Glassnode Warns of Imminent Bitcoin Volatility Surge

The recent calm in the Bitcoin market is unlikely to last, with a period of heightened volatility expected, according to Glassnode.

Market speculation remains relatively subdued for #Bitcoin, with investors locking in only marginal profit and losses, and a reset across perpetual swap markets.

Historically, periods of quiet and calm market structure are short-lived, and often precede an expectation for… pic.twitter.com/Yy8TTjdbtS

— glassnode (@glassnode) August 27, 2024

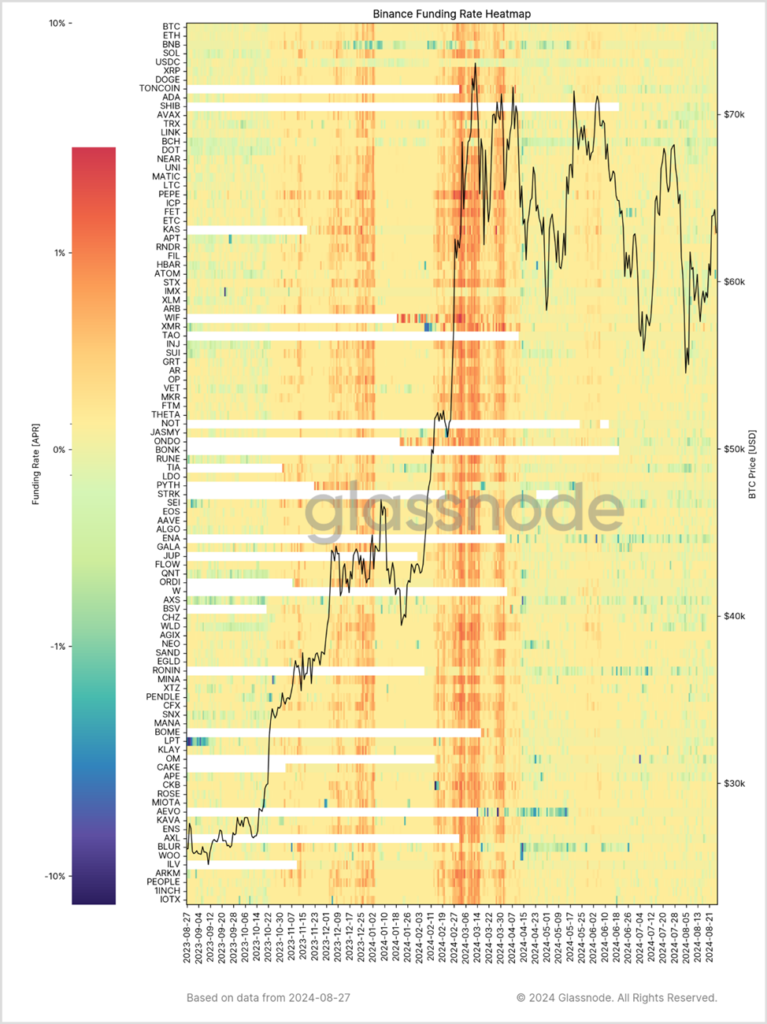

Both on-chain indicators and perpetual contracts have reached equilibrium. This is reflected in the reduced pace of profit and loss realization and the return of funding rates to neutral levels. Analysts suggest these signs indicate a significant reduction in speculation.

In recent months, net capital inflow into Bitcoin has slowed, with 89% of days showing higher values than current levels. Experts noted that such periods of inactivity typically precede significant volatility increases.

