Harvard Economist Admits Error in Bitcoin Forecast

However, his pessimistic stance on cryptocurrencies remains unchanged.

Kenneth Rogoff, a Harvard professor and former chief economist at the IMF, has acknowledged that his pessimistic forecast for Bitcoin was mistaken. In 2018, he claimed that digital gold was more likely to fall to $100 than reach $100,000.

Almost a decade ago I was the Harvard economist that said that bitcoin was more likely to be worth $100 than 100k. What did I miss? I was far too optimistic about the US coming to its senses about sensible cryptocurrency regulation; why would policymakers want to facilitate tax…

— Kenneth S Rogoff (@krogoff) August 19, 2025

He believed that strict regulation of the industry in the US would crash the price of the first cryptocurrency. Rogoff did not foresee that in 2024 a crypto-friendly administration would come to power in the country.

Following Donald Trump’s victory in the US presidential election in November, Bitcoin broke through the $100,000 level and reached a new all-time high of $124,128.

At the time of writing, the crypto asset is trading at $113,620.

The economist also did not expect Bitcoin to become a competitor to fiat currencies in the global shadow economy, valued at $20 trillion.

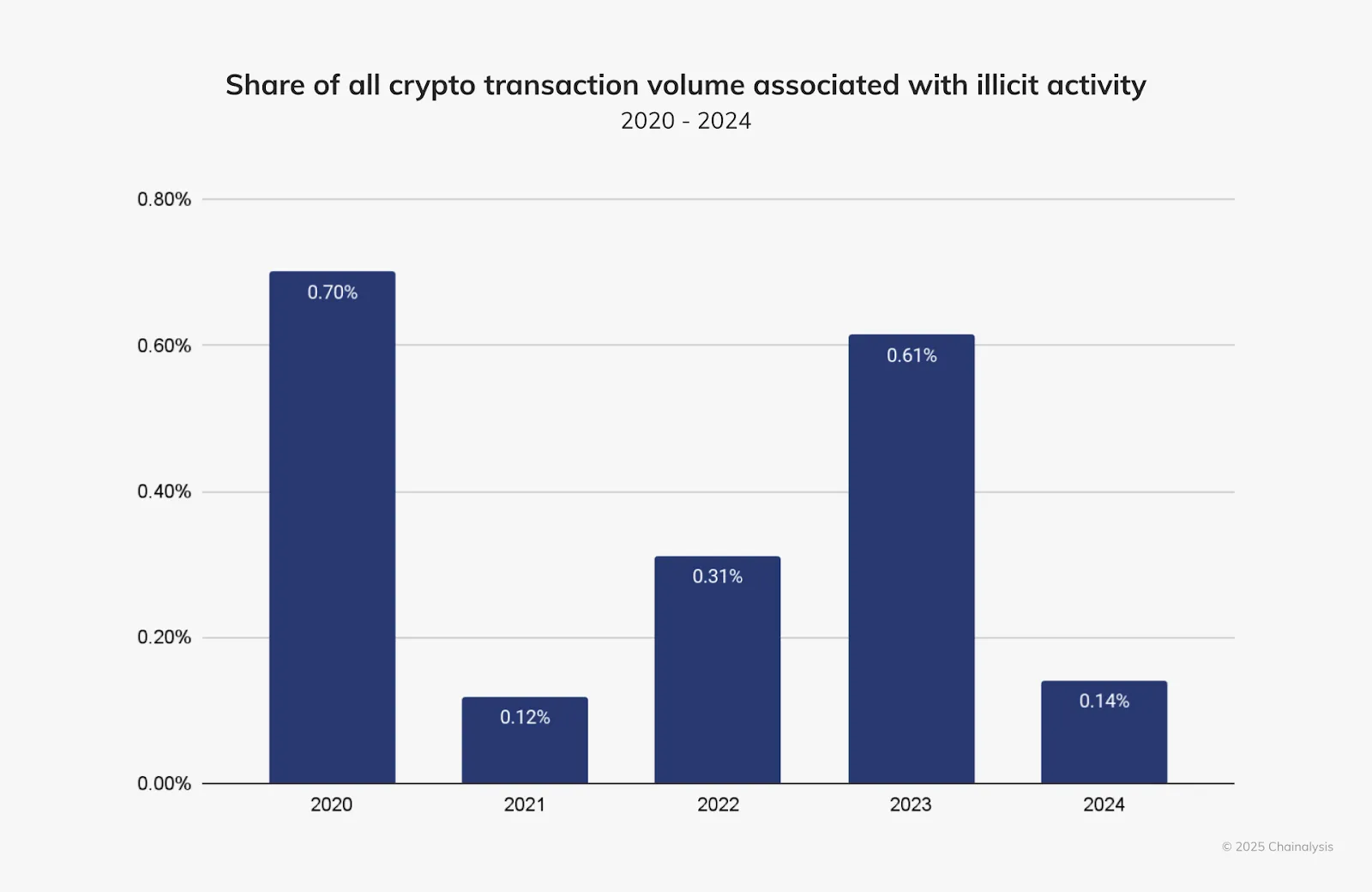

However, in 2024, the volume of illegal operations with digital assets amounted to $50 billion. This is less than 1% of the amounts laundered using cash.

“Thirdly, I did not anticipate that regulators, especially the main one, could hold hundreds of millions (if not billions) of dollars in cryptocurrencies with impunity, despite the glaring conflict of interest,” Rogoff added.

Community Reaction

Rogoff’s fundamental stance on cryptocurrencies remains unchanged, but representatives of the crypto industry viewed his statement as a victory. Bitwise’s Chief Investment Officer Matt Hougan noted that Rogoff still failed to appreciate the technology’s potential.

You missed: Failed to imagine that a decentralized project, which drew power from people and not centralized institutions, could succeed at scale. https://t.co/HLidOOKXUu

— Matt Hougan (@Matt_Hougan) August 19, 2025

“You missed: Failed to imagine that a decentralized project, which drew power from people and not centralized institutions, could succeed at scale,” he wrote.

Matthew Sigel, head of digital asset research at VanEck, sarcastically pointed out that Rogoff had disabled comments on his Bitcoin post.

Maybe you missed it because you live in an echo chamber, same as when you lock replies.

Fundamentals matter: fiat debasement, demographic wealth shifts, and global demand for a neutral reserve asset. https://t.co/rkMQ9MFWsE pic.twitter.com/ReZBiUvOVC— matthew sigel, recovering CFA (@matthew_sigel) August 19, 2025

“Maybe you missed it because you live in an echo chamber, same as when you lock replies. Fundamentals matter: fiat debasement, demographic wealth shifts, and global demand for a neutral reserve asset,” the expert noted.

Meanwhile, analyst David Lavant from FalconX stated that he was “very grateful” to Rogoff because his book “The Curse of Cash” was “so terrible that it was one of the reasons that pushed him towards Bitcoin.”

Earlier, on August 9, two of the most prestigious US educational institutions — Harvard and Brown University — reported purchasing Bitcoin through an ETF.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!