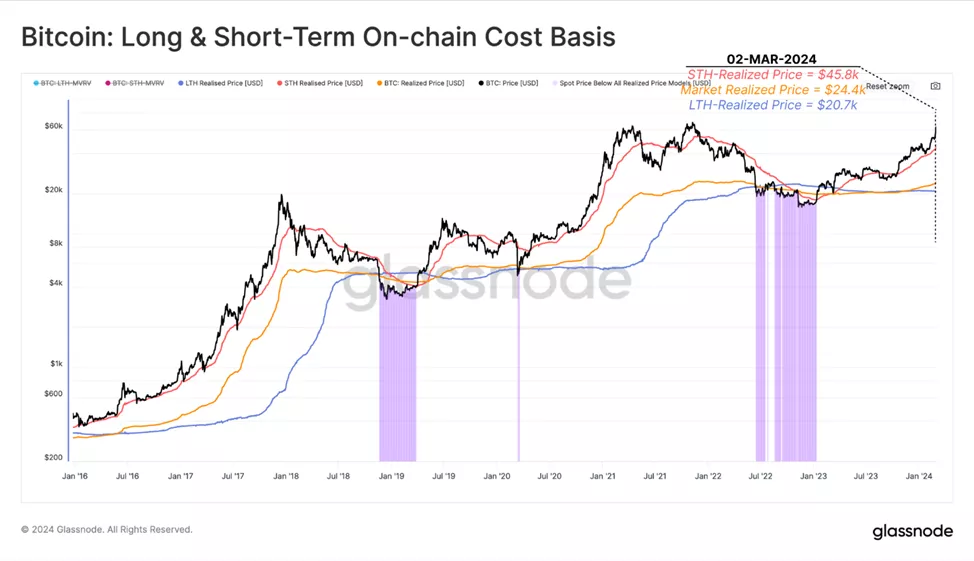

As Bitcoin approached its ATH, the unrealized profit of holders reached 228%. The “cost” of purchasing coins for this category of market participants is $20,700, while for short-term players it is $45,800.

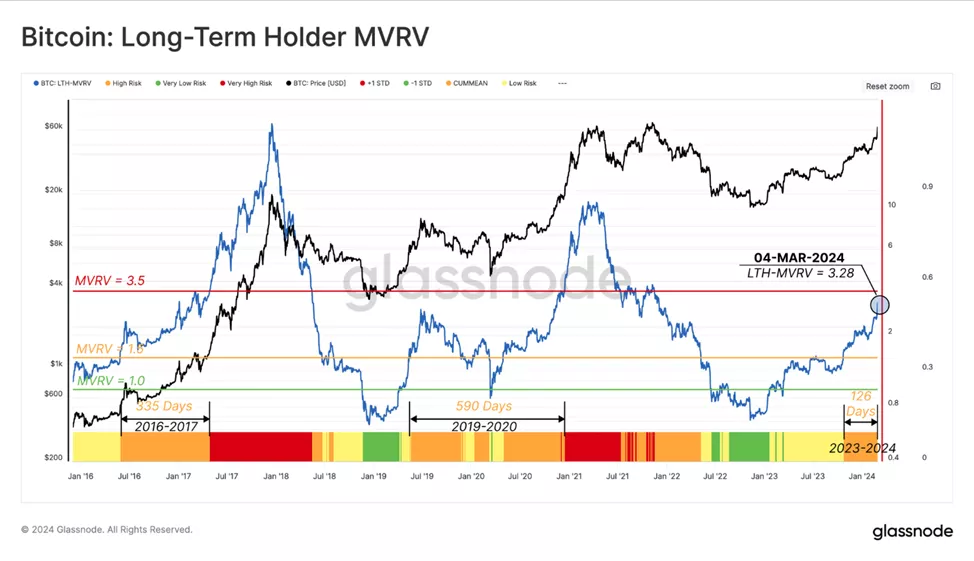

The MVRV ratio (3.28), which characterizes the magnitude of unrealized profit, for long-term investors approached the euphoria threshold value (3.5).

Analysts explained that historically this group increases their spending as new ATHs are reached, with distribution accelerating until they help form the cycle’s peak.

According to specialists’ calculations, since December, the number of coins held by holders has decreased by 480,000 BTC. In other words, some began to lock in 50–200% profits even before the ETF launch date.

In the current cycle, the monthly distribution rate of bitcoins by long-term investors reached 257,000 BTC, with 58% of the volume formed by GBTC operations. For comparison, during the rallies in mid-2019 and early 2021, this figure was 319,000 BTC and 836,000 BTC respectively.

Experts have described the price pullback of digital gold after the new ATH as a “healthy consolidation.”

According to JPMorgan, the upcoming halving in April could trigger a sharp decline in the price of the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!