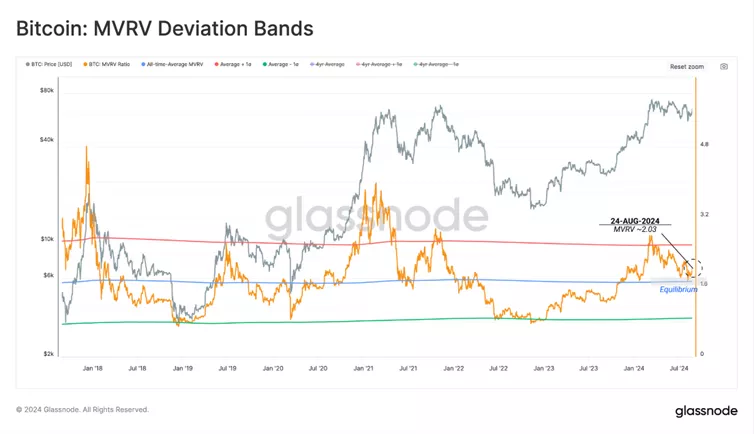

The MVRV ratio (2.03) has returned to its equilibrium level (1.72), signaling a cooling of excitement following the ETF launch. Historically, this critical mark has signaled the transition between bull and bear markets.

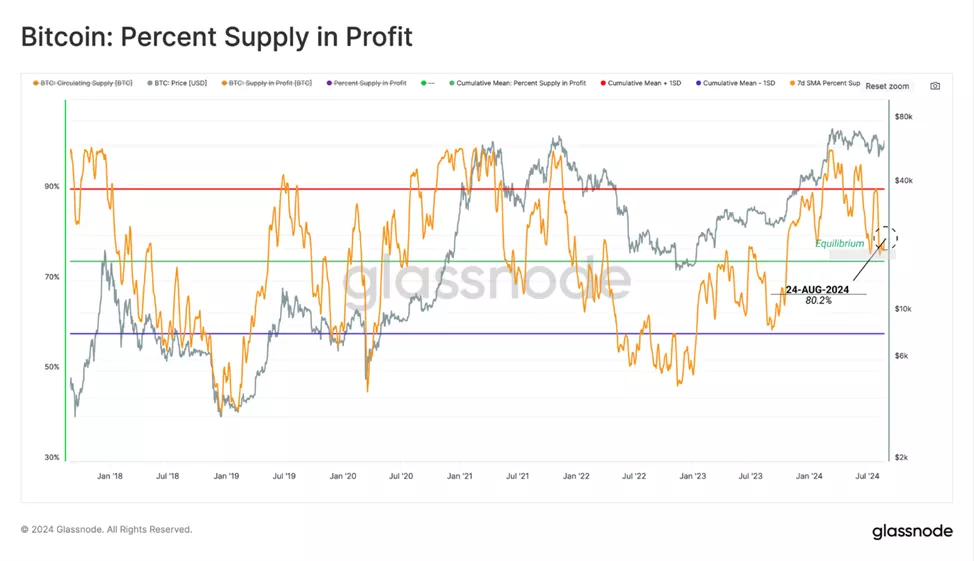

A similar pattern is observed in the percentage of coins in profit (80.2%).

