Grayscale Adds Chainlink to Digital Large Cap Fund

Grayscale Investments has decided to add Chainlink (LINK) as a component of the Digital Large Cap Fund.

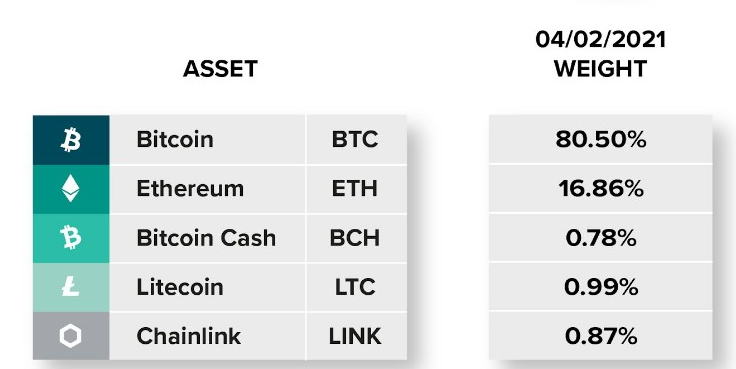

We are pleased to announce the updated weightings for Grayscale Digital Large Cap Fund

— Grayscale (@Grayscale) April 6, 2021

Following the latest quarterly rebalance, the asset’s share stood at 0.87%. Bitcoin and Ethereum accounted for 80.5% and 16.86% of the fund’s assets, respectively. Bitcoin Cash and Litecoin now account for 0.78% and 0.99%, respectively.

Launched in February 2018, the Digital Large Cap Fund provides passive exposure to the most popular cryptocurrencies.

Over the past year, Bitcoin’s share in the fund fluctuated around 80%, Ethereum rose from 9.6% to 16.86%. This was in part due to the exclusion of XRP from the fund and the liquidation of the trust based on that token. The decision was influenced by the SEC’s ruling against Ripple on December 23.

The inclusion of LINK in the Digital Large Cap Fund followed the launch of a trust based on this asset on March 17, 2021. Chainlink ranked tenth by market capitalization, at $12.83 billion, according to CoinGecko.

According to the latest data, investors poured $542.4 million into the Digital Large Cap Fund. Grayscale Investments’ total assets under management stood at $46.4 billion.

04/06/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $46.4 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC $BAT $LINK $MANA $FIL $LPT pic.twitter.com/yPmyOO4ZJG

— Grayscale (@Grayscale) April 6, 2021

The Bitcoin-based trust remains the most popular among investors, with assets of $38.2 billion (82% of AUM). Demand for the Ethereum-based product is also strong at $6.7 billion (14.4%).

In January, Grayscale Investments applied to register six new trusts based on Aave, Polkadot, Cosmos, Monero, EOS and Cardano.

In early April, the company said it intended to convert the Bitcoin trust into an exchange-traded fund based on the first cryptocurrency.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!