Hedge-fund owner accused of $12 million Bitcoin fraud

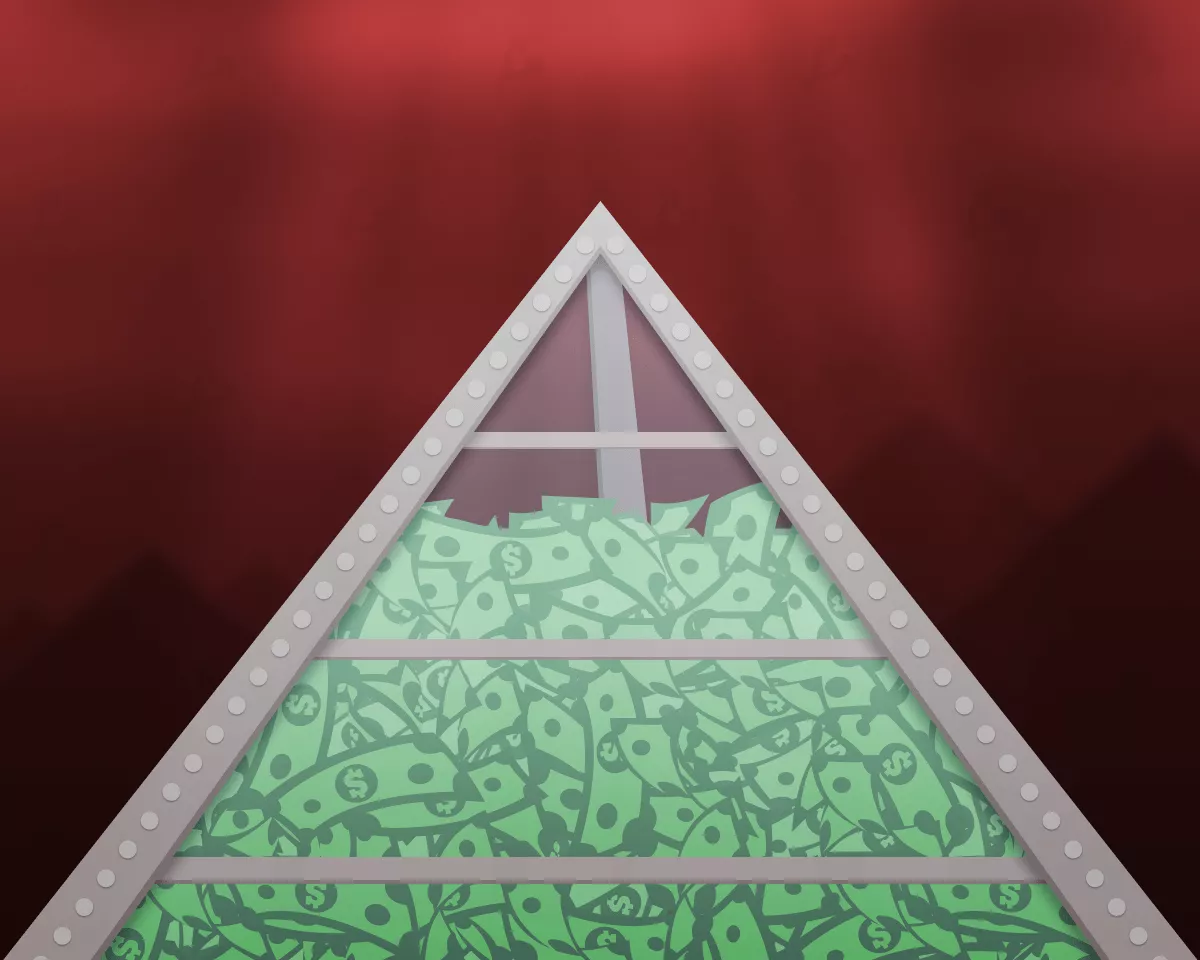

In the U.S. district court in Ohio, a lawsuit was filed by the CFTC against a local resident accused of orchestrating a financial pyramid with losses exceeding $12 million in cash and Bitcoin.

According to the agency, through SR Private Equity LLC and NBD Eidetic Capital LLC, Ratnakishora Giri offered clients investments in digital assets, promising outsized profits with no risk of financial losses.

To create the appearance of successful trading strategies, the defendant allocated newly received deposits among existing investors in his hedge funds.

The bulk of the funds was spent on renting private jets and yachts, as well as purchasing a country house, a car, and expensive clothing.

The CFTC accuses him of violating the Commodity Exchange Act, which prohibits manipulating information and using “fraudulent schemes”.

The regulator seeks to halt the hedge funds under his management and to forgo any monetary benefits, “directly or indirectly” related to the violation of the rules.

Earlier in August, the CFTC, together with the SEC obligated hedge funds with AUM above $500 million to report crypto risks.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!