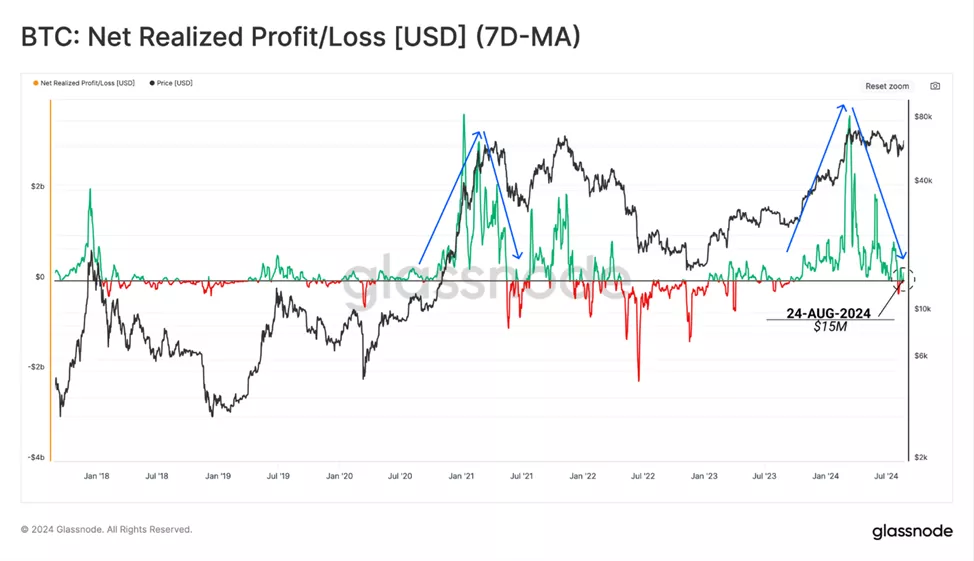

The daily net realized profit has dropped to $15 million, a stark contrast to the $3.6 billion at the time of the ATH in March.

This metric typically returns to neutral levels near inflection points, such as trend continuation or reversal back into a downtrend, experts noted.

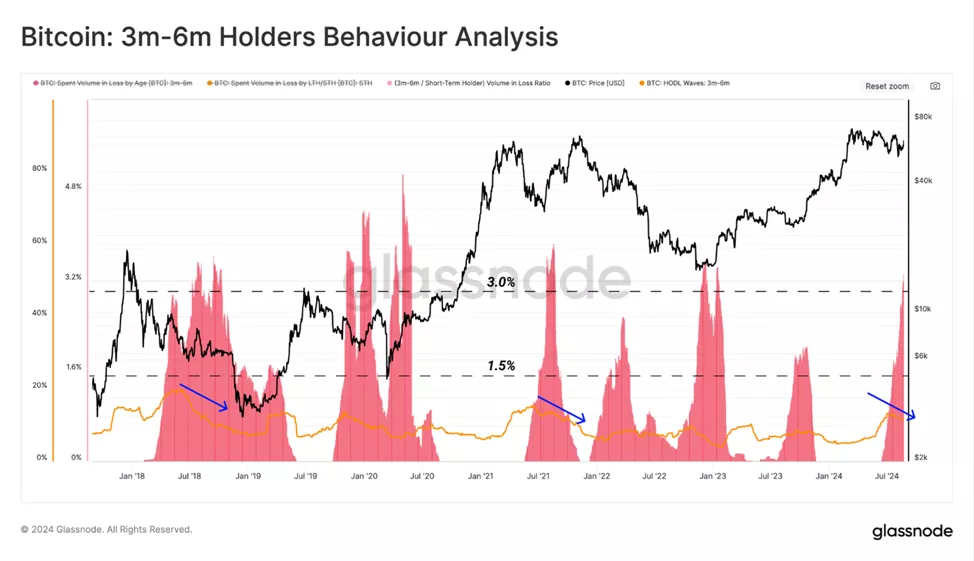

Currently, coins aged three to six months account for over 12.5% of the total available supply, resembling the mid-2021 sell-off and the 2018 bear market peak.

The increase in the share of Bitcoins in this time range indicates a test of new investors’ confidence, with some transitioning to long-term holders.

Analysts have recorded a significant surge in losses among recent Bitcoin buyers since early July. The scale of capitulation is comparable to major inflection points in the past. Statistically, coins that remain unspent are less likely to be spent in the near future.

