Grayscale’s Bitcoin Fund Halves in Value

The crypto assets of Grayscale Investments’ GBTC have nearly halved in value approximately three months after conversion into a spot ETF.

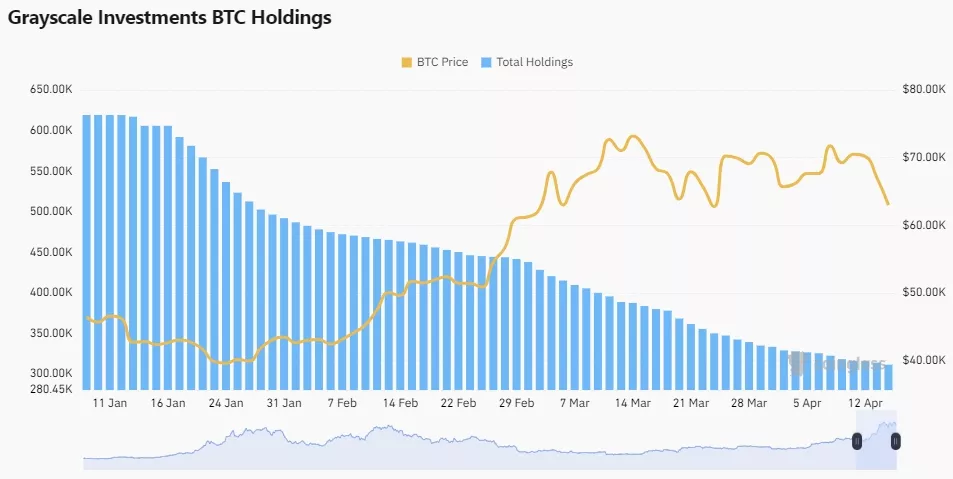

Unlike other issuers such as BlackRock or Fidelity, the company’s investment structure launched on the New York Stock Exchange, operating with approximately 619,220 BTC.

According to Coinglass, the volume of cryptocurrency held by GBTC as of April 16 decreased to ~311,620 BTC.

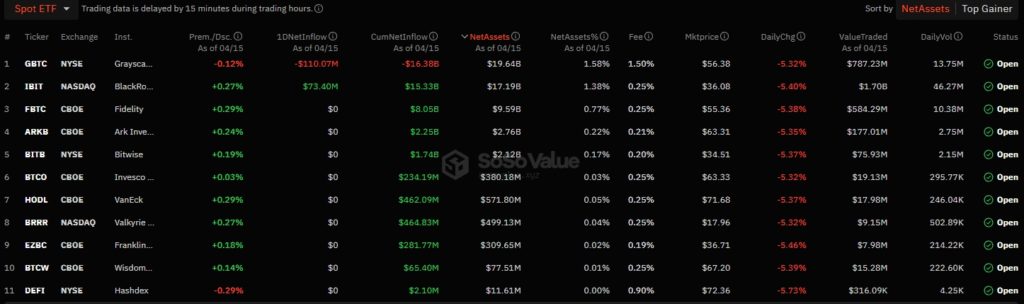

Thanks to the rise in Bitcoin’s price since the beginning of the year, the assets under management (AUM) only fell by ~31% — from $28.7 billion to $19.6 billion.

BlackRock’s spot Bitcoin ETF has approached the leader with a figure of $17.2 billion.

Both products were the only ones to record any fund movement on April 15. However, the trends were opposite. Despite recent statements by Grayscale CEO Michael Sonnenshein about stabilizing outflows from GBTC, withdrawals from the fund continued.

Before the launch of spot Bitcoin ETFs in the US, experts highlighted Grayscale’s management fee of 1.5%. Most competitors like BlackRock maintain a rate of 0.25%. Moreover, many initially operated with a discount system.

“It’s not surprising that all new issuers entering the market here in the US are engaging in a race to offer concessions. They all start from scratch and hope to attract assets from investors,” Sonnenshein commented at the time.

Earlier, the head of Grayscale predicted the failure of most Bitcoin ETFs. In his view, only “two or three exchange-traded funds” will remain in the segment.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!