Grayscale Foresees Approval of Altcoin-Based ETFs

Within the next two to three years, the SEC is expected to approve spot exchange-traded funds based on cryptocurrencies other than Bitcoin and Ethereum. This prediction comes from David LaValle, head of Grayscale’s global ETF division, as reported by The Block.

The topic was discussed by participants at a round table hosted by the NYSE and Nate Geraci, president of ETF Store.

“100%. The path to spot exchange-traded funds based on cryptocurrencies lies through regulated futures. The digital asset market continues to expand and evolve. We have already proven we can do this with Bitcoin. The company is having a fruitful conversation [with the SEC] regarding Ethereum,” stated the expert.

Simeon Hyman, head of investment strategy at ProShares, agreed with LaValle.

“I can’t imagine that there won’t be a couple more [crypto]currencies that will be large enough and significant enough for us all to participate in. This should happen,” he commented.

Matt Hougan, CIO of Bitwise, also supported his colleagues, expressing optimism about the long-term registration of exchange-traded funds based on other digital assets.

“We have entered the era of ETFs for cryptocurrencies. […] You will use this wonderful format to give people what they want,” he added.

The discussion participants noted the growing interest in new products from advisors and financial professionals for diversifying their clients’ portfolios.

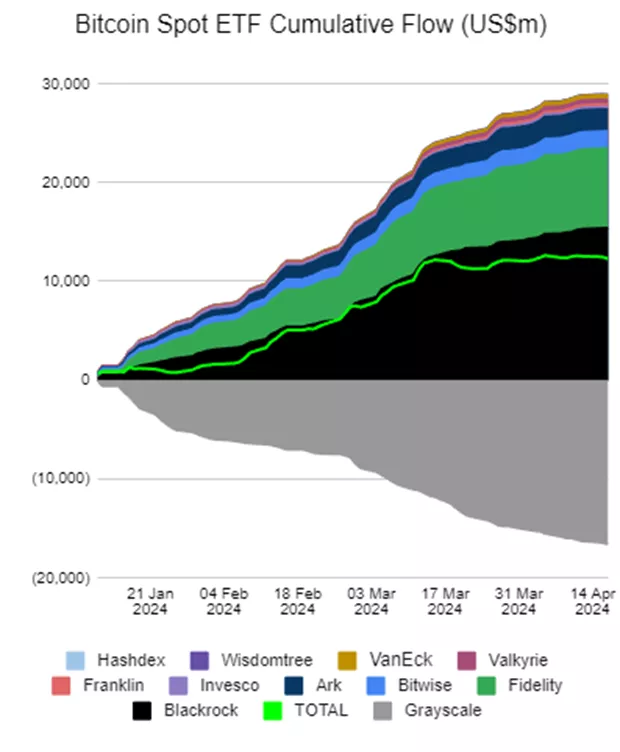

Grayscale’s GBTC continues to hold the status of the largest BTC-ETF issuer with AUM of $18.7 billion. The figure for its closest competitor, BlackRock’s IBIT, has risen to $16.7 billion.

Since the approval of the instrument, the asset volume in GBTC has more than halved (by $16.6 billion), partly due to higher fees.

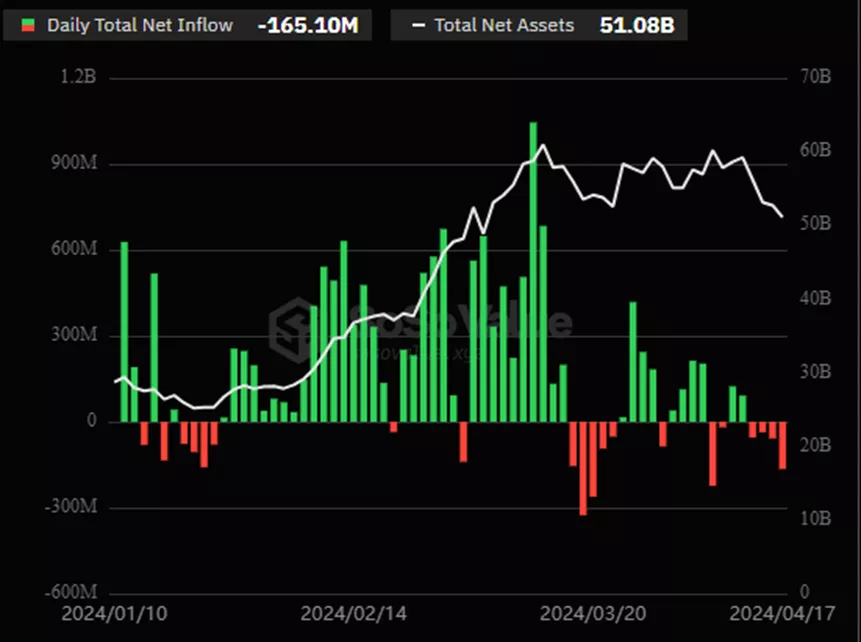

On April 17, the net outflow from GBTC was $133 million, while the net inflow into IBIT was $18.1 million.

The combined net inflow into products after their approval has dropped to $12.3 billion. On the last reporting day, the metric decreased by $165 million.

Earlier, Grayscale CEO Michael Sonnenshein predicted the collapse of most Bitcoin ETFs. In his view, only “two or three exchange-traded funds” will remain in the segment.

In April, the top manager predicted a stabilization of the outflow from GBTC.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!