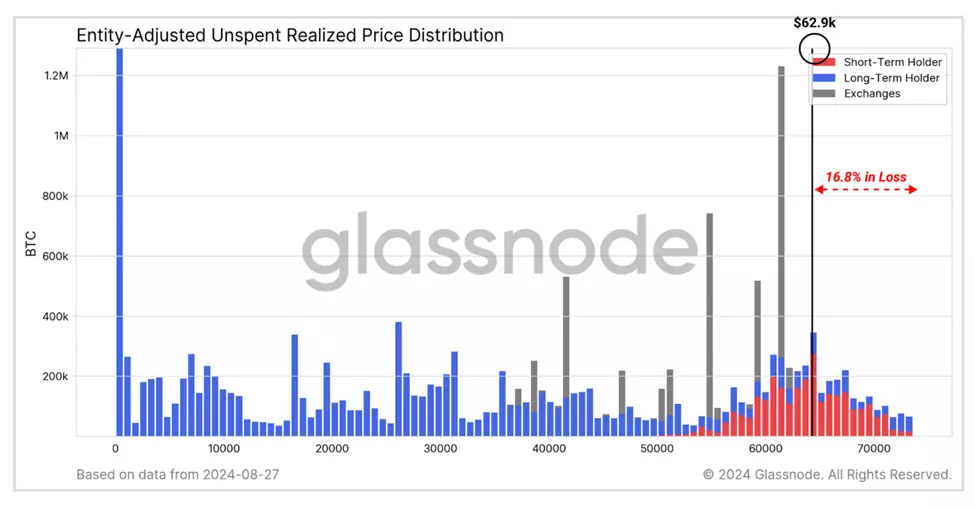

According to the chart of realized price levels in the context of UTXO (URPD), 480,000 BTC acquired by investors above $62,900 are currently in a “hodling” status. The unrealized loss on them reaches 16.9%.

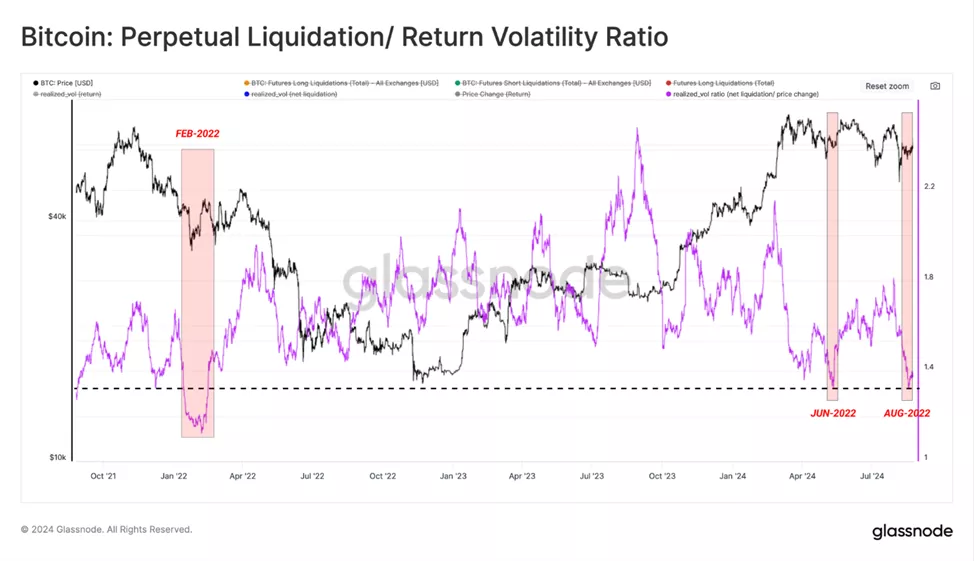

In conclusion, specialists examined the perpetual contracts market. They found a decline in the cost-to-volume liquidation ratio to February 2022 levels, indicating a significant weakening of speculative interest.

This phenomenon is also characteristic of the broader digital asset ecosystem, as judged through the lens of the funding rate. This confirms the hypothesis of a significant reset in speculative interest, and thus spot markets are likely to play a leading role in the near future, experts indicated.

Earlier, in the early hours of Wednesday, August 28, the price of the leading cryptocurrency fell below the psychological level of $60,000. The dynamic was intensified by the triggering of stop orders, as evidenced by increased trading volume.

Previously, QCP Capital predicted that the price of the leading cryptocurrency would remain in a narrow range between $62,000 and $67,000 in the near term, as indicated by indecision in options